Initial market reaction

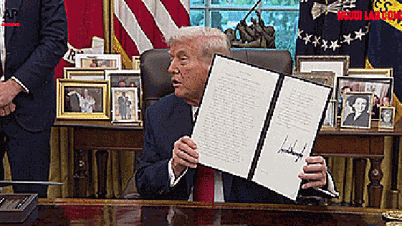

On June 21, US President Donald Trump ordered airstrikes on three key Iranian nuclear facilities - Fordow, Natanz and Isfahan - using six 15-ton bunker-buster bombs from B-2 bombers and 30 Tomahawk missiles from US submarines. This was the first time since the 1979 Islamic Revolution that the US had directly attacked Iranian territory, marking its intervention in the conflict between Israel and Iran.

Initial reports from Iran suggest that damage at the Fordow facilities was not severe as the nuclear material had been removed earlier.

Iran responded with a barrage of ballistic missiles that caused widespread damage in Israeli cities, but did not take direct action against the US. However, Iranian leaders, including Foreign Minister Abbas Araghchi, said they reserved the right to respond, calling the US attack a violation of international law. The escalating tensions immediately affected global financial market sentiment.

With major commodity and financial markets largely closed for the weekend, the immediate reaction was limited. However, risk assets were under pressure.

Bitcoin fell 2.8%, retreating to the threshold of 100,000 USD/BTC on the evening of June 22 (Vietnam time). Ethereum even fell more than 9% in 24 hours. The cryptocurrency market capitalization decreased 4.2% to 3,070 billion USD. Fear is dominating.

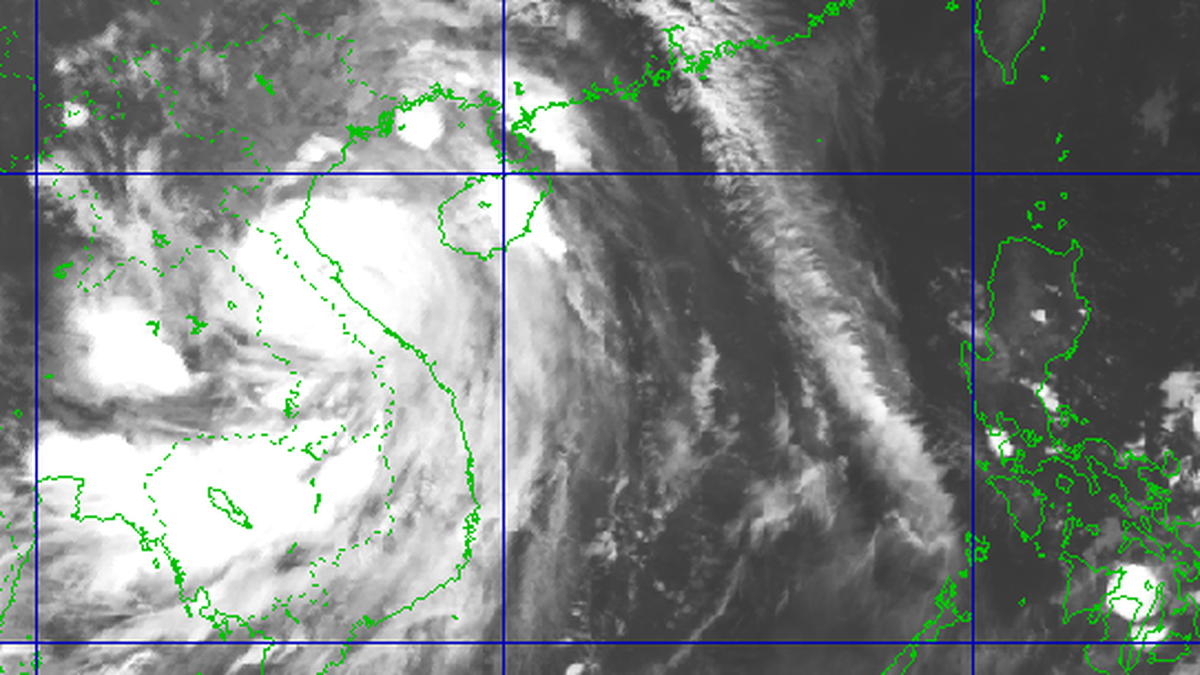

In the commodity market, oil prices are expected to increase sharply when the Asian market opens on the morning of June 23 due to concerns about the possibility of Iran blocking the Strait of Hormuz - a shipping route for 20 million barrels of oil per day, equivalent to more than 1/3 of the global oil supply.

However, since the war began on June 13, oil prices have only increased by about 10%, reflecting market caution over the possibility of Iran holding back to avoid losing support from China and Gulf countries.

Gold, often seen as a safe haven asset, has recently reacted in the opposite direction to the heat in the Middle East. Prices have fallen sharply in recent sessions due to profit-taking pressure and expectations of stability in the Middle East.

US stocks are also facing the risk of falling when they open the new week. Indexes such as the S&P 500 and Nasdaq could be pressured by geopolitical concerns and the risk of a global recession if the conflict continues to escalate.

Other risks include disruptions to energy supply chains, rising inflation due to oil prices and a weakening of the US dollar if confidence in US economic policy is shaken.

In the Middle East, stock markets across the region mostly rose on Sunday after the US entered the war between Israel and Iran.

Shares in Tel Aviv hit an all-time high on Sunday on hopes that Washington’s involvement in the conflict with Tehran would help end it, despite Iran’s foreign minister’s assertion that the country cannot return to diplomacy “while it is under attack.”

Iran's retaliation scenario and long-term impact

The US airstrike was described by President Trump as an effort to stop a “nuclear threat” from Iran, but it also marked a break with one of Mr Trump’s principles: avoiding military intervention in the Middle East.

This is perhaps a “big gamble” not only for global security but also for Mr. Trump’s political legacy, when no one can accurately predict Iran’s reaction and the long-term consequences.

Iran has several retaliation options, each of which carries great risks.

Oil prices could continue to rise if tensions escalate, especially if the Strait of Hormuz is threatened. Gold prices could rebound sharply if the conflict drags on, given its role as a safe haven. US stocks could fall in the short term, especially if Iran retaliates strongly, raising energy costs and inflation.

On CNBC, Giovanni Staunovo, a commodities analyst at UBS, said that oil prices are likely to rise due to the rising cost of hedging against geopolitical risks. Oil prices are expected to remain volatile in the near term because “it is unclear how the conflict may develop.”

However, Vice President JD Vance said the strikes had “set back” Iran’s nuclear program, while also highlighting Mr Trump’s hope for a diplomatic solution. If Iran were to negotiate, markets could stabilize quickly.

The US airstrike on Iran is clearly a potentially risky turning point, pushing financial and commodity markets into a state of uncertainty. Oil prices are likely to skyrocket, gold prices will fluctuate sharply, and the stock and cryptocurrency markets will be under great pressure.

Source: https://vietnamnet.vn/dong-thai-bat-ngo-cua-ong-trump-gia-vang-va-dau-co-the-tang-vot-2413931.html

![[Photo] The 4th meeting of the Inter-Parliamentary Cooperation Committee between the National Assembly of Vietnam and the State Duma of Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/9f9e84a38675449aa9c08b391e153183)

![[Photo] Joy on the new Phong Chau bridge](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/b00322b29c8043fbb8b6844fdd6c78ea)

![[Photo] High-ranking delegation of the Russian State Duma visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/c6dfd505d79b460a93752e48882e8f7e)

Comment (0)