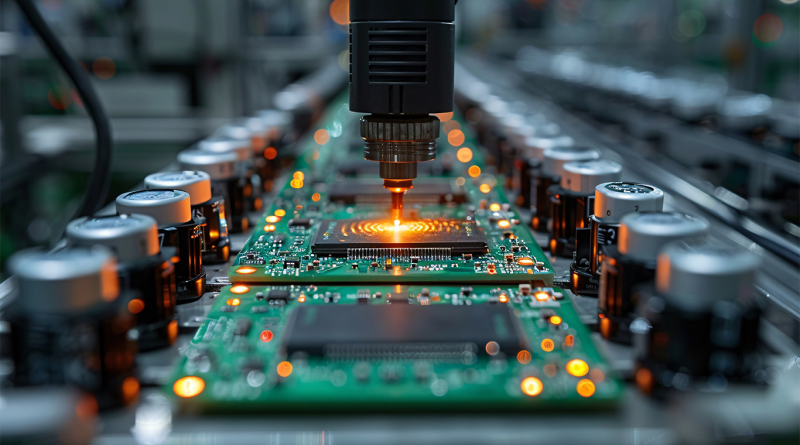

Taiwan Semiconductor Manufacturing Company Limited (TSMC), a global maker of advanced chips used in artificial intelligence applications, is expected to report a 58% jump in fourth-quarter profit thanks to booming demand for artificial intelligence (AI).

The world’s largest contract chipmaker, with customers including Apple and Nvidia, has benefited from the AI trend. However, the Taiwanese company is facing headwinds from the US government’s technology restrictions on China and uncertainty about the incoming administration of President-elect Donald Trump, who has threatened to impose broad import tariffs.

TSMC is expected to report a 58% jump in fourth-quarter profit thanks to booming demand for artificial intelligence.

TSMC is expected to report a net profit of NT$377.95 billion (US$11.41 billion) for the quarter ending December 31, 2024, according to LSEG SmartEstimate. SmartEstimates gives greater weight to forecasts from the 22 most accurate analysts. This estimate equates to a net profit of NT$238.7 billion for the fourth quarter of 2023.

TSMC reported a surge in fourth-quarter revenue in Taiwan dollars last week, beating market expectations. The company will provide its outlook for dollar revenue in its quarterly earnings report, scheduled for 06:00 GMT on Thursday.

2025 will be a year where TSMC's growth will be largely driven by AI customers, said Brett Simpson, co-founder and senior analyst at Arete Research.

“From the US government ’s perspective, Arete is optimistic that TSMC can build a good relationship with the new administration, especially as their new manufacturing cluster in Arizona is the largest foreign direct investment project in the United States,” Arete said.

TSMC is the world's largest contract chipmaker.

TSMC has begun manufacturing advanced 4-nanometer chips in Arizona for U.S. customers, according to U.S. Commerce Secretary Gina Raimondo over the weekend. The U.S. government has previously provided $6.6 billion in funding to TSMC to boost the construction of its factory in the country, while the U.S. Commerce Department has also lobbied for a $5.5 billion concessional loan to the world's largest contract chipmaker.

TSMC is spending billions of dollars on new factories overseas, including $65 billion for three plants in the US state of Arizona, although the company says most of its production will remain in Taiwan.

Progress at the Arizona plant and the plant's yield rate, or the percentage of chips that can be used, will be crucial for TSMC, said Edward Chen, president of Fubon Financial's equity investment unit.

TSMC, in its upcoming earnings report, will update its outlook for the current quarter as well as for the full year, including planned capital spending as it races to expand production.

In its most recent earnings report in October 2024, TSMC said capital spending was likely to be higher in 2025, but did not provide a specific number.

However, the company forecasts capital spending in 2024 to be slightly higher than $30 billion.

The AI boom has helped propel TSMC's stock price to become Asia's most valuable, with its Taipei-listed shares soaring 81% last year compared with a 28.5% gain for the broader market.

Source: https://www.baogiaothong.vn/nha-san-xuat-chip-tsmc-du-kien-loi-nhuan-quy-iv-tang-58-192250113150136933.htm

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)