|

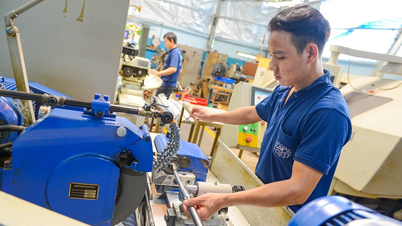

| High profit growth in the first half of the year has made bank stocks receive great attention from investors. Photo: Duc Thanh |

“King stocks” help VN-Index reach historic peak

The VN-Index is continuously conquering historical peaks. Along with the securities and real estate stocks, banking stocks are the leading group, creating a historical milestone for the VN-Index.

Since the beginning of the year, many bank stocks have increased by tens of percent, some even by several times. Specifically, from the beginning of the year to the middle of this week, stock codesSHB (SHB Bank) increased by nearly 110%, ABB (ABBank) increased by 86%, VPB (VPBank) increased by 54%, TCB (Techcombank) increased by more than 52%, STB (Sacombank) increased by 46%, EIB (Eximbank) increased by 44%...

In particular, in the past month alone, SHB stock price increased by nearly 36%, TPB ( TPBank ) stock increased by 29%, VPB stock increased by 42%...

According to analysts, in the context of record low interest rates, the Government and the State Bank (SBV) are stepping up money injections to support the economy , bank stocks are being supported. Not only benefiting from the loose monetary policy, the banking industry also received positive news related to bad debt recovery (legalizing the right to seize collateral), strong digitalization helps reduce input costs, eliminating credit room, foreign investors are interested in bank stocks and the prospect of upgrading in September...

Associate Professor, Dr. Nguyen Huu Huan, Head of the Financial Markets Department (Faculty of Banking, University of Economics, Ho Chi Minh City) commented that the promotion of digital transformation in recent years has helped banks operate more efficiently, save costs, and increase competitiveness.

Although the net interest margin (NIM) of banks has been on a narrowing trend since the beginning of the year (due to pressure to reduce lending rates to support businesses, while deposit rates remain unchanged), strong credit growth has offset this decline. Therefore, bank profits in the first half of the year still grew very well.

In addition, the non-interest income of banks is very promising. In addition to traditional services, the banking industry is facing the opportunity to increase revenue from new services. In particular, the upcoming digital asset game also opens up great opportunities for banks and financial groups. Many banks will focus on this new "game", which no one has yet exploited. This promises to be a lucrative cake, bringing attractive profits to participating banks.

Interest rates and cash flows will determine the attractiveness of bank stocks.

While a few months ago, bank stocks were considered attractive, after increasing by more than 28% in the past three months, bank stock valuations are no longer cheap. According to analysts, in general, bank stock valuations are at a "moderate" level and the attractiveness of "king stocks" in the coming time depends largely on interest rate variables.

Mr. Tran Ngoc Bau, General Director of WiGroup, said that the stock is currently priced at a fairly average level. However, if interest rates increase again, the stock valuation will become expensive. In other words, when interest rates are low and money is abundant, the stock price is still attractive; conversely, when interest rates are higher and money is scarcer, the stock price will become expensive.

According to Associate Professor, Dr. Nguyen Huu Huan, Head of the Financial Markets Department (Faculty of Banking, University of Economics, Ho Chi Minh City), the low interest rate environment is creating favorable conditions to promote lending to banks.

According to Associate Professor, Dr. Nguyen Huu Huan, Head of the Financial Markets Department (Faculty of Banking, University of Economics, Ho Chi Minh City), the low interest rate environment is creating favorable conditions to promote lending to banks.In particular, removing the credit room will open up many opportunities for banks, especially small banks. When removing the room, small banks can grow 20-30% if they have the right strategy and policies. For large banks, strong growth when removing the room will be more difficult.

The government is directing the banking sector to stabilize interest rates and reduce costs to further reduce lending rates. However, according to Mr. Tran Ngoc Bau, deposit interest rates are under pressure, partly due to high domestic credit demand and partly due to the continued pressure on exchange rates. In fact, many banks have recently had to use tools to attract deposits, proving that capital flows have shown signs of being "scarce".

Mr. Phan Le Thanh Long, General Director of AFA Group, commented that bank stocks are no longer as cheap as before, but the attractiveness of bank stocks in the coming time does not depend on valuation, but on cash flow.

According to this expert, during the period of market excitement, stock prices depend largely on investor psychology and cash flow developments. Especially in a frontier market like Vietnam - where up to 80% of investors are individuals - investor psychology is decisive. In other words, in terms of valuation, bank stocks are no longer attractive, but the market and this industry group can still increase strongly in the coming time, if cash flow continues to flow in.

Currently, the P/E and P/B ratios of the banking group are equivalent to the average level in the 3-year period. The valuation of the “king stock” is not expensive, but it is no longer cheap. Looking at the cheap interest rates and the loose monetary policy, the target of double-digit growth in the coming period, many investors are still optimistic.

Mr. Phan Dung Khanh, Investment Consulting Director of Maybank Investment Bank, said that the cash flow into the market is still positive, so it will be difficult for there to be a deep correction as expected. The market trend is still up, and any corrections, if any, will only be short-term, sometimes lasting only a few sessions.

However, according to many experts, for banking stocks, most of the positive information has been reflected in the price. Not to mention, for this industry group, investors must be wary of some risks such as: inflation may increase, exchange rates continue to face pressure, causing the State Bank to stop reducing interest rates, bad debt in the banking industry shows signs of increasing while the buffer covering bad debt decreases... Therefore, in addition to closely monitoring the developments of interest rates, exchange rates, and cash flow, experts recommend that investors should be cautious when using leverage at this stage.

Source: https://baodautu.vn/stocks-already-have-a-demand-for-money-when-dinh-gia-khong-con-re-d359432.html

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)