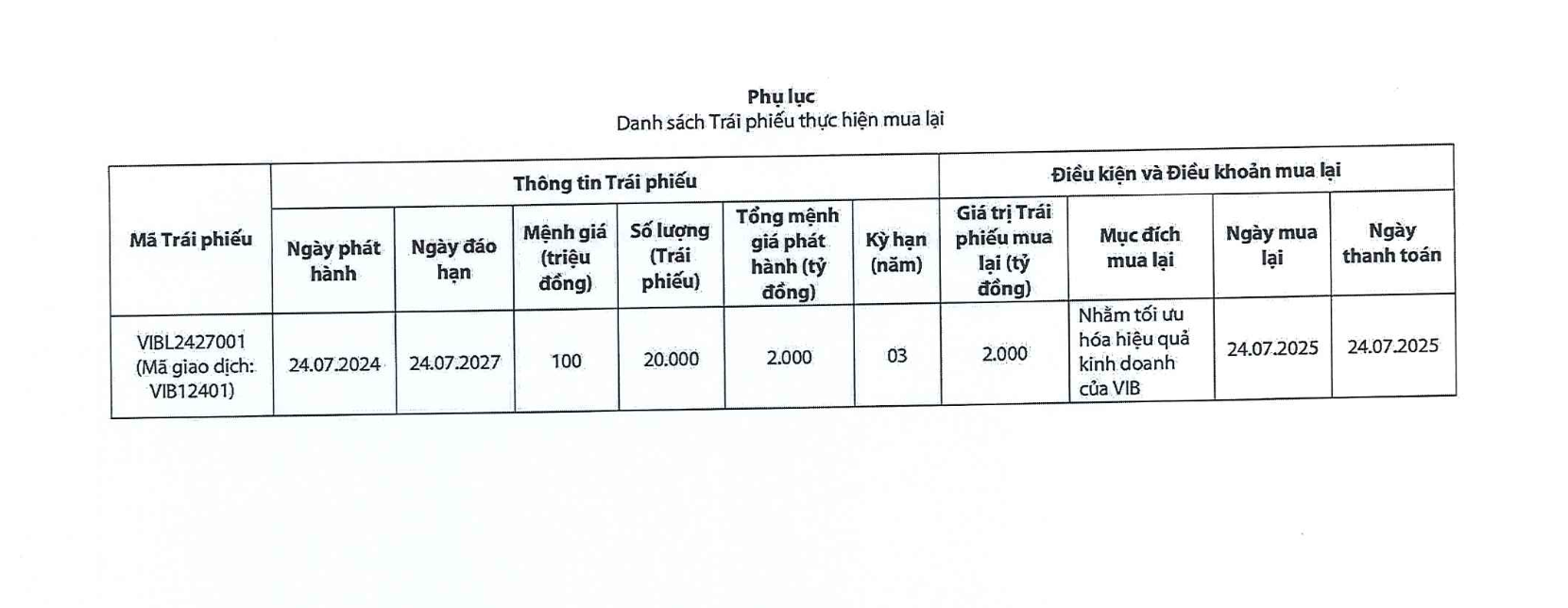

Accordingly,VIB plans to settle the bond lot code VIBL2427001 (transaction code: VIB12401) ahead of schedule on July 24, 2025. This bond lot has a term of 3 years, issued on July 24, 2024 and was originally expected to mature in 2027.

The bank explained that the early buyback is aimed at optimizing capital efficiency in a volatile market context.

VIB's announcement on bond repurchase

This is the second time in 2025 that VIB has repurchased bonds before maturity. Previously, on February 28, the bank successfully settled the VIBL2226001 bond lot worth VND948 billion, issued from 2022 with a term of 4 years.

According to data from the Hanoi Stock Exchange (HNX), since the beginning of the year, VIB has not issued any new bonds.

Regarding business performance, in the first quarter of 2025, VIB recorded pre-tax profit of nearly VND 2,421 billion and after-tax profit of more than VND 1,936 billion, both down more than 3% over the same period last year.

As of March 31, 2025, VIB's total assets reached approximately VND496,000 billion. Outstanding customer loans reached VND335,000 billion, up more than 3% compared to the beginning of the year. Credit growth occurred evenly across segments, in which the retail segment continued to play a key role, accounting for nearly 80% of total outstanding loans.

As of the end of the first quarter, the bank's bad debt ratio was at about 2.68%. The remaining risk management indicators were all at a safe and optimal level, in which the Basel II capital adequacy ratio (CAR) reached 11.8% (regulation: over 8%), the loan-to-deposit ratio (LDR) was at 75% (regulation: under 85%), the short-term capital ratio for medium and long-term loans was 23% (regulation: under 30%) and the Basel III net stable capital ratio (NSFR) was 115% (Basel III standard: over 100%).

Source: https://daibieunhandan.vn/vib-muon-mua-lai-lo-trai-phieu-2-000-ty-dong-sau-mot-nam-phat-hanh-10379997.html

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

Comment (0)