At the time of survey at 2:00 p.m. on August 26, 2024, the gold price on the trading floors of some companies was as follows:

The price of 9999 gold today is listed by DOJI at 79.0 million VND/tael for buying and 81.0 million VND/tael for selling.

|

| Gold price this afternoon August 26, 2024. Illustration photo |

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 80.0-81.0 million VND/tael (buy - sell).

SJC gold price at Bao Tin Minh Chau Company Limited is also traded by the enterprise at 79.0-81.0 million VND/tael (buy in - sell out). Meanwhile, at Bao Tin Manh Hai, it is being traded at 79.0-81.0 million VND/tael (buy in - sell out).

Saigon Jewelry Company - SJC increased the price of 4-number 9 gold rings by 200,000 VND per tael, buying price to 77.2 million VND, selling price to 78.5 - 78.6 million VND. Phu Quy Company increased the price of gold rings by 50,000 VND, buying price to 77.2 million VND, selling price to 78.5 million VND. Phu Nhuan Jewelry Joint Stock Company (PNJ) increased the buying price to 77.2 million VND, selling price to 78.4 million VND...

The price of gold rings is at an all-time high. Compared to the beginning of the year, the price of gold rings has increased by 15.3 million VND/tael, equivalent to an increase of 24.2%. However, the price of gold rings is still 2.4 million VND/tael lower than that of SJC gold bars. Gold traders have not changed the price of SJC gold bars, keeping it at 79 million VND/tael for buying and 81 million VND for selling.

According to Kitco, the world gold price recorded at 2:00 p.m. today, Vietnam time, was 2,517.52 USD/ounce. Today's gold price increased by 6.66 USD compared to yesterday's gold price. Converted according to the current exchange rate at Vietcombank , the world gold price is about 74.649 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is still 4.351 million VND/tael higher than the international gold price.

|

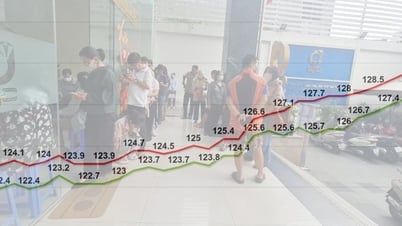

| Gold price fluctuation chart in the last 24 hours. |

Gold prices are expected to continue to rise as the USD falls and investors expect the US Federal Reserve (FED) to cut interest rates for the first time next September, with a reduction of up to 0.5 percentage points. However, in the short term, gold prices may face profit-taking pressure as they continuously hit new peaks and remain at a high level - above 2,500 USD/ounce.

Analysts see solid upside potential for gold as the US Federal Reserve prepares to cut interest rates next month, with Fed Chairman Jerome Powell emphasizing the time for policy adjustments in his speech at the Jackson Hole Symposium.

Adam Button, head of currency strategy at Forexlive.com, said that with interest rates falling, gold will continue to shine as the dollar weakens. This does not look like a market peaking. Phillip Streible, chief market strategist at Blue Line Futures, said that we could see gold rise to $2,600 an ounce before the market sees more steady selling pressure and profit-taking. Interest rates are likely to fall 0.5% in September and 1% by year-end.

According to data from SPDR Gold Shares, the world's largest gold-backed exchange-traded fund, inflows of 12.38 tonnes were recorded this month but holdings are still down more than 21 tonnes this year.

Source: https://congthuong.vn/gia-vang-chieu-nay-2682024-vang-nhan-tiep-tuc-tang-len-muc-ky-luc-341535.html

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

Comment (0)