|

| Mr. Richard D. McClellan. |

Big challenges, but opportunities remain

While the scope and enforceability of the US tariff measures remain uncertain, the move signals the beginning of a new chapter in US-Vietnam trade relations, requiring both sides to be more cautious, coordinate more closely, and have more foresight.

However, despite the uncertainty of tariffs, Vietnam remains one of the most attractive investment destinations in Southeast Asia. The question is not whether investment will continue to flow in, but rather which sectors, in what form and under what conditions. The answer depends on how Vietnam positions itself relative to its regional rivals, as well as how it handles the immediate changes and longer-term restructuring.

Over the past decade, Vietnam has built an export-led growth model underpinned by free trade agreements (FTAs), low labor costs and a neutral stance on geopolitics . But the US tariffs imposed in July signaled a shift in its trade policy toward more transactional and protectionist trends, particularly in sectors vulnerable to re-export abuse or heavily dependent on Chinese components.

This is not the first time Vietnam has faced economic shocks. Covid-19, energy shortages and inflation have all tested the resilience of the economy, but this new tax comes at a time when the country is trying to move up the value ladder in the market, develop a semiconductor and green technology ecosystem, and build an International Financial Center. Therefore, the impact is even higher than previous shocks. The challenges are huge, but Vietnam still has opportunities.

Which industries continue to grow?

Despite rising US protectionism, some sectors are still well-positioned. These include consumer electronics and home appliances, green manufacturing and clean technology, digital infrastructure and data centers, high-tech agriculture , and select food processing.

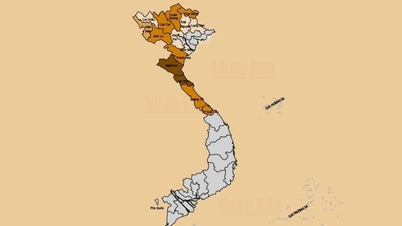

In terms of consumer electronics and home appliances, Vietnam has demonstrated its capacity in assembling and is increasingly making progress in manufacturing high-value electronic products such as televisions, refrigerators, mobile phones and components for global brands. Samsung, LG and Apple suppliers have built strong ecosystems in both the North and the South. Even with tariffs, the US remains an important market. Along with that, the strategy of diversifying trade to the EU, the Middle East and ASEAN will help minimize negative impacts.

In terms of green manufacturing and clean technology, Vietnam is positioning itself as a renewable energy production hub, especially in solar panels and electric vehicle parts. If it can secure strategic raw materials such as rare earths and increase investment in grid infrastructure, Vietnam will remain attractive to climate-resilient investors, especially those looking for alternatives to China.

Tariffs are a test of Vietnam’s mettle in the regional FDI race. Vietnam must rewrite its story, from a low-cost factory to a center of innovation and strategic connectivity.

Tariffs are a test of Vietnam’s mettle in the regional FDI race. Vietnam must rewrite its story, from a low-cost factory to a center of innovation and strategic connectivity.

In terms of digital infrastructure and data centers, global technology corporations continue to explore Vietnam as a location for regional data centers and digital logistics support centers. The success of this industry depends on solving the energy problem: providing clean, stable electricity for high-density computing systems. If the power planning, legal framework and data security regulations are properly implemented, this sector is likely to see an investment boom in the coming time.

In the field of high-tech agriculture and selective food processing, although agricultural products are at risk of escalation according to tariff schedules, niche segments such as organic agricultural products, specialty coffee and processed foods still have opportunities in the US market, especially when Vietnam strengthens the evidence for traceability, sustainability and brand origin.

|

| Vietnam does not necessarily need to win every investor and every project, but should focus on deals that bring long-term value. |

Regional competition is fiercer

Regionally, Vietnam’s competitors are also competing fiercely. Indonesia, Thailand and the Philippines are actively attracting investors with a number of significant advantages such as large scale, centralized investment agencies, rapid infrastructure development, especially in Indonesia’s battery and electric vehicle supply chain, investor care programs, political stability (relative to the past) and Thailand’s strong automotive development industry base, as well as an English-speaking workforce, quality outsourcing platform and digital visa policies for experts to attract high-tech enterprises like the Philippines.

Meanwhile, Vietnam’s competitive advantages lie in the speed of project implementation, the responsiveness of local authorities and centralized coordination at the central level. But as capital flows become more selective, these advantages need to be further consolidated.

Short-term action: Keep the door open

Vietnam’s immediate priority is to reduce uncertainty for current and future investors. This includes clearly defining its response to US tariff policy: whether there will be renegotiations, whether there will be any exemptions. Quick responses from the Government will help reassure investors, perhaps by setting up inter-ministerial working groups for strategic sectors, especially those heavily impacted by the US market such as electronics, furniture, textiles, and at the same time strengthening trade diplomacy, not only with the US, but also with allies to open more doors to other markets, cooperate in production or provide diplomatic support.

In addition, public communication work also needs to be improved. Global investors are closely watching how Vietnam explains its strategy and predicts policy adjustments. Enterprises need to proactively participate in associations such as AmCham, EuroCham… and regional forums to get accurate advice from the international community.

Long-term solution: Invest in institutions, not just increase incentives

Tariff shocks often expose fundamental flaws. For Vietnam, the underlying problem is structural.

First, institutional consistency. In reality, many ministries, sectors and localities are competing to attract investment. Some of the messages are even contradictory. Vietnam needs a unified channel for strategic sectors, from the process of signing strategic cooperation agreements (MOUs) to issuing clear licenses and providing professional services to investors.

Second, regarding legal certainty. Investors are still concerned about the implementation of some laws that are still problematic and not synchronized, the circulars change frequently and there is still a lack of an effective dispute resolution mechanism. Long-term capital always needs a long-term legal framework. Legal transparency, especially regarding data, intellectual property and the transfer of capital and assets back to the home country of investors, will be decisive.

Third, to attract more FDI, Vietnam must promote public-private partnerships, green bonds and infrastructure-linked financial instruments. This is the key to opening the door to becoming an international financial center. If domestic capital cannot be mobilized, foreign capital flows will be blocked.

Vietnam’s young workforce is a valuable asset, but it needs to be retrained, especially in areas such as semiconductor manufacturing, AI, and industrial digitalization. New semiconductor and AI strategies are fundamental, but must be implemented with deep business participation.

Vietnam has already turned trade disruptions into opportunities. The US-China trade war accelerated supply chain shifts, and the Covid-19 pandemic accelerated digitalization. Now, tariff risks combined with regional competition may force Vietnam to push for further reforms.

Reshaping the story

To not only survive, but also move to the top, Vietnam needs to rewrite its story: not just to become the “factory of the world”, but to become an “emerging hub of innovation, digital transformation and strategic connectivity”.

Vietnam also needs to choose its strategy carefully. Accordingly, it is not necessary to win every investor and every project, but should focus on deals that bring long-term value, upgrade capacity, increase upstream value and create ecosystem spillover effects.

More importantly, there must be a long-term development strategy. Private investors may seek short-term profits, but the Government’s task is to build a stable, smart, globally integrated platform that can keep international investors in the long term.

The US tariff announcement on July 2, 2025, does not mark the end of Vietnam’s FDI story, but opens a new chapter of fiercer competition, but with higher expectations. Future potential investors will demand more than ever, including transparency, capacity and goodwill to cooperate.

Vietnam has ambition, now it needs the tools and consensus to turn that ambition into reality.

Source: https://baodautu.vn/viet-nam-truoc-thach-thuc-thue-quan-canh-tranh-thu-hut-fdi-ngay-cang-khoc-liet-va-nong-bong-d388642.html

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

Comment (0)