Digital transformation is the technological trend of the times, and is also a vital factor that creates a foundation for sustainable business development. Especially for the financial industry, digital transformation in management plays an increasingly important role in automating processes, optimizing operational efficiency and increasing competitiveness.

In the process of financial enterprises implementing ESG, applying digital transformation is extremely necessary, contributing to creating the premise to evaluate the performance of ESG strategy.

“Young people want everything to be fast, immediate and the experience must be great. ”

Sharing at the seminar "Digital transformation in governance - Experience in implementing ESG from financial enterprises" organized by Dan Tri newspaper on the morning of September 30, Mr. Pham Hong Hai - General Director of Orient Commercial Joint Stock Bank (OCB ) - affirmed that digital transformation is a matter of survival, there is no choice, if not done, you will be eliminated.

“Young people today want everything to be fast, available immediately, and the experience must be great. If we cannot provide solutions, we will not be able to compete,” said Mr. Hong Hai. That is the pressure and motivation forcing banks to transform digitally.

Mr. Pham Hong Hai - General Director of Orient Commercial Joint Stock Bank (Photo: Nam Anh).

Mr. Hai cited that OCB started from a very small bank. Therefore, if the bank wants to make a difference, it must use the motivation of speed. And digital transformation is a very good solution to the problem of speed for the bank.

He said that since 2018, OCB has launched a solution called OCB OMNI - an application for individual customers, applying all the latest technological solutions on AI and customer personalization. The bank also launched a digital bank called Liobank, from which the entire experience from "front to back end" is completely digitized. According to Mr. Pham Hong Hai, OCB is also one of the first banks to launch a system specializing in processing internal process transactions...

As a result, digital transformation helps this bank not only understand its customers better, but also helps the bank offer products more suitable for each customer segment.

“For example, after applying Open APIs for about 3 years now, the transaction value has increased by about 200%, the number of transactions has also increased by about 100%. In addition, the CASA ratio has grown by more than 30%, putting OCB in the top 10 banks with the highest CASA ratio in the market today. These are some typical examples showing the effectiveness of the digital transformation strategy,” said Mr. Hong Hai.

Don't expect digital transformation to be a "magic wand "

However, based on his experience, Mr. Hai recommends not expecting digital transformation to be a "magic wand" that can solve all current problems, but rather determining what digital transformation can support, taking small steps and then creating widespread efficiency like an "oil spill".

When implementing digital transformation, the first difficulty is that businesses do not know what they want, because when talking about digital transformation, everyone wants to do it, but how to make it fit with the bank's strategy is very difficult.

Another challenge, according to Mr. Hai, is that people often want everything, seeing what digital transformation their neighbors have, they want to bring it all into their platform. However, if they do so, Mr. Hong Hai believes it will "break" because it does not create a unique value for the business.

In particular, the issue of human resources is a big problem. While Vietnam has a fairly abundant human resource strength in technology, human resources that understand technology and business are very rare.

Those who understand business do not understand technology and vice versa. Therefore, when implementing, the business person does one thing and the technology person does another, resulting in a product that is not like anyone else. Therefore, businesses need to train a team that is both proficient in technology and knowledgeable in business.

Along with skills, the mindset or culture of the leader and staff is also worth noting. Normally, people are afraid of change, any change is seen as risky.

To solve this, OCB must create many small groups where people can easily gain decision-making authority during the digital transformation process. This, according to the CEO, will create dynamism for staff, with a small scale, people can see immediate results, thereby creating confidence that this is the path we should take.

Digital Banking: Challenges from Data and Predictions of a Robot-Only Future

In the banking sector alone, fragmented data is also a big challenge. According to Mr. Hong Hai, bank data is fragmented in different departments, not unified and has no owner, meaning that each person will have a different way of handling the data. In the end, we do not know where it comes from.

Therefore, banks need to reorganize and redefine data and who manages that data. Another difficulty is related to data security. After the CIC data loss event, it shows that if we do not build a data security culture, it will cause great risks.

Banks often want to build high walls to prevent outsiders from stealing data. But the biggest risk is internal people, if they are not aware of protecting data, for example, receiving emails sent from outside, they will accidentally create a big hole.

Finally, how to use the data. Once you have the data, how to use it to create value for customers and increase efficiency for the bank is also a problem.

Mr. Hong Hai gave an example of the CASA ratio (the ratio between non-term deposits and the total mobilized capital of the bank, measuring the bank's ability to attract low-cost capital). When studying through new data, he found that customers kept CASA when they had a very good experience with the App. If there were many system errors during payment, they would no longer keep CASA at that bank.

Mr. Nguyen Duc Trung - Principal of Banking University of Ho Chi Minh City (Photo: Nam Anh).

From an expert perspective, Associate Professor Dr. Nguyen Duc Trung - Principal of Banking University of Ho Chi Minh City - pointed out 4 main issues of digital banking.

The first is the distribution channel and customer experience. Thanks to eKYC technology, opening an account from afar is possible. In particular, the Super-app application on mobile helps customers almost not need to use cash, all operations can be performed through a digital banking platform that integrates services from payment, flight booking to many other utilities.

Second, in terms of services, with the system that banks apply in machine learning, they can use data-driven systems to solve lending, savings products, digital insurance... He emphasized that he was especially impressed with payments related to QR codes.

Third, related to operations and business processes. Many commercial banks today have implemented robotics and automation, such as initial loan processing and transaction reconciliation. Banks now make decisions based on large databases very easily.

Finally, the issue of digital transformation has really been the story of the head of financial enterprises, commercial banks and creating a digital transformation culture. Most notably, corporate banks have invested heavily in security, data security, and data safety. Banks have shifted from a traditional culture to a more flexible culture to suit the issue of digital transformation, quickly adapting products and services.

Mr. Trung affirmed that Vietnam is a dynamic country and in about 3 years we will have a complete digital transformation from customer experience, distribution channels... With the experience of Thailand and China, experts predict that in about 3 years we will have Dark Factories (fully automated production models) of the banking industry, where there are only robots, humans are the main adjusters behind.

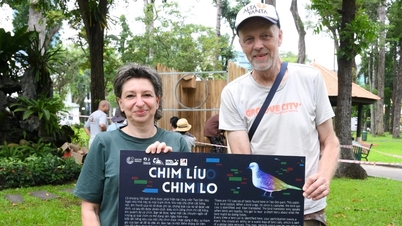

The seminar "Digital transformation in governance - ESG implementation experience from financial sector enterprises" organized by Dan Tri newspaper took place at 9:00 a.m. on September 30.

Speakers attending the seminar included Associate Professor Dr. Nguyen Duc Trung - Principal of Banking University of Ho Chi Minh City, Mr. Pham Hong Hai - General Director of Orient Commercial Joint Stock Bank (OCB), Mr. Tuan Nhan - CEO of Vietcap Securities Joint Stock Company.

This seminar is a satellite event of the Vietnam ESG Forum 2025 with the theme " Science and technology and driving force for sustainable development". The Vietnam ESG Forum is an annual event initiated and organized by Dan Tri newspaper to connect parties to share messages and inspire ESG implementation towards sustainable development. The seminar is accompanied by Orient Commercial Joint Stock Bank (OCB) and DNSE Securities Joint Stock Company.

After its launch, the Vietnam ESG Forum has received many positive responses from the community and experts to promote and develop ESG standards in business operations of enterprises.

The highlight of the Vietnam ESG Forum is the Vietnam ESG Awards - honoring units that effectively implement ESG. Interested businesses and organizations can register to participate in the Vietnam ESG Awards 2025 here.

Source: https://dantri.com.vn/kinh-doanh/chuyen-doi-so-dung-thay-hang-xom-co-cai-gi-cung-muon-be-het-ve-minh-20250930093407691.htm

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

Comment (0)