Optimizing resources is always a problem for any business, including securities companies - Photo: QUANG DINH

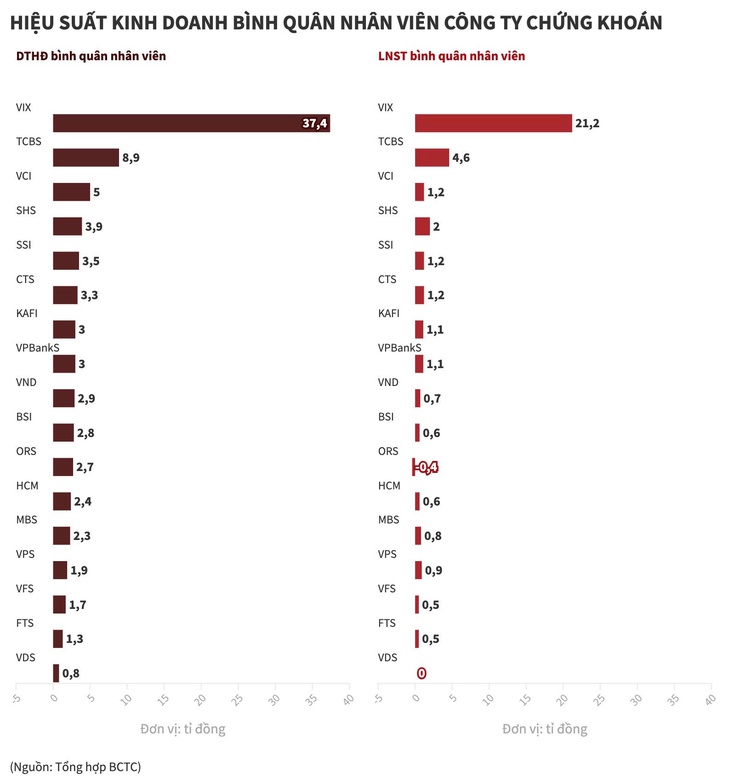

The financial report for the first 6 months of this year shows a clear differentiation in labor exploitation efficiency of securities companies in the market.

VIX, TCBS, VCI Securities lead in revenue efficiency

The first indicator of a company's performance is its ability to generate revenue from its core business.

Accordingly, VIX Securities is the leading company in terms of operating revenue performance in the first half of 2025. With revenue of VND 2,955.8 billion and an average staff size of 79 people, each employee at VIX generated about VND 37.4 billion in the first half of the year. That means each person generated about VND 6.2 billion in revenue on average per month.

Techcombank Securities (TCBS) ranked second with total operating revenue of VND4,688.2 billion and 526 employees. Each TCBS employee brought in about VND8.9 billion in revenue in the first half of the year, equivalent to nearly VND1.5 billion per month.

Ranked 3rd in terms of performance by revenue is Vietcap Securities (VCI). In the first half of this year, this unit recorded 2,010.6 billion VND in operating revenue. With an average staff of 406 people, VCI's staff brought in about 5 billion VND in revenue.

SSI has the highest revenue in the industry with 5,152.3 billion VND. However, due to the average employee size of 1,478 people, the average revenue is 3.5 billion VND.

Business performance of securities company employees in the first 6 months of 2025 - Chart: NGUYEN NGUYEN

Statistics show that the average operating revenue per employee of securities companies is at VND2.9 billion for the first half of 2025.

However, some parties have lower performance than the median such as Rong Viet Securities (VDS) with VND 814 million (about VND 136 million per month),FPT Securities (FTS) with VND 1.3 billion (about VND 212 million per month).

Competition in self-employment

Another indicator to consider labor productivity is the average after-tax profit generated by each employee. With a profit of nearly 1,674 billion VND in the first half of the year, each VIX employee brought in about 21.2 billion VND in after-tax profit.

The monthly average is more than 3.5 billion VND. This is the highest figure in the industry, exceeding the median profit of the group of surveyed companies by 0.8 billion VND.

Similarly, in the first half of the year, Kafi Securities' operating revenue reached VND991.3 billion, 2.8 times higher than the same period in 2024. Of which, profit from FVTPL financial assets reached VND599.7 billion, 2.5 times higher.

The after-tax profit index shows significant differentiation among securities companies, with the level ranging from about 3 million VND to nearly 3.5 billion VND per person per month.

Even Tien Phong Securities (ORS) lost 112.7 billion VND so human resource efficiency is still negative.

Securities companies in the leading group tend to maintain a lean structure and have strengths in certain business areas.

For example, with VIX Securities, operating revenue in the first half of this year was four times higher than the same period in 2024.

The main reason is that the profit from financial assets recorded through profit/loss (FVTPL) reached VND 2,482.7 billion (accounting for 84%), 5.8 times higher than the first half of 2024. This partly shows that VIX's proprietary trading segment was effective when the market increased sharply in the first half of the year.

However, it should be emphasized that the proprietary trading segment is inherently highly volatile, directly dependent on market developments. When the market is favorable, profits can skyrocket; but if the trend reverses, the recorded losses will also be very large.

Therefore, the problem of sustainability in business operations remains a big challenge for securities companies that are too dependent on self-trading.

On the other hand, ORS's operating revenue decreased by nearly 29% compared to the same period in 2024. Profit from FVTPL financial assets reached VND 304.8 billion, down 39.6%. Revenue from brokerage, investment consulting, custody, and other operating income also decreased compared to last year.

Meanwhile, operating costs remained almost unchanged, financial operating costs increased by 17.4%, causing the company to record a negative operating result of VND100 billion, while in the same period last year, the profit was up to VND211.6 billion.

Source: https://tuoitre.vn/nhan-vien-cong-ty-chung-khoan-nao-mang-ve-bon-tien-nhat-20250915172428589.htm

![[Photo] High-ranking delegation of the Russian State Duma visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/c6dfd505d79b460a93752e48882e8f7e)

![[Photo] The 4th meeting of the Inter-Parliamentary Cooperation Committee between the National Assembly of Vietnam and the State Duma of Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/9f9e84a38675449aa9c08b391e153183)

![[Photo] Joy on the new Phong Chau bridge](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/b00322b29c8043fbb8b6844fdd6c78ea)

Comment (0)