| Commodity market today October 16, 2024: World raw material prices continue to fluctuate Commodity market today October 17: Sugar prices drop to the lowest level in nearly a month |

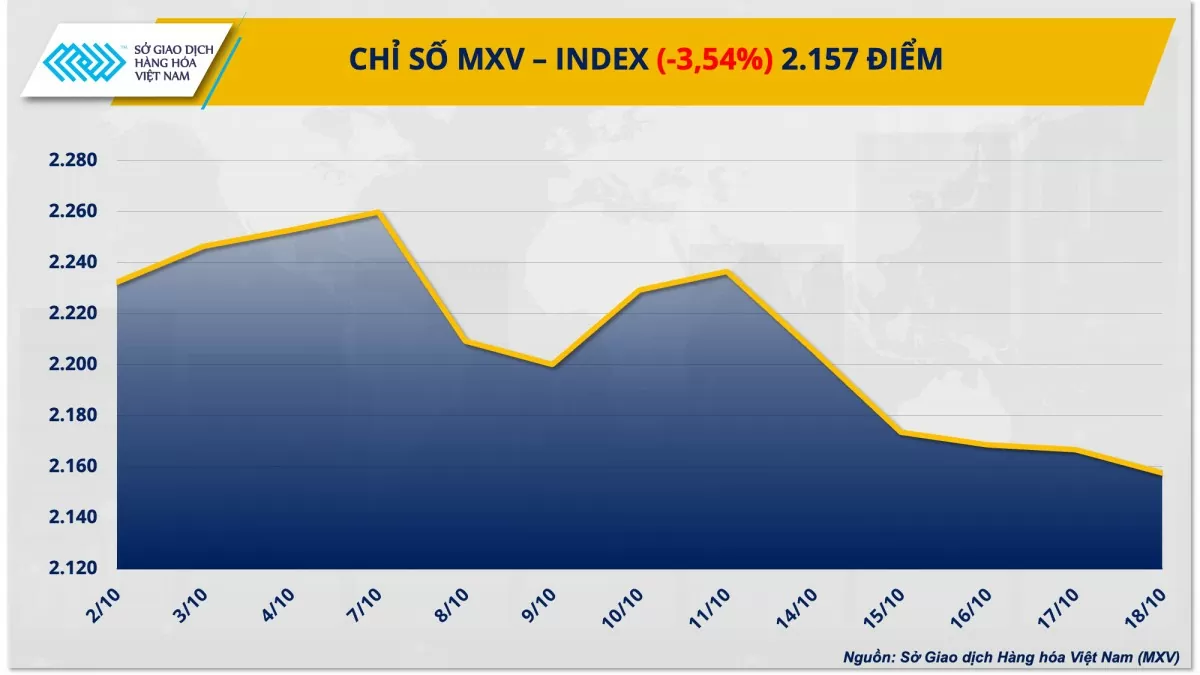

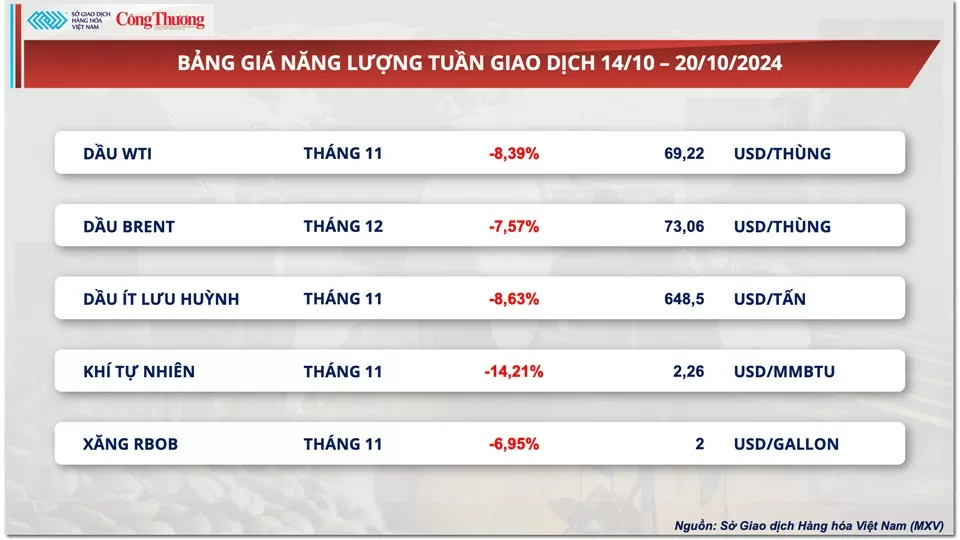

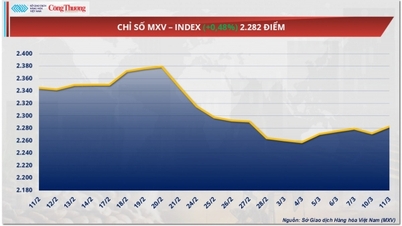

The energy market led the overall market trend as all commodity prices fell sharply by 7-14%. Brent and WTI crude oil prices plunged by 7.6% and 8.4%, respectively. The agricultural market also saw many weak sessions amid positive supply prospects in the US and Brazil. At the close, the MXV-Index lost 3.54% to 2,157 points.

|

| MXV-Index |

Crude oil prices fell to their lowest level since early October.

Crude oil prices slid in the week of October 14-20, ending two consecutive weeks of gains. MVX said that China's sluggish demand and easing tensions in the Middle East were the main factors affecting oil prices last week. This also led OPEC to lower its forecast for global oil demand growth this year.

WTI crude oil price for November delivery fell 8.39% to 68.69 USD/barrel; Brent crude oil price for December delivery also lost 7.57% to nearly 73 USD/barrel, the lowest level recorded in early October.

|

| Energy price list |

In its October report, OPEC forecast global crude oil demand to grow by 1.93 million barrels per day in 2024, down from the 2.03 million barrels per day forecast in its previous report. This marked the third consecutive downward revision by the organization for the “black gold” commodity.

Notably, weak consumption in China was the main reason OPEC cut its demand growth forecast. OPEC cut its forecast for China's oil demand growth from 650,000 barrels per day to 580,000 barrels per day. Although Chinese government stimulus measures will help boost demand in the fourth quarter, OPEC still believes that economic difficulties and the trend towards green fuels are hindering oil consumption growth this year.

Separately, customs data showed China imported 45.5 million tonnes of crude oil in September, down 7.4% from a year earlier, marking the fifth consecutive month of year-on-year declines in crude oil imports.

At the same time, the easing of tensions in the Middle East has also contributed to the pressure on oil prices. Israel has informed the US that Tel Aviv will carry out retaliatory attacks on Iranian military facilities instead of nuclear and energy facilities. This could help the conflict avoid the risk of escalating into a full-scale war between Iran and Israel, which could disrupt crude oil supplies from the Middle East.

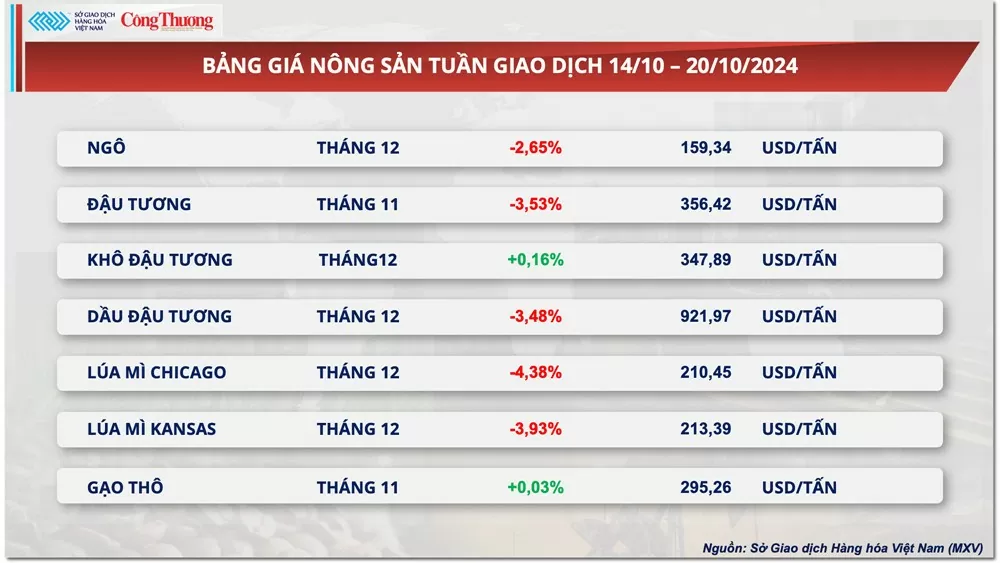

Soybean prices extended their decline to a third consecutive week.

Last week, the agricultural market was also covered in red. In particular, soybean prices lost 3.53% to 356 USD/ton, extending the decline into the third consecutive week. Although the market recorded some positive information about demand, however, this was not enough due to the pressure from the ongoing harvest in the US and the prospect of improved weather in Brazil.

|

| Agricultural product price list |

In its Crop Progress Report, the US Department of Agriculture (USDA) said that the country’s soybean harvest progress as of October 13 was 67% complete, up 20% from the previous week and 3% higher than market expectations. This figure far exceeds the 57% of the same period last year and the historical average of 51%, indicating that dry weather has facilitated harvesting activities, thereby increasing selling pressure in the market.

In addition, the monthly report of CONAB said that Brazil's soybean production in the 2024-2025 crop year is forecast to reach 166.05 million tons, up 12.6% from the previous year's 147.38 million tons. This increase is driven by expectations of improved acreage and yields. With more abundant supplies, Brazil's soybean exports are expected to reach 105.54 million tons, up more than 14% from the 2023-2024 crop year. In addition, in October, the National Association of Cereal Exporters of Brazil (ANEC) raised its October soybean export outlook to 4.34 million tons, from the previous estimate of 4.12 million tons. Large supplies from the South American market were a factor that boosted soybean sales last week.

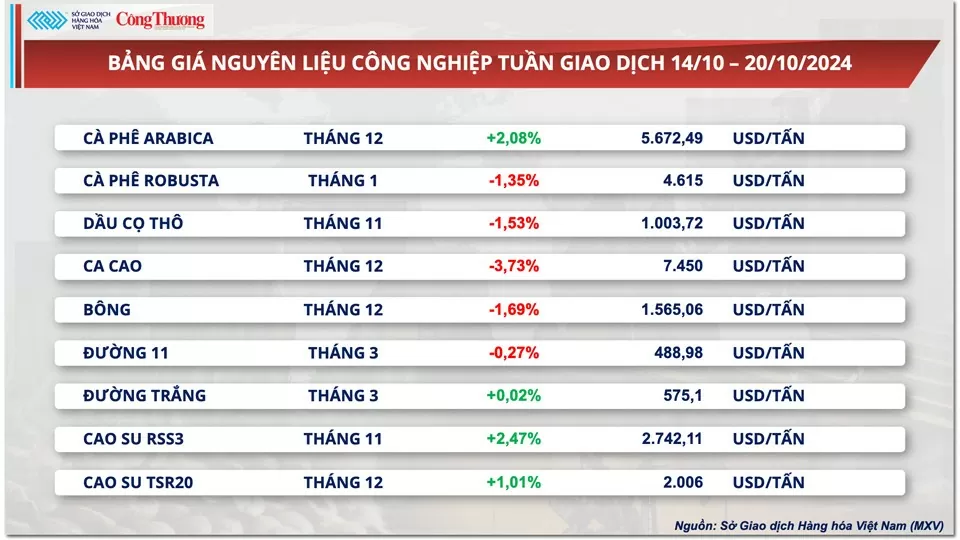

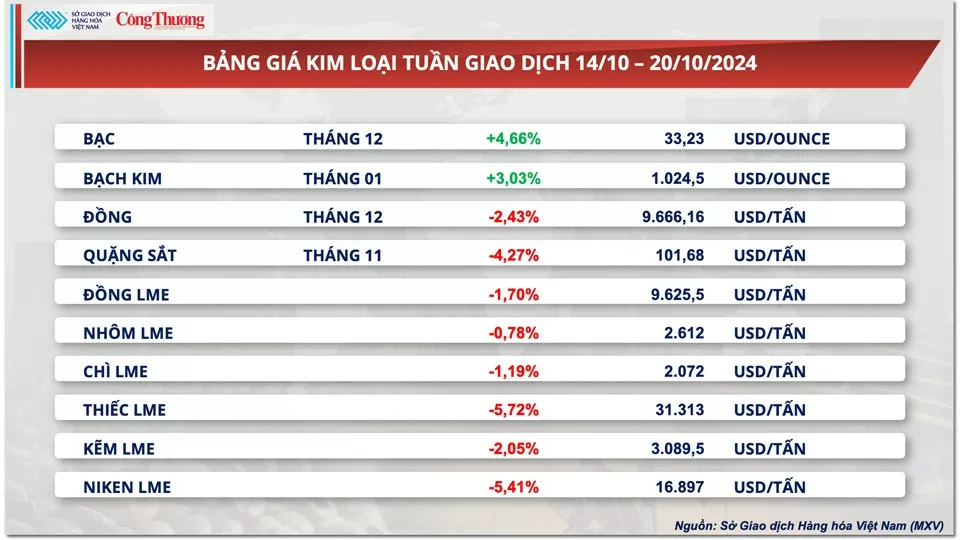

Prices of some other goods

|

| Industrial raw material price list |

|

| Metal price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-ngay-1810-thi-truong-hang-hoa-nguyen-lieu-trai-qua-tuan-giao-dich-do-lua-353676.html

Comment (0)