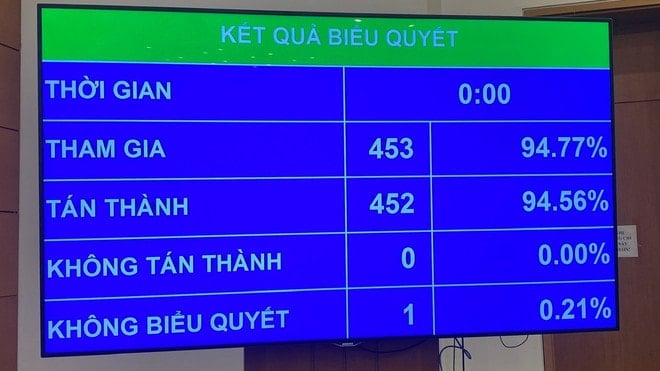

With 452/453 delegates participating in the vote in favor, on the morning of June 17, the 9th Session of the 15th National Assembly passed the National Assembly Resolution on reducing value added tax.

Accordingly, the National Assembly resolved to reduce the VAT rate applied to groups of goods and services specified in Clause 3, Article 9 of the Law on Value Added Tax No. 48/2024/QH15 by 2% (to 8%).

Goods and services not eligible for tax reduction include: telecommunications, financial activities, banking, securities, insurance, real estate business, metal products, mining products (except coal), goods and services subject to special consumption tax (except gasoline). This Resolution takes effect from July 1, 2025 to December 31, 2026.

Before the delegates pressed the button to approve, presented the report explaining, accepting and adjusting, Minister of Finance Nguyen Van Thang explained and clarified the determination of the scope of groups of goods and services exempted from VAT as in the draft law.

According to Mr. Thang, there are some opinions suggesting applying a 2% VAT reduction for all items. However, there are also opinions suggesting instead of reducing 2% for many subjects, reducing from 4-5% for the right subjects in need of support.

To clarify, the Minister of Finance said that this draft Resolution has expanded the subjects eligible for tax reduction compared to the provisions in previous Resolutions of the National Assembly and extended the tax reduction period until the end of 2026. Accordingly, transportation, logistics, goods, and information technology services businesses are eligible for tax reduction.

In addition, according to the provisions of the law on VAT, teaching, vocational training and medical services are not subject to VAT so there is no need to reduce tax.

Services such as finance, banking, securities, and insurance are not subject to VAT, so there is no need to reduce VAT. Telecommunications and real estate services are industries that have grown in recent times and are also not subject to VAT reduction.

Furthermore, according to the Government's proposed plan on April 16, the expected reduction in State budget revenue in the last 6 months of 2025 and the whole year of 2026 is equivalent to about 121,740 billion VND, of which the last 6 months of 2025 will decrease by about 39,540 billion VND, and in 2026, it will decrease by about 82,200 billion VND.

In case of implementing tax reduction according to the plan to reduce all items subject to VAT rate of 10%, the expected reduction in State budget revenue in the last 6 months of 2025 and the whole year of 2026 is equivalent to about 167,000 billion VND, of which, the last 6 months of 2025 will reduce about 54,000 billion VND, in 2026 it will reduce about 113,000 billion VND. Therefore, the Government requests the National Assembly to keep the draft Resolution.

HA (according to Vietnam+)Source: https://baohaiduong.vn/quoc-hoi-thong-nhat-giam-2-thue-vat-ap-dung-den-het-nam-2026-414247.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

![[Infographic] What are the growth targets of Dong Nai province in the first 9 months of 2025?](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/3/45f9330556eb4c6a88b098a6624d7e5b)

Comment (0)