The US Department of Commerce (DOC) has just announced preliminary conclusions in the anti-dumping investigation on vehicle chassis and components imported from Vietnam.

According to information published in the Federal Register, the investigation was initiated by DOC on March 24, 2025. On July 18, 2025, the Department decided to postpone the issuance of the preliminary conclusion to September 24, 2025.

The products subject to the investigation are chassis and subassemblies thereof originating in Vietnam. In the notice, DOC determined that Vietnamese manufacturers exported the products to the United States at less than “fair value.”

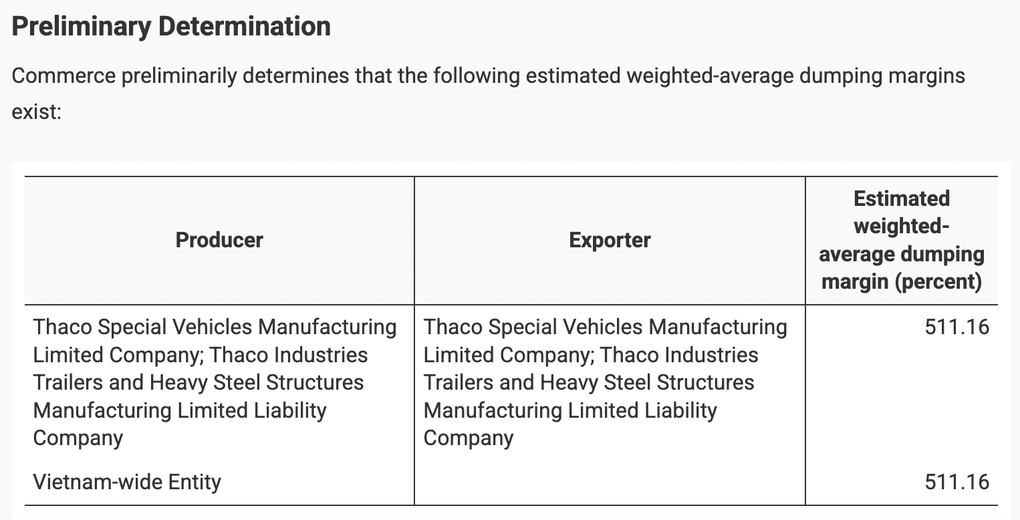

The two Vietnamese companies named are Thaco Special Vehicles Manufacturing and Thaco Industries Trailers and Heavy Steel Structures. The US investigation agency merged these two companies into one entity (THACO) to conduct the investigation.

DOC said that THACO was the only enterprise in Vietnam that was considered separately, and after the analysis process, the agency calculated the dumping margin and issued a preliminary tax rate of 511.16%. This is considered a record high temporary tax rate in cases related to heavy industrial products originating from Vietnam.

DOC also determined that all entities in Vietnam cooperated during the investigation. Therefore, the Department decided to apply THACO's anti-dumping margin to all vehicle chassis exported from Vietnam.

The US Department of Commerce determined that Vietnamese manufacturers exported products to the United States at prices below “fair value” (Photo: information posted on the Federal Register).

However, this is only a preliminary conclusion.

It is known that THACO (founded by billionaire Tran Ba Duong) has sent a request to DOC to postpone the announcement of the final conclusion and extend the application of temporary measures to a maximum of 6 months. The US Department of Commerce has approved this request, and announced that the final conclusion will be issued within 135 days from the date of announcement of the preliminary conclusion.

In similar investigations against other countries, Mexico was imposed a preliminary anti-dumping tax of 32.37% by the US. Thailand was also imposed a preliminary anti-dumping tax ranging from 46.12% to 181.57% depending on the enterprise.

Source: https://dantri.com.vn/kinh-doanh/ty-phu-tran-ba-duong-nhan-tin-khan-tu-bo-thuong-mai-my-20251006075751921.htm

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting of the Government Standing Committee to remove obstacles for projects.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/06/1759768638313_dsc-9023-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chaired a meeting of the Steering Committee on the arrangement of public service units under ministries, branches and localities.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/06/1759767137532_dsc-8743-jpg.webp)

Comment (0)