Lack of superior investment channels, money still flows into banks

Bank deposits continue to increase and reach new records, while demand for gold and real estate "surfing" is slowing down.

|

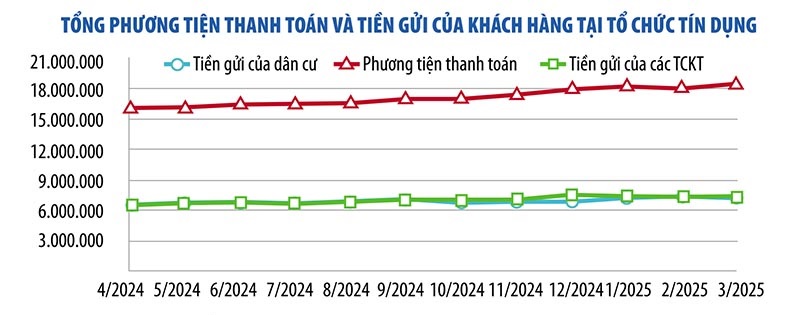

The latest figures just announced by the State Bank show that by the end of March 2025, deposits from both individual customers and economic organizations of credit institutions reached nearly 15 million billion VND, up 1.8% over the previous month. Of which, deposits from residents reached 7.47 million billion VND, up 5.73% over the beginning of the year. Deposits from enterprises reached 7.52 million billion VND, down 1.92% over the end of 2024, but up more than 158,000 billion VND over the previous month.

According to Dr. Chau Dinh Linh (Banking University of Ho Chi Minh City), deposits are flowing strongly into banks because people are cautious in the context of the economy and other investment channels that have many potential risks and are unpredictable. Although the rate of return is lower than other investment channels, savings deposits are safe and highly liquid.

Similarly, Mr. Nguyen Quang Huy, Executive Director of the Faculty of Finance and Banking (Nguyen Trai University) said that although the interest rate is not attractive compared to many other investment channels, it is suitable for the risk appetite of the majority of people (safety is the number one requirement). "The market has many investment channels, but there is a lack of attractive investment channels in terms of yield, safety and liquidity. Therefore, idle money in the people still flows mainly into the banking system," Mr. Huy commented.

State Bank data shows that by the end of May 2025, credit in the entire economy increased by 6.52%, nearly 3 times higher than the growth rate in the same period last year. Thus, credit in the entire economy has reached a scale of about 16.6 million billion VND, an increase of 1 million billion VND compared to the end of 2024.

After a surge in recent months, the real estate market has shown signs of slowing down. According to Dr. Tran Xuan Luong, Deputy Director of the Vietnam Real Estate Market Research Institute, investors are more cautious due to political fluctuations in the world, as well as changes in domestic institutions. The real estate market in the last 6 months of 2025 is expected to move sideways, maintaining a stable state.

Many economic experts also believe that after a period of hot price growth, the real estate market will slow down, and the demand for real estate "surfing" will decrease. Slowing liquidity will cause the cash flow into this sector to no longer flow as strongly as in the first half of the year.

In the gold market, the price of SJC gold bars increased by 44% in the first 4 months of the year, but has been flat for the past 2 months. In the world , the price of gold has skyrocketed from 2,624 USD/ounce at the beginning of this year to nearly 3,500 USD/ounce at the end of April 2025 and is hovering around 3,400 USD/ounce.

Although the world gold price is forecast to continue to rise, experts say that the gold price is in a phase where it “can turn around at any time”. Therefore, investors need to be cautious and should only invest in gold if they truly consider it a defensive asset or a long-term investment.

“It is difficult to predict the price of gold in the coming time, but I think that in the context of global instability, institutional and individual investors are increasingly turning to gold to hedge against uncertainties. In Vietnam, the demand for gold investment is still very strong, but investors must be vigilant and always ready for any surprises,” Mr. Shaokai Fan, Director of Asia-Pacific region (excluding China) and Director of Global Central Banks at the World Gold Council recommended.

Regarding the stock investment channel, Mr. Phan Dung Khanh, Investment Consulting Director of Maybank Investment Bank, said that the market still receives more positive news than negative news. Cash flow and liquidity are gradually improving, supporting investor sentiment. However, for the market to grow strongly, fundamental information such as economic growth or market upgrade is still needed...

According to experts, the National Assembly's legalization of digital assets and crypto assets in the Digital Technology Industry Law and the establishment of an International Financial Center in Vietnam will open a new official investment channel. However, this investment channel requires specialized knowledge and is highly risky, not suitable for the majority of investors.

When all investment channels are unstable, the majority of investors still prioritize capital preservation - the biggest advantage of savings deposits. "This explains why idle money still flows into banks despite the low savings interest rates," said Dr. Nguyen Tri Hieu, an economic expert.

The Vietnam Gold Business Association recently sent a dispatch to comment on the Draft Amendment and Supplement to Decree 24 on Gold Market Management (Decree 24).

Notably, the Association has proposed not to add credit institutions, especially commercial banks, to participate in the production and trading of gold bars.

Explaining this, VGTA said that according to the Law on Credit Institutions dated January 18, 2024, commercial banks do not have the function of producing gold. The main tasks of commercial banks are currency trading (especially credit activities) and providing payment services.

"If commercial banks are allowed to participate in the production and trading of gold bars, they will be forced to use a large amount of capital to invest in factories, machinery, train workers, and invest in areas that are not within their main functions and tasks of providing credit and supporting capital for production and business enterprises to achieve economic growth targets," the Association said.

Besides, commercial banks are not specialized organizations in gold production and trading and history has proven that commercial banks were ineffective in producing and trading gold bars before 2012.

"Some commercial banks have left behind long-lasting, unexpected consequences that have been stabilized thanks to the effective and determined direction of the State Bank," VGTA emphasized.

In addition, the Vietnam Gold Business Association also commented on regulations on conditions for granting a license to produce gold bars for enterprises with charter capital of VND1,000 billion or more.

The Association believes that this regulation is too strict, only 1 to 3 gold production and trading enterprises can meet this condition.

With the above regulation, the number of enterprises participating in gold bar production is insignificant, making it difficult for the market to expand and there is a risk that the State will continue to hold a monopoly, reducing diversity and limiting the supply of gold bars.

For the above reasons, the Association recommends that a charter capital of 500 billion VND or more is appropriate. In addition, it is necessary to focus on the production capacity of the enterprise, business efficiency, business reputation, brand in the market, design and quality of gold bars; and compliance with state regulations related to gold trading.

|

Regarding the issuance of annual limits and licenses for each export, import of gold bars and import of raw gold for gold bar manufacturing enterprises in the draft, the Association believes that it should be considered to be removed.

Because this regulation increases sub-licenses, increases administrative procedures for businesses, hinders gold bar export activities, and regenerates foreign currency for the country. At the same time, it loses production and business opportunities for businesses because the world gold market fluctuates continuously and is affected by many factors.

If businesses wait for each licensing procedure, they will lose the opportunity to export or import at the best price, affecting production efficiency and export activities.

The Association also proposed to only regulate the State Bank to grant annual quotas for gold bar import and export and raw gold import, allocated to each enterprise from the first quarter of the year according to the principles of publicity, transparency, and no sub-licenses.

On that basis, enterprises proactively choose the time and volume (within the limit) to import or export to achieve the highest efficiency. Enterprises periodically report on the implementation of the gold import and export limit to the State Bank. The State Bank will consider and decide on any additional adjustments to the limit.

In addition, it is recommended that the Drafting Committee consider the mechanism to encourage the import of raw gold to produce gold bars and jewelry to meet domestic market demand and serve export and foreign currency regeneration, and should not create a mechanism for commercial activities (import and export of gold bars).

Agricultural business households can borrow up to 500 million VND without collateral

The Government has just issued Decree No. 156/2025/ND-CP amending and supplementing a number of articles of Decree No. 55/2015/ND-CP dated June 9, 2015 of the Government on credit policy for agricultural and rural development, which has been amended and supplemented a number of articles according to Decree No. 116/2018/ND-CP dated September 7, 2018 of the Government.

Accordingly, the Decree increases the maximum unsecured loan amount for individuals, households, cooperatives, business households, cooperatives, cooperative unions and farm owners to suit the capital needs for agricultural production of current customers.

Specifically, the unsecured loan limit for individuals and households is increased from 100-200 million VND to 300 million VND.

The unsecured loan limit for cooperatives and business households is increased from VND300 million to VND500 million.

The unsecured loan amount for farm owners is increased from VND 1-2 billion to VND 3 billion.

The unsecured loan level for cooperatives and cooperative unions is increased from 1 - 3 billion VND to 5 billion VND.

The Decree also cuts down on administrative procedures, making it easier for customers to borrow capital from credit institutions. Accordingly, the content related to the requirement to submit a certificate of land use rights and land without disputes confirmed by the People's Committee at the commune level is removed; at the same time, it stipulates that customers can borrow without collateral and the credit institution must agree (instead of the mandatory requirement as previously prescribed) on the customer submitting to the credit institution a certificate of land use rights and ownership of assets attached to the customer's land during the loan period without collateral at the credit institution.

The Decree also amends the provisions on debt repayment restructuring, maintaining the debt group and setting up provisions to handle risks in the direction of assigning the State Bank of Vietnam to regulate debt repayment restructuring for debts that are kept in the same debt group according to Decree 55/2015/ND-CP; at the same time, it provides guidance on debt classification and setting up risk provisions for debts that are kept in the same debt group to comply with the Law on Credit Institutions 2024 and relevant legal regulations.

The newly added contents in the Decree are: Adding a number of concepts related to debt forgiveness policy to facilitate debt forgiveness and be consistent with the reality of debt forgiveness in the past time; Adding credit policies to encourage organic and circular agriculture to enjoy credit policies similar to customers producing high-tech agriculture, linking in agricultural production (regarding unsecured loan levels, risk handling mechanisms) to be consistent with the current trend of agricultural development according to new models under the direction of the Prime Minister...

The amendment and supplement of the Decree is to conform to the current capital needs for agricultural production and continue to promote efficiency, put into practice in the coming time in accordance with the policies and directions of the Party and State, contributing to further unlocking resources for the rural agricultural sector, contributing to the common efforts to complete the goal of accelerating, breaking through, and reaching the finish line in the socio-economic development of the whole country in the coming time as well as in accordance with the 2-level local government model.

The Decree will take effect from July 1, 2025.

Sharing the fire with Minister of Finance Nguyen Van Thang in the question and answer session on the morning of June 19, Governor of the State Bank of Vietnam (SBV) Nguyen Thi Hong said that it is necessary to diversify capital sources for the economy, instead of relying only on bank capital. However, the Governor also warned that when mobilizing capital for large projects, it is necessary to calculate the ability to borrow and repay debt.

|

According to the Governor, the current growth of Vietnam's economy is heavily dependent on capital but efficiency is not high, as shown by the ICOR index which is still high compared to the region, showing that capital use efficiency needs to be further improved.

Although Vietnam has attracted a large amount of foreign investment capital, especially FDI capital, it has not yet taken advantage of many capital advantages, especially in technology transfer and management capacity, and has not yet connected with the domestic sector. The Governor believes that in the coming time, there needs to be a "renewal" in the FDI attraction strategy towards promoting technology transfer, management and more connection with the domestic economy.

Agreeing with the Finance Minister's opinion that high economic growth needs to rely on both domestic and foreign capital, the Governor said that foreign capital is very diverse such as: FDI capital, FII capital, foreign loans... With the current public debt and foreign debt targets, Vietnam's foreign borrowing space is still very open.

However, from experience in macro management, the Governor noted the borrowing and use of capital.

Specifically, according to the Governor, domestic capital is currently heavily dependent on the banking system, including short-term capital, medium- and long-term capital. Outstanding credit/GDP at the end of 2024 has reached 134%, if it continues to increase, it will pose risks to the banking system and cause consequences for the economy, making it difficult to achieve the goal of both high and sustainable economic growth.

"This is an issue that ministries and sectors need to pay close attention to in the coming time when balancing capital for high economic growth targets," the Governor suggested.

The SBV leaders also said that the demand for domestic investment capital in the coming time is very large. From now until 2030, with a vision to 2045 and especially 2030, it is expected that many projects with large investment capital will be implemented, such as the construction of an additional 2,000 km of highways (currently the North-South expressway project with a large total investment capital is being implemented), investment in the construction of many airports, ports, and power planning VIII...

The Governor recommends that, from now on, ministries and functional branches need to calculate where to mobilize capital, how to borrow and repay debt, how to divide capital, how to reserve capital sources... to ensure that they do not create great pressure on macro risks.

The State Bank of Vietnam said that, as the lifeblood of the economy, in recent years, the banking system's credit has increased by an average of 14-15% per year, a high level compared to the region. In 2025, to serve the high growth target of 8% or more, the State Bank of Vietnam has set a growth target of 16% and can adjust it if inflation is under control.

"In the context of a highly open economy, monetary policy management has made great efforts in the past. In the coming time, the State Bank will continue to closely follow developments to implement management tools, at the right time and in the right doses to control inflation, stabilize the macroeconomy, stabilize the foreign exchange market and ensure the safety of the banking system. This is a fundamental point because if the macroeconomy, currency and foreign exchange fluctuate as before, it will be very difficult for businesses to develop," the Governor pledged.

According to the 2025 data just released by the World Gold Council (WGC), 95% of reserve managers said they expect central banks to continue to increase their gold reserves in the next 12 months. This is a record high compared to the results of surveys from 2019 to now. Reserve managers still maintain a positive view on gold in the context of gold reaching many record highs and central banks maintaining gold purchases for 15 consecutive years.

|

In fact, the Central Bank Gold Reserves (CBGR) 2025 survey, which collected data from 73 central banks globally, found that nearly 43% of central banks plan to increase their gold reserves in the coming year.

The continued plans by central banks around the world to buy more gold reserves shows that gold continues to serve as a safe haven asset that helps reduce risks amid prolonged economic and geopolitical uncertainty that puts pressure on reserve managers.

The three main reasons why central banks and reserve managers are prioritizing holding gold as an asset at the moment are: gold's long-term value preservation ability (80%), gold's role as an effective portfolio diversifier (81%), and gold's performance in times of crisis (85%).

Central banks in emerging markets and developing economies (EMDEs) once again maintained a positive outlook on the future share of gold in their reserve portfolios.

Twenty-eight out of 58 (48%) EMDE countries surveyed said their gold reserves would increase over the next 12 months, while three out of 14 (21%) developed economies had similar intentions, higher than last year.

Interest rates remain a key driver of demand for gold in both groups of countries. However, while inflation (84%) and geopolitics (81%) are top concerns for EMDEs, 67% and 60% of respondents from developed economies share the same concerns.

Notably, more central banks are increasing their gold holdings domestically. Specifically, 59% of central banks hold gold in their national reserves, up from 41% in 2024.

In addition, most central banks surveyed (73%) believe that the share of the US dollar in global reserves will decline by a moderate or high rate over the next five years. However, these institutions also believe that the share of other currencies (such as the euro or the yuan) and gold in global reserves will increase over the same period.

Mr. Shaokai Fan, Director of Asia-Pacific (excluding China) and Director of Global Central Banks at the World Gold Council, affirmed that the figure of nearly half of the central banks participating in the survey intending to increase their gold holdings next year, in the context of gold reaching many record prices in 2025, is remarkable.

“This figure reflects the current global financial and geopolitical situation. At the same time, it shows that gold maintains its role as a strategic asset in the context of the world facing instability and volatility. Concerns about interest rates, inflation, and instability push central banks to turn to gold to reduce risks,” said Mr. Shaokai Fan.

Investors are more optimistic about the Fed cutting interest rates after US economic data showed that the Consumer Price Index (CPI) in May 2025 was lower than expected. Accordingly, the US CPI increased 0.1% in May, lower than the 0.2% forecast of economists surveyed by Dow Jones. Therefore, investors predict an 80% probability that the Fed will cut interest rates in September 2025, with the second rate cut as early as October.

In the world market, the greenback fell sharply due to the impact of expectations of the Fed cutting interest rates, geopolitical tensions, lower-than-expected US inflation data, as well as developments in US-China trade negotiations. The USD-Index fell to 97.86 points in the last session of the week - down more than 9% compared to the beginning of the year. This weakness mainly came from concerns about economic growth and trade policy from the US.

Mr. Dinh Duc Quang, Director of Currency Trading Division, UOB Vietnam Bank, said that with the prospect of USD interest rates trending downward, along with short-term difficulties due to the impact of tariff fluctuations on economic prospects and attracting investment flows into assets in the US, UOB forecasts that the USD-Index may be under pressure to fall below the 100 mark in the remaining months of 2025 and may be around 97 in early 2026.

Associate Professor, Dr. Nguyen Huu Huan, Senior Lecturer at the University of Economics, Ho Chi Minh City, said that the decrease in the USD-Index has helped reduce pressure on the VND/USD exchange rate. However, the exchange rate is still maintained at a high level, showing that this pressure still exists. In addition, the exchange rate tends to be seasonal, it may decrease at the present time, but is expected to start increasing again around August 2025.

The central VND/USD exchange rate listed by the State Bank of Vietnam (SBV) on June 13 decreased by VND15, down to VND24,975/USD. Commercial banks kept the USD price unchanged, Vietcombank bought at VND25,820 - 25,850/USD, sold at VND26,210/USD.

In a report published on June 9, 2025, UOB said that since the beginning of the quarter, the VND has depreciated by 1.8%, reaching a new record low of VND26,000/USD. This weakness mainly stems from the less positive economic outlook and the increased risk of the US re-imposing the 46% tariff if negotiations do not make significant progress.

The above factors are expected to continue to put pressure on VND in the short term. UOB believes that VND will still fluctuate in a weak price range within the trading range with USD until the end of Q3/2025. However, from Q4/2025 onwards, VND may begin to regain recovery momentum, in line with the general improvement trend of Asian currencies as trade uncertainties gradually ease.

According to UOB economists, inflation in Vietnam has cooled somewhat, at about 3.1% yoy in March and April 2025, down from an average of 3.6% in 2024 and 3.26% in 2023, and below the target of 4.5%. The benign inflation backdrop, while global trade tensions and rising tariff uncertainty, is opening up the possibility of the SBV easing monetary policy.

However, unlike some countries in the region, the weakening of the exchange rate is a factor that the SBV has to consider. UOB forecasts that the SBV will keep the policy interest rate unchanged, with the refinancing rate maintained at 4.50%.

If domestic business conditions and the labor market weaken significantly, UOB expects the SBV could cut the refinancing rate once to a Covid-19 low of 4%, followed by a further 50 basis points reduction to 3.50%, provided the foreign exchange market remains stable and the Fed cuts rates.

According to UOB analysts, VND will continue to fluctuate in a weak price range within the trading range with USD until the end of Q3/2025. However, from Q4/2025 onwards, VND may begin to regain its recovery momentum, in line with the general improvement trend of Asian currencies as trade uncertainties gradually ease. UOB updated its forecast for VND/USD exchange rate at 26,300 VND/USD in Q3/2025, 26,100 VND/USD in Q4/2025, 25,900 VND/USD in Q1/2026, and 25,700 VND/USD in Q2/2026.

Mr. Pyon Young Hwan, Director of Foreign Exchange and Derivatives, Shinhan Bank Vietnam, said that if the Fed cuts interest rates, it will be an opportunity for emerging markets like Vietnam to have more room to loosen monetary policy. The Fed's interest rate cut can help stabilize the VND/USD exchange rate, creating favorable conditions for the State Bank to implement monetary policy easing measures more flexibly.

However, Vietnam may still need to maintain higher interest rates than the US for a certain period of time. According to Shinhan Bank experts, in the short term, the trend of the VND/USD exchange rate depends on the results of the first round of tariff negotiations between the US and Vietnam. Shinhan Vietnam forecasts that by the end of the third quarter of 2025, the exchange rate will fluctuate around 25,600 - 26,000 VND/USD.

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

Comment (0)