Russia will reimpose some capital controls it introduced at the start of the war, aimed at preventing the currency from falling further.

The Russian government announced that it will force dozens of exporters to convert foreign currency earnings into rubles. Russia's financial watchdog Rosfinmonitoring will monitor the implementation of the new rules for 43 companies in energy, metals, grain and other sectors.

The ruble rose 3.4% on the news on October 12, reaching 96 rubles to the US dollar, its strongest level in more than two weeks. It also strengthened against the euro and the yuan.

"The main purpose of these measures is to create long-term premises for increasing transparency and predictability in the currency market. At the same time, this will also reduce speculation," Russian Deputy Prime Minister Andrei Belousov said in a statement.

"By the end of the year, we expect the ruble to reach 88-92 rubles per US dollar," said Yevgeny Kogan, a professor at the Russian Higher School of Economics (HSE).

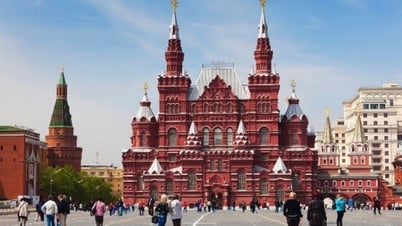

An employee counts 1,000 ruble notes in a bank in Russia. Photo: Reuters

The policies are similar to those Moscow imposed in February 2022, just days after launching its military operation in Ukraine. At that time, a series of Western sanctions sent the ruble plunging to a record low of 135 rubles per US dollar.

Russia at that time required exporters to convert 80% of their foreign currency revenue into rubles, not to keep it in dollars or euros. Citizens were also not allowed to transfer money abroad. Foreign investors were also not allowed to sell Russian securities.

The ruble has lost more than a third of its value against the dollar this year, as the war in Ukraine has hit Russia's export-oriented economy. Analysts say Moscow's gas and oil revenues are unlikely to surge.

This is causing Russia's current account surplus to shrink, down nearly 80% in the first nine months of the year compared to the same period last year. The Russian Central Bank said the narrowing gap between exports and imports contributed to the ruble's depreciation.

Russia's budget deficit has also soared since the start of the conflict. The Russian Finance Ministry said the country's deficit for the first nine months of the year was 1.7 trillion rubles ($17 billion). In the same period last year, it had a surplus of 203 billion rubles.

To tackle the ruble's devaluation and high inflation, the Russian Central Bank raised its key interest rate from 8.5% to 12% in August. Last month, they raised it again to 13%.

Ha Thu (according to Reuters)

Source link

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)