(NLDO) - Early retirement when streamlining the apparatus will receive a one-time pension benefit; benefits based on the number of years of early retirement...

The Ministry of Home Affairs has just issued Circular 01 dated January 17, 2025 guiding the implementation of policies and regimes for cadres, civil servants, public employees and workers in the implementation of organizational restructuring of the political system.

Accordingly, Circular 01 has guided how to calculate policy benefits for people who retire early.

The Ministry of Home Affairs has guidelines on how to calculate policies and regimes for cadres, civil servants and public employees when streamlining the apparatus.

Those who are eligible and are decided by the competent authority to retire before the prescribed retirement age shall immediately receive pension according to the provisions of the law on social insurance without having their pension rate deducted due to early retirement. At the same time, they shall receive a one-time pension; a subsidy based on the number of years of early retirement and a subsidy based on the working time with compulsory social insurance contributions.

Specifically, for those who have between 2 and 5 years left until retirement age as prescribed in Decree No. 178 of 2024, they will enjoy the following 3 allowances:

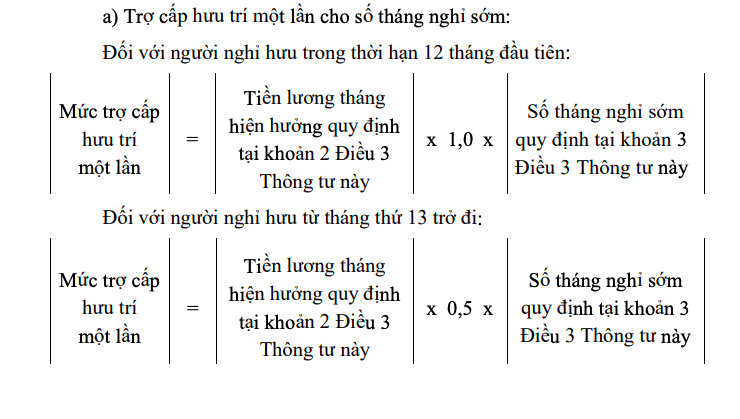

First , one-time retirement benefits for the number of months of early retirement:

How to calculate lump sum pension for months of early retirement

Second , allowance for years of early retirement: For each year of early retirement (full 12 months), you will receive 5 months of current salary.

How to calculate benefits for years of early retirement

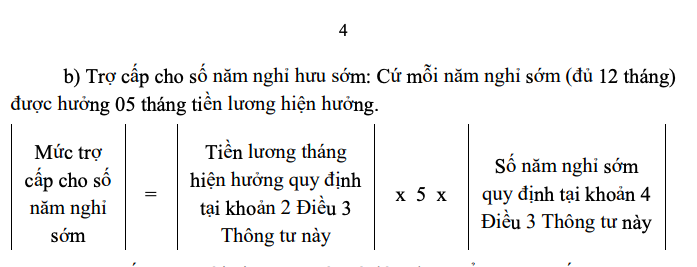

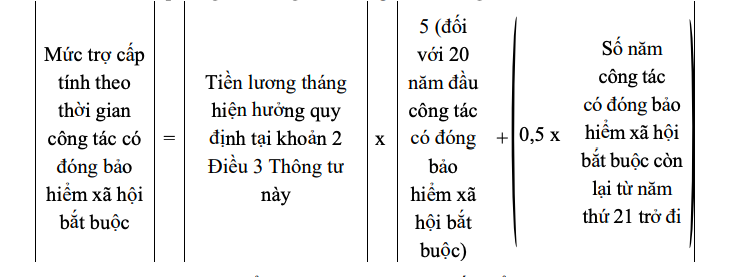

Third , allowance according to working time with compulsory social insurance:

For the first 20 years of work with compulsory social insurance, a subsidy of 5 months of current salary is provided; for the remaining years (from the 21st year onwards), each year a subsidy of 0.5 months of current salary is provided.

How to calculate allowance based on working time with social insurance

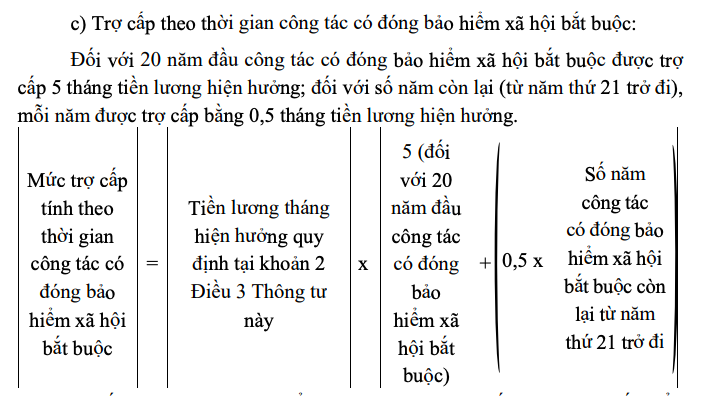

In the case of having more than 5 years to 10 years of retirement age as prescribed in Point b, Clause 2, Article 7 of Decree No. 178/2024, they are entitled to the following 3 allowances:

First , one-time retirement benefits for the number of months of early retirement:

How to calculate lump sum pension for months of early retirement

Second , allowance for years of early retirement: For each year of early retirement (full 12 months), you will receive 4 months of current salary.

How to calculate benefits for years of early retirement

Third , allowance according to working time with compulsory social insurance:

For the first 20 years of work with compulsory social insurance, a subsidy of 5 months of current salary is provided; for the remaining years (from the 21st year onwards), each year a subsidy equal to 0.5 months of current salary is provided.

How to calculate allowance based on working time with compulsory social insurance

Also according to Circular No. 01, in case of having less than 2 years left until retirement age as prescribed in Point d and Point dd, Clause 2, Article 7 of Decree No. 178 of 2024, they will receive a one-time pension allowance for the number of months of early retirement as calculated for retirees within the first 12 months.

Source: https://nld.com.vn/cach-tinh-huong-tro-cap-doi-voi-nguoi-nghi-huu-truoc-tuoi-khi-tinh-gon-bo-may-196250117151441412.htm

![[Photo] Prime Minister Pham Minh Chinh attends the 1st Hai Phong City Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/27/676f179ddf8c4b4c84b4cfc8f28a9550)

![[Photo] Soldiers guard the fire and protect the forest](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/27/7cab6a2afcf543558a98f4d87e9aaf95)

Comment (0)