According to the Vietnam National Administration of Tourism , in the first 8 months of 2024, the tourism industry welcomed nearly 11.5 million international tourists and nearly 90 million domestic tourists. In August alone, the number of international tourists reached more than 1.4 million and domestic tourists reached 10 million.

During the 4-day National Day holiday on September 2 this year (August 31 - September 3), it is estimated that the tourism industry nationwide served about 3 million tourists (up 20% over the same period in 2023). The average room occupancy rate at tourist accommodation establishments reached 56% (up 1.85% over the 2023 holiday period), with the occupancy rate reaching over 60% on September 1 and 2, 2024.

However, in contrast to the positive signals of the tourism industry, the resort real estate segment has not shown many signs of a breakthrough in the coming period. Specifically, according to DKRA's August 2024 market report, the shophouse/resort townhouse segment recorded no sales in the month. Supply remained at 2,907 units from 30 unsold projects, with 65% of the inventory belonging to the Central market and 32% belonging to the Southern market.

The primary selling price of this type has not fluctuated much with the highest selling price belonging to the Southern market at 70 billion VND/unit and the lowest in the Northern market at 4.6 billion VND/unit. Meanwhile, the secondary market recorded some products with prices reduced by 30% - 40% but still facing difficulties in liquidity.

“The sharp decline in purchasing power, lack of new supply, high-value inventory, etc. have caused significant obstacles in recent months, causing this segment to almost fall into a prolonged hibernation cycle,” DKRA commented.

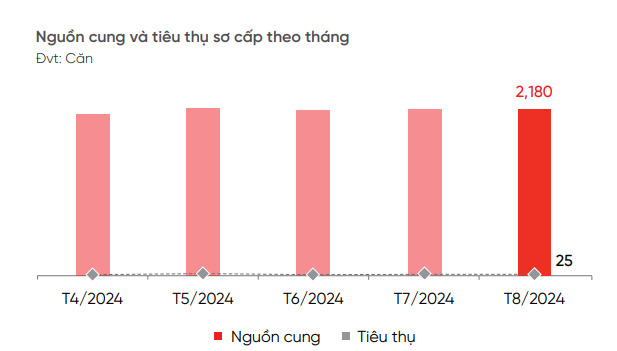

Monthly supply and consumption of resort real estate have not fluctuated much in recent months (Photo: DKRA)

Regarding the resort villa category, this unit recorded a slight increase in supply of 0.4% compared to the previous month but a decrease of 5% compared to the same period in 2023. The primary supply recorded in the month was 2,180 units from 60 projects. The highest selling price was nearly 156 billion VND/unit and the lowest was 5.2 billion VND/unit, all of which are products belonging to the Southern market.

Market liquidity was also recorded at a low level with a consumption rate of 1% (25 units), demand decreased by approximately 22% compared to the previous month, the transaction volume concentrated on products with a selling price of less than 10 billion VND/unit. Policies of commitment to lease back, buy back, interest support, etc. continue to be widely applied but are not as effective as expected. The market continues to face many difficulties in liquidity and price increase potential when investor confidence as well as the recovery of this segment is still very low.

As for Condotel, this type also recorded only slight fluctuations with the consumption rate in August reaching 4% with 192 units sold. The remaining supply comes from 46 projects with more than 4,800 units, 67% concentrated in the Central market, with the highest selling price of 180 million VND/m2 in the Central region and the lowest of more than 36 million VND/m2 in the Northern market.

DKRA commented that the demand for this type of property has decreased by 53% compared to last month, transactions mainly focused on projects with completed legal documents with a total selling price of less than 3 billion VND/unit. This type of property is still facing difficulties in liquidity and has not shown signs of recovery in the short term.

Resort real estate has yet to show signs of bottoming out.

Also related to this type, the Government recently issued Decree No. 115/2024/ND-CP dated September 16, 2024 detailing a number of articles and measures to implement the Law on Bidding and the Law on Land on selecting investors to implement investment projects using land. In which, a number of articles of a number of Decrees under the state management of the Ministry of Planning and Investment were amended, supplemented, and abolished.

Specifically, Clause 5, Article 68 of Decree 115 amended and supplemented Point c, Clause 7, Article 31 of the Decree with the following content: "For urban planning, the appraisal content must include an assessment of the conformity of the investment project with the zoning plan; in case the project is proposed in an area that does not require a zoning plan according to the provisions of the law on urban planning or the zoning plan must be adjusted and has not been approved by a competent authority, the conformity of the investment project with the general plan must be assessed."

This regulation will remove many years of obstacles and bottlenecks in procedures for approving investment policies for social housing projects, commercial housing projects and investment projects using land for accommodation purposes such as serviced apartments, officetels, condotels, etc.

Source: https://www.congluan.vn/chi-tieu-thu-duoc-1-nguon-cung-trong-thang-8-biet-thu-nghi-duong-van-tiep-tuc-ngu-dong-post313681.html

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

Comment (0)