Investment comments

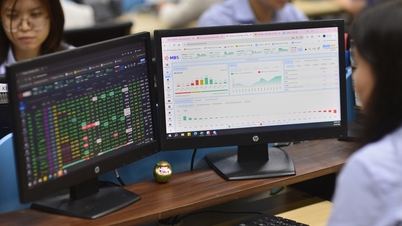

Asean Securities (Aseansc) : VN-Index is still trading in a short-term downtrend. Closing prices are lower than most recent session opening prices. MA20 and MA10 lines are both trending down, indicating a short-term downtrend.

The market recorded a recovery session after there was no great pressure from the supply side, however, the buying pressure was not too great, just for testing purposes. Investors still need to pay attention to the market's price reaction from the nearest resistance level, which is the previous gap down zone of 1,260 - 1,280 points.

Aseansc maintains its recommendation that investors hold a low proportion of stocks and continue to wait for testing periods to make new purchases.

Shinhan Securities Vietnam (SSV) : At the end of the session on April 9, VN-Index increased thanks to pillar stocks such as banks and securities. However, the buying money flow is still cautious. MACD is sloping down, showing that the correction process is still continuing.

The strategy is for investors to reduce the proportion of stocks and handle stocks that violate technical regulations. Maintain an observation state and should not rush to open positions.

BIDV Securities (BSC) : In the coming trading sessions, the market may continue to increase by inertia to the 1,270 - 1,275 point range, but there is a possibility of profit-taking pressure here. Liquidity in today's recovery session is still weak, investors should trade cautiously in the coming sessions.

Stock news

Investors and economists are cutting bets on the US Federal Reserve cutting interest rates this year as stronger-than-expected economic data bolsters the argument that the central bank will have to keep rates higher for longer to fight inflation.

At present, the market basically thinks that the Fed will only cut interest rates twice in 2024, and the possibility of the Fed having a third interest rate cut this year is only 50%. At the beginning of the year, the market expected the Fed to cut interest rates 5-6, even up to 7 times this year.

- The wind is turning in monetary policy, when will the "cheap money" period return? The Swiss National Bank (SNB) unexpectedly decided to cut interest rates. The SNB's action may lead to further monetary policy easing moves from other central banks. Switzerland has reduced its operating interest rate by 25 basis points to 1.5%.

The move contradicts economists' forecasts for a rate freeze. Swiss inflation continued to fall in February, at 1.2%. "Inflation has returned to below 2% in recent months and is within the SNB's control. According to the new forecast, inflation is likely to remain at this stable level for the next few years," the SNB stressed .

Source

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

Comment (0)