VN-Index shows signs of recovery; Dividend payment schedule;FPT continuously breaks history; Techcombank benefits from the show "Brother overcomes a thousand obstacles".

VN-Index maintains 1,250 point threshold after losing 14 points

At the beginning of the week, VN-Index maintained a slight increase at the 1,250 point level after a strong recovery in the last week of November, increasing by more than 22 points.

However, liquidity still decreased, the average trading value on HOSE in November reached more than 10,000 billion VND/session, the lowest level since May 2023. The total average value of the 3 floors reached more than 13,600 billion VND/session, down 16.1% compared to the previous week and 19.7% compared to the average of the past 5 weeks.

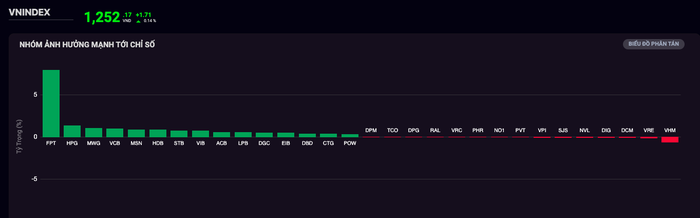

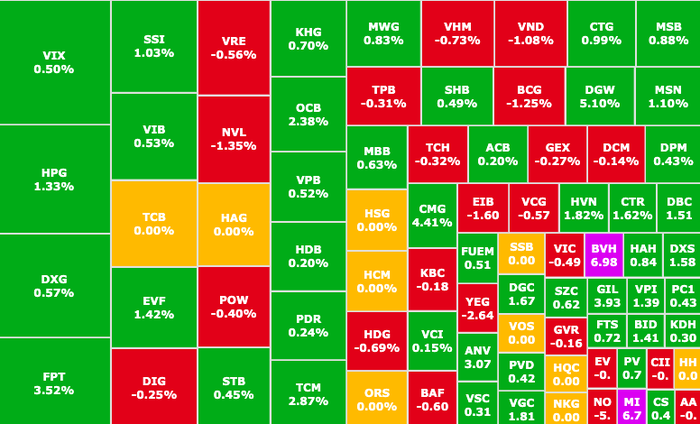

Cash flow from large-cap stocks leads the market: banks, real estate, securities,... (Photo: SSI iBoard)

Cash flow is concentrated in large-cap groups, but the proportion in midcap groups (medium capitalization) increased significantly, reaching 36.7%. Key sectors such as banking, real estate, securities, textiles, chemicals and aviation recorded an increase in cash flow.

High net selling pressure, individual investors reached 2,163 billion VND through order matching, concentrated in technology and banking stocks, on the contrary, the chemical group was net bought.

Foreign investors returned to net buying last week, reaching VND1,112 billion, helping the net buying force for the whole month of November in this investment group reach VND1,214 billion, concentrated in the information technology, food and beverage groups. In contrast, net selling force concentrated in the banking group.

In November, foreign investors withdrew a net VND12,000 billion, of which VND9,450 billion was through order matching. Since the beginning of the year, the net selling value has exceeded VND90,000 billion.

Thus, in 1 month of trading, VN-Index lost up to 14 points. Although the Vietnamese stock market is showing signs of recovery in terms of points, it is still under great pressure from record low liquidity, cash flow differentiation, and cautious psychology of investors, which are factors that experts emphasize need to be monitored this week.

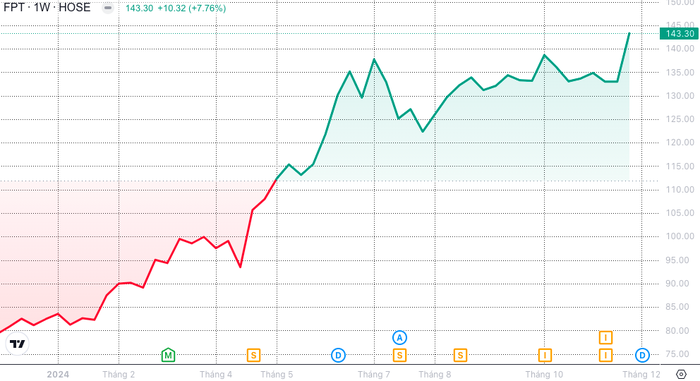

FPT shares have surpassed their peak 36 times since the beginning of the year.

At the end of November trading session, FPT shares of FPT Corporation increased by 3.52% to VND 144,300/share.

It is worth noting that from the beginning of 2024 until now, this code has surpassed the peak a total of 36 times. This is a rare record in the history of the Vietnamese stock market.

FPT shares have outperformed the VN-Index since the beginning of the year (Photo: SSI iBoard)

After 11 months, FPT has increased by more than 70%, outperforming the VN-Index. At the current market price, FPT's market capitalization is about VND210,000 billion (about USD8.4 billion).

However, SSI Securities still maintains its recommendation to buy FPT shares in the latest report, with a target price of VND 186,300/share, nearly 30% higher than the closing price on November 29 according to the investment thesis:

- Accumulated for the first 10 months of 2024, FPT's revenue and pre-tax profit maintained a growth rate of about 20% over the same period for each indicator, estimated after-tax profit of parent company shareholders in 2025 increased by 6%, coming from the prospect of the project just launched in November - FPT AI Factory, expected to record revenue from 2025.

- FPT will continue to increase market share in foreign markets, promote the continuous expansion of the IT sector and maintain long-term profit growth.

Techcombank is expected to benefit from "The Brother Who Overcame a Thousand Difficulties"

According to a new assessment from KB Securities (KBSV) about TCB stock (Techcombank, HOSE), participating and becoming a diamond sponsor and co-organizing the concert "Anh trai qua ngan cong thorn" helps this bank better position its brand.

Accordingly, Techcombank has launched a program to give away tickets to existing/new account opening customers, with conditions for using the automatic profit feature.

Techcombank benefits from the show "Brother overcomes thousands of obstacles" (Photo: Internet)

In fact, after the first concert, Techcombank recorded 4,500 tickets finding owners, more than 120,000 customers turned on the Automatic Profit feature on the Techcombank Mobile application.

Therefore, KBSV believes that this helps increase a large amount of non-term deposits with low costs from 0.2-0.5%, at the same time, increasing the number of potential customers for the bank in the future.

In parallel, the analysis team also noted that the bank's participation in financing will also increase operating costs during the period.

Giving an upcoming forecast, KBSV has a positive view on credit growth at the bank, saying that Techcombank will maintain a credit growth rate of 21% for 2024 and 16-18% for the period 2025-2027.

This assessment is based on the premise that a better recovery in the real estate market will boost home loan activities. Meanwhile, Techcombank has taken home loan disbursement as the main driving force for credit growth for individual customers.

Regarding business results, in the third quarter 2024 financial report, Techcombank reported pre-tax profit of VND 22,800 billion in the first 9 months of 2024, an increase of 33% over the same period in 2023.

Comments and recommendations

Mr. Do Thanh Son, Head of Investment Consulting, Mirae Asset Securities, said that some macro information will have an impact on the stock market . Specifically, in the domestic market , the National Assembly has had discussions in meetings about many industry groups and stocks, along with personnel work in the past time, bringing plans to resolve in the coming time.

Accordingly, regarding the Securities Law, the National Assembly Standing Committee has directed agencies to absorb and revise regulations on 02 contents in the draft Law: (1) Report on charter capital and (2) commercial banks participating as clearing members, paying for transactions for securities traded on the securities trading system.

In the global market, Fed Chairman Powell said they were in no "rush" to cut interest rates two weeks ago and now inflation is rising again. In addition, China's business activity is now improving a lot compared to the dangerous contraction in 2023. Vietnam's stock market is often strongly influenced by the Chinese market, so this could be a positive signal.

Based on the above situation, he commented that the market in the upcoming sessions may have supply-demand testing periods before the 1,250 point threshold, after which the market will fluctuate around this area.

VN-Index is forecast to fluctuate around 1,250 points.

The groups that are being priced cheaply are mainly banks and real estate due to risks related to the recovery of the domestic economy and legal clearance being slower than the market expects.

However, the valuation of these two groups is near historical lows. Therefore, with the prospect of domestic economic recovery and institutional reform, these two soybean groups can be assessed as being at a medium risk - high expected return level. Or in other words, these two groups are relatively cheap enough for medium-term positions.

During this period, investors should limit their attention to the index, instead, focus on stocks in the portfolio and industry groups with stories that are still performing better than the general market.

Some stocks that investors can pay attention to : MBB (MBBank, HOSE), CTG (VietinBank, HOSE), PDR (Phat Dat Real Estate, HOSE), DXG (Dat Xanh Real Estate, HOSE), AGG (An Gia Real Estate, HOSE).

BSC Securities shares a positive view with the expectation that the VN-Index will return to the threshold of 1,265 points. Accordingly, BSC assesses that the market last week was inclined to the positive side when 16/18 sectors increased, in which the Insurance group led, followed by Information Technology. Moreover, foreign investors have returned to net buying on both exchanges: HOSE and HNX; although cash flow is still weak, market sentiment has been quite supportive of the recovery of the VN-Index. Investors should pay attention to the resistance level of 1,250 points when "shaky" developments may appear in the next 1-2 sessions.

SSI Securities assessed that VN-Index has passed the 1,246 point threshold and closed at 1,250 points, however, technical indicators still do not have a clear consensus, the index next week will head to the 1,262 point area if the challenge scenario is successful at 1,250 - 1,253 points, correction pressure will be triggered if the 1,246 point threshold is lost.

TPS Securities believes that liquidity remains at a low level, the market's growth momentum is mostly concentrated in the afternoon session, so only when large-cap stocks appear, the market can open up a 'brighter' scenario. Currently, investors should observe and can buy more strongly when liquidity returns, but more time is needed to determine the market trend.

Dividend payment schedule this week

According to statistics, there are 15 enterprises that have dividend rights from December 2-6, of which 11 enterprises pay in cash and 4 enterprises pay in shares.

The highest rate is 20%, the lowest is 3.6%.

4 businesses pay by stock:

Big Invest Group JSC (BIG, UPCoM), ex-right trading date is December 3, rate is 19%.

Van Dat Group JSC (VDG, UPCoM), ex-right trading date is December 3, rate is 10%.

TNH Hospital Group Corporation (TNH, HOSE), ex-dividend date is December 5, rate is 15%.

City Auto JSC (CTF, HOSE), ex-dividend date is December 6, rate is 7%.

Cash dividend payment schedule

*Ex-dividend date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to buy additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | Education Day | Day TH | Proportion |

|---|---|---|---|---|

| FPT | HOSE | 2/12 | December 13 | 10% |

| BSH | UPCOM | 2/12 | December 23 | 10% |

| CMW | UPCOM | 3/12 | December 25 | 5.1% |

| TV4 | HNX | 3/12 | December 27 | 10% |

| INC | HNX | 3/12 | December 16 | 8% |

| ADP | HOSE | 4/12 | December 24 | 7% |

| GDW | HNX | 4/12 | December 20 | 3.6% |

| VHC | HOSE | 5/12 | December 18 | 20% |

| TV2 | HOSE | 5/12 | December 12 | 10% |

| VGG | UPCOM | 5/12 | December 24 | 15% |

| SPM | HOSE | 6/12 | December 18 | 5% |

Source: https://phunuvietnam.vn/chung-khoan-tuan-2-6-12-vn-index-giao-dich-quanh-vung-1250-diem-20241116085223631.htm

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

Comment (0)