As the Vietnamese real estate market continues to face major challenges, many listed companies have reported poor financial results in the first half of this year. However, the companies are still willing to pay high salaries to their CEOs.

Novaland : Big loss but leadership income remains high

According to the financial report for the second quarter of 2025 of No Va Real Estate Investment Group (Novaland, stock code: NVL), although in the first half of the year, the company still lost more than 666 billion VND, it has improved significantly compared to the "record" loss of 7,327 billion VND in the same period last year.

Notably, new General Director Duong Van Bac, who took on this role from November 2024, had an income of up to 2.4 billion VND in the first half of the year, equivalent to about 400 million VND/month.

Compared to his income when he was CFO, the figure for CEO income increased sharply by about 69% (in his previous position, he received 1.4 billion VND in the first half of last year). Currently, Mr. Bac is the leader with the highest income and also the only one with increased income in the Board of Directors and General Director of Novaland.

Meanwhile, Mr. Bui Thanh Nhon, Chairman of the Board of Directors, received an income of 600 million VND in the first half of the year. This level has not changed compared to the same period. Two other members of the Board of Directors, Mr. Pham Tien Van and Mr. Hoang Duc Hung, respectively received an income of 300 million VND/person/month, which is higher than the top group in the Company but still lower than the CEO.

Novaland General Director Duong Van Bac (Photo: NVL).

Profits fall but executive salaries rise

At An Gia Real Estate Investment and Development Joint Stock Company (stock code: AGG), General Director Nguyen Thanh Son has no income.

Meanwhile, Chairman of the Board of Directors Nguyen Ba Sang earned 1.24 billion VND, up 66% over the same period last year. Other leaders also recorded significant increases in income. Deputy General Director Nguyen Mai Giang earned 680 million VND, up 35%. Chief Accountant Nguyen Thanh Chau earned 625 million VND, up 16%.

Although An Gia is having difficulty maintaining profits, the income of the company's leadership team still shows no signs of decreasing. The company recorded a profit after tax in the first half of the year of VND90 billion, down 58% compared to the same period in 2024.

An Gia leaders' first half year income (Photo: An Gia Financial Statements).

Profits are decreasing but leadership income is still high, which is still the story at Construction Development Investment Corporation (DIC Corp, stock code: DIG) and Van Phu Real Estate Development Corporation (Van Phu Invest, stock code: VPI).

Specifically, Chairman of the Board of Directors of DIC Corp, Mr. Nguyen Hung Cuong, received 900 million VND, Vice Chairman Nguyen Thi Thanh Huyen received 600 million VND in the first 6 months of the year. The remaining members of the Board of Directors have income ranging from 19 million VND to 90 million VND/person.

The remuneration payment to the Board of Directors at DIC Corp is still maintained despite the poor financial results. In the second quarter of this year, the company's profit decreased by 58% compared to the same period. Thanks to the reduction of losses in the first 3 months of the year, the semi-annual profit after tax increased by 70% to 6.7 billion VND.

Or Van Phu Invest recorded a 75% decrease in profits in the second quarter. However, the income of the company's leaders remained high. CEO Pham Hong Chau recorded an income of more than 77 million, while members of the Board of Directors earned hundreds of millions of VND in the second quarter. Chairman To Nhu Toan received a salary of 603 million VND, and the Vice Chairmen and Deputy General Directors also received an income of about 400 million VND/quarter.

Income improves with business performance

In contrast, Phat Dat Real Estate Development Joint Stock Company (stock code: PDR) recorded a profit after tax of VND115 billion in the first half of the year, up 12% over the same period. Despite the more positive results, the income of the company's management remained stable compared to the previous year.

Specifically, Chairman of the Board of Directors Nguyen Phat Dat received a total income of nearly 970 million VND; General Director Bui Quang Anh Vu received more than 2.8 billion VND; Vice Chairman of the Board of Directors Nguyen Tan Danh received 300 million VND.

Notably, at Danh Khoi Group Joint Stock Company (NRC Corp, stock code: NRC), the income of leaders increased sharply.

Specifically, Chairman Le Thong Nhat received an income of 651.8 million VND in 6 months, an increase of 67 million VND compared to the same period, while General Director Nguyen Huy Cuong received an income of nearly 662 million VND, an increase of nearly 100 million VND compared to the previous year. In the first half of the year, NRC Corp's revenue reached 11.2 billion VND, profit reached 4.84 billion VND, an increase of 147% compared to the same period.

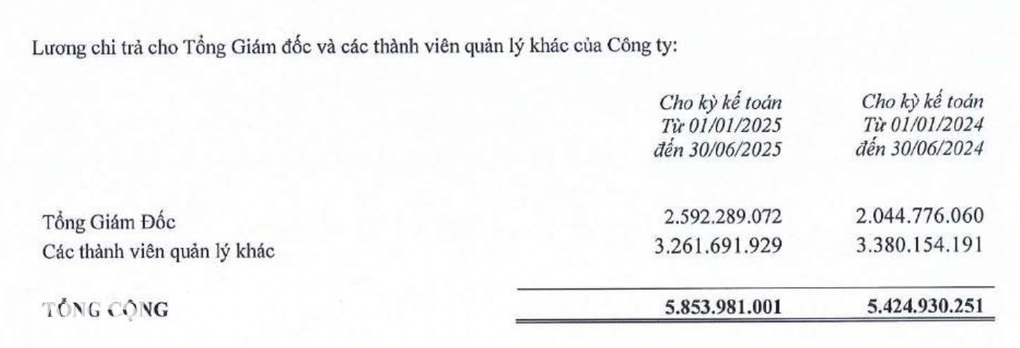

Dat Xanh Group (stock code: DXG) doubled its profit in the second quarter of 2025 to VND 277 billion, the highest since the second quarter of 2021. This growth was mainly driven by financial revenue and cost reduction.

Correspondingly, the income for the general director increased by 500 million VND, up to nearly 2.6 billion for 6 months.

Income of leaders in the first half of the year of Dat Xanh (Photo: Dat Xanh Financial Statements).

Source: https://dantri.com.vn/kinh-doanh/soi-thu-nhap-sep-cong-ty-bat-dong-san-co-nguoi-hon-400-trieu-dongthang-20250813110022777.htm

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

Comment (0)