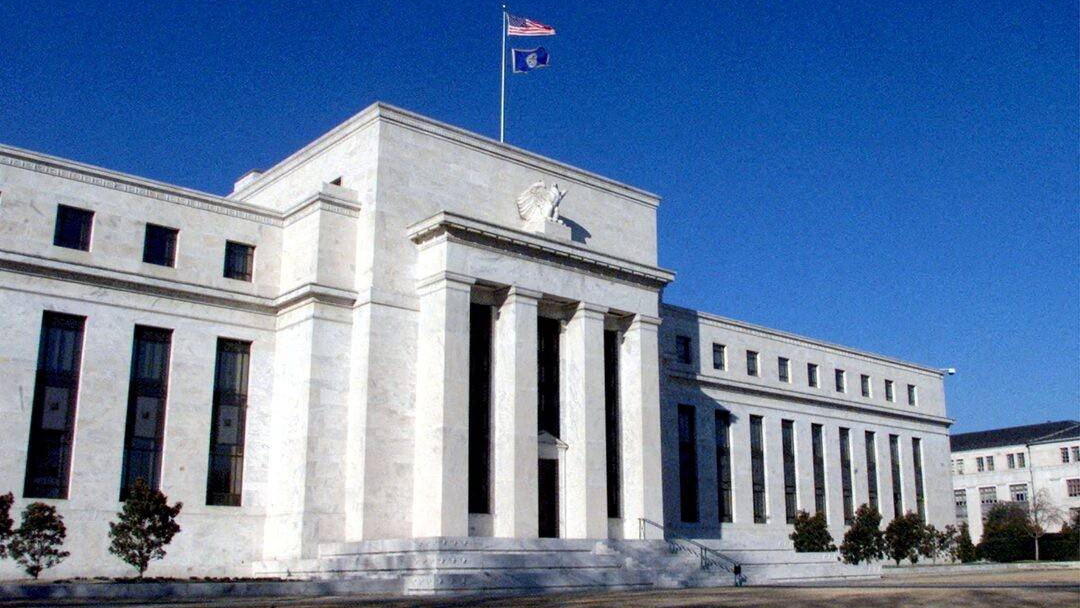

As expected by the market, the FED has decided to continue easing monetary policy. Accordingly, the US reference interest rate has decreased to 4.25% - 4.5%, a decrease of 25 basis points (0.25%). This is the third consecutive time that this agency has reduced interest rates, with the previous two reductions being 0.5% and 0.25% respectively.

This is not a surprising decision by the FED, but what the market is more interested in is the future plans of the US central bank, in the context of stable inflation above target and quite solid economic growth, these conditions are not usually accompanied by policy easing.

In a statement issued after the end-of-2024 meeting, Mr. Jerome Powell, Chairman of the US Federal Reserve, said: “The economy is generally strong and has made significant progress toward the Fed’s goals over the past two years. The labor market has cooled. Inflation has moved much closer to the Fed’s 2-run goal. The Fed is committed to maintaining the strength of the economy by supporting maximum employment and returning inflation to its 2-year objective. To achieve that goal, the Federal Open Market Committee (FOMC) decided to take another step in reducing policy constraints, by lowering the policy rate by a quarter of a percentage point.”

Immediately after the FED's decision, many financial experts and investors predicted that the agency would likely stop cutting interest rates at its meeting in late January 2025. Therefore, next year, US central bank policymakers expect to cut interest rates only twice, each time by 1/4 percentage point by the end of 2025. They also raised their inflation forecast for Donald Trump's first year in office as US President, from 2.1% to 2.5%.

This pace is higher than the Fed's target of 2%. In addition, the Fed also plans to make two cuts in 2026 and one in 2027, each by 0.25 percentage points. Notably, the Fed also adjusted up the long-term "neutral" interest rate to 3%, 0.1% higher than the September forecast. The neutral interest rate - that is, neither slowing nor stimulating the economy - has been gradually rising this year.

The US stock market plunged after the FED's announcement. At the end of the session on December 18, the Dow Jones index fell 2.58%, while the Nasdaq Composite dropped sharply by 3.56%. This was the biggest drop of these two indexes since August.

“The outlook for the US economy is quite bright. However, we have to continue to do our job and continue to have restrictive policies to be able to reduce inflation to 2%. The US is not really feeling the impact of geopolitical uncertainty, but we are certainly in a time of increased geopolitical uncertainty and that remains a risk,” Mr. Jerome Powell added.

Also at this meeting, the FED raised its forecast for US GDP growth in 2024 to 2.5%, half a percentage point higher than the forecast in September. However, in the coming years, policymakers expect economic growth to slow to the long-term forecast of 1.8%.

Source: https://vov.vn/kinh-te/fed-tiep-tuc-ha-lai-suat-phat-tin-hieu-than-trong-trong-nam-2025-post1143128.vov

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

Comment (0)