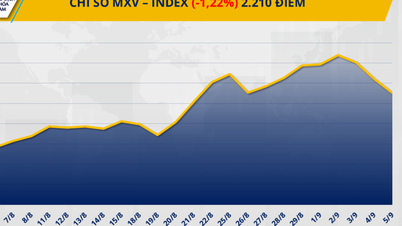

Oil prices hit lowest level since May

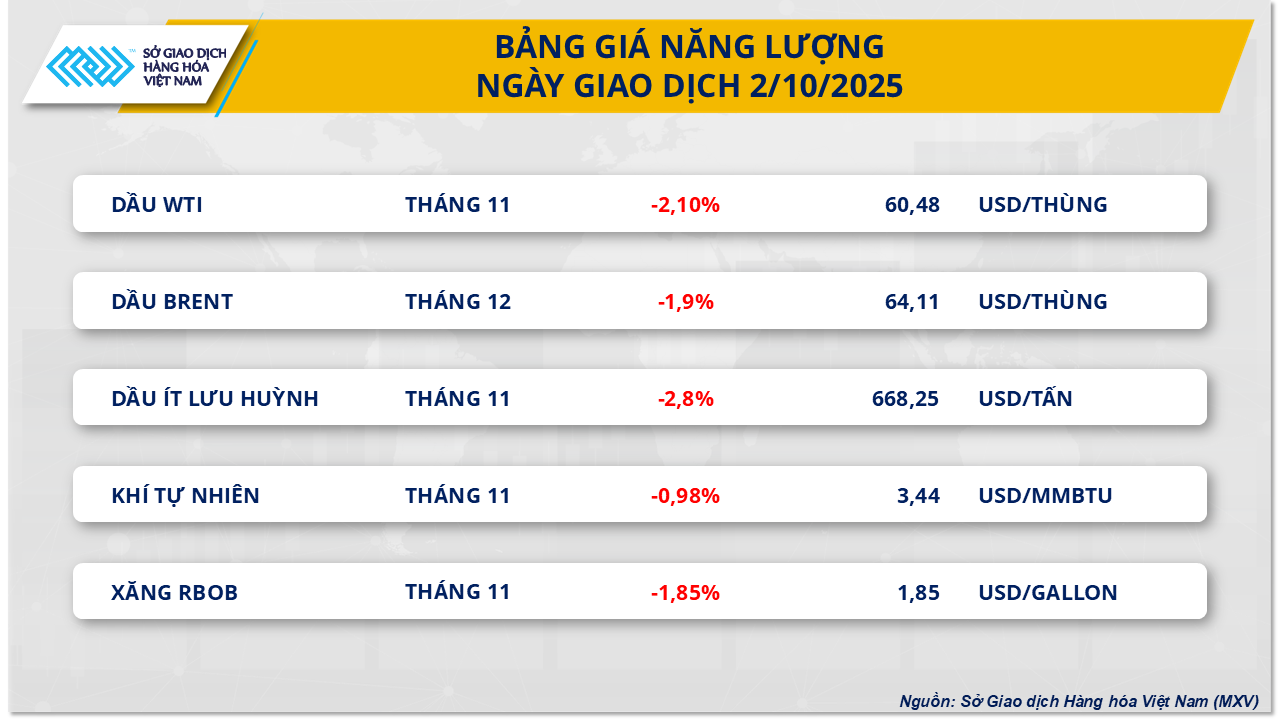

According to the Vietnam Commodity Exchange (MXV), the energy group fell across the board yesterday, with all five commodities in the red. Notably, crude oil prices continued to extend their streak of four consecutive declines.

Of which, Brent crude oil price lost nearly 1.9%, down to 64.11 USD/barrel - the lowest level since the end of May; WTI crude oil decreased more sharply, up to 2.1%, closing at 60.48 USD/barrel, the lowest level in 5 months.

The downward pressure on prices is mainly due to the prospect of excess supply. The market is focusing on the October 5 meeting of OPEC+, with many predicting that the alliance will continue to raise production in November. According to analysis by the largest investment bank in the US - JPMorgan Chase, the combination of the possibility of increased supply, global refining slowdown due to maintenance, and consumption entering a period of low demand, will increase inventories and continue to weigh on prices.

In the US, data from the Energy Information Administration (EIA) reinforces this trend. Crude, gasoline and distillate inventories all rose in the week ending September 26. At the same time, refinery runs and output fell, reflecting weaker near-term fuel demand.

Domestically, retail gasoline prices in the operating period on October 2 were adjusted up, significantly affected by Russia's fuel export ban. Diesel recorded the strongest increase, up 380 VND/liter (2.04%), while E5RON92 and RON95 gasoline only increased slightly by 6 VND/liter (0.03%) and 44 VND/liter (0.22%), respectively.

According to the Ministry of Industry and Trade - Ministry of Finance, domestic price fluctuations reflect the combined impact of many factors: OPEC+ maintains the trend of increasing production, US oil reserves increase, global demand slows down, along with the continued escalation of geopolitical tensions between Russia and Ukraine.

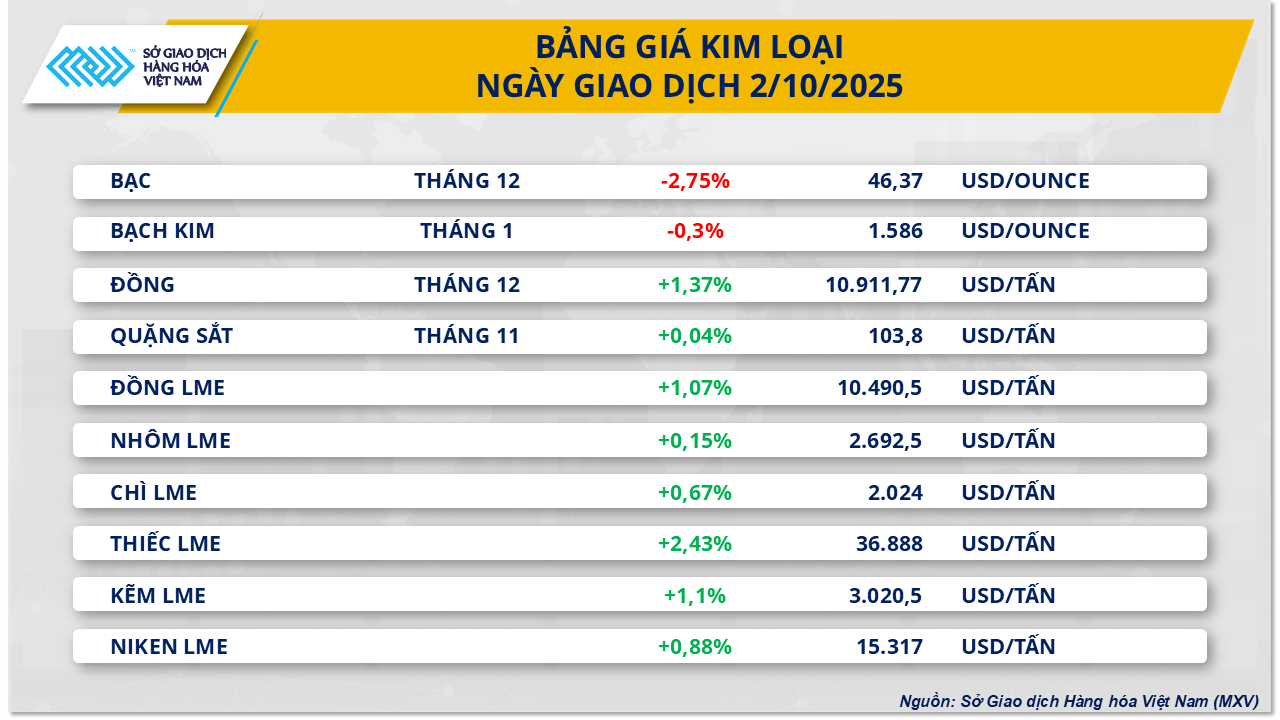

Tightening supply concerns support copper prices

Amid a mixed metal market, COMEX copper rose nearly 1.4% to $10,911 a tonne yesterday, driven by concerns over a global supply glut.

In Chile, the world's largest copper producer, August output fell nearly 10% year-on-year to just over 423,600 tonnes, according to the National Statistics Agency (INE). This is the sharpest decline since May 2023. State-owned conglomerate Codelco had previously warned that output could only remain around 5.5 million tonnes/year, due to difficulties in mining at great depths, declining ore content and rising costs. Following the collapse at the El Teniente mine in late July, Codelco revised down its 2025 output forecast by about 30,000 tonnes, to 1.34-1.37 million tonnes.

The global copper supply has also been affected by the incident at the Grasberg mine in Indonesia - the world's second largest. The Freeport-McMoRan mine was forced to declare force majeure after a mudslide in early September caused difficulties in mining operations. According to research organization BMI, the 20 largest mines alone account for about 36% of global production this year, so any incident at these mines could have a ripple effect on the supply chain.

Meanwhile, the demand outlook remains positive. China, the largest copper consumer, recently announced the Action Plan for the Stabilization of Non-ferrous Metals Industry Growth in 2025-2026, aiming to increase production by an average of 1.5% per year for 10 key metals, including copper. Beijing also aims to expand copper applications in new energy vehicles and telecommunications infrastructure, indicating that the metal continues to play an important role in its industrial development strategy.

The combination of supply disruption risks at major mines and the prospect of sustained demand from China is providing significant support for copper prices, while strengthening the red metal’s position as an industrial raw material.

Source: https://baotintuc.vn/thi-truong-tien-te/mxvindex-tiep-tuc-giang-co-tren-vung-2200-diem-20251003083035501.htm

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)