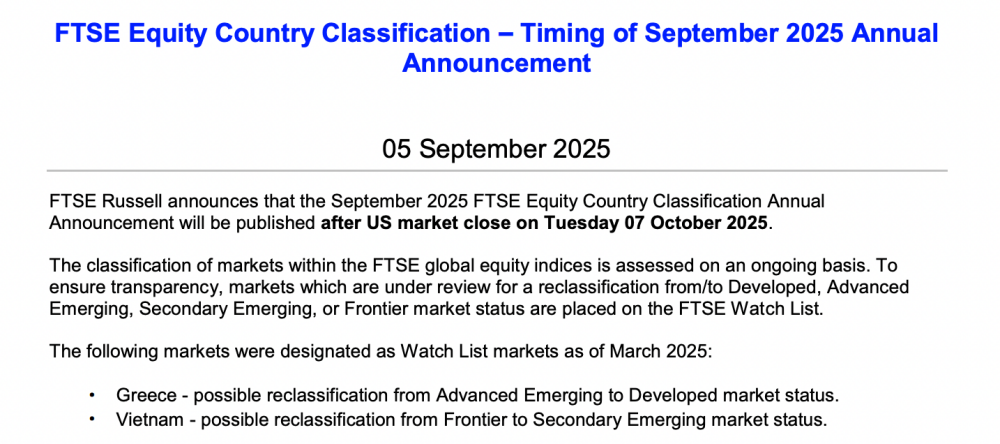

On 5 September 2025, FTSE Russell announced that the FTSE Equity Country Classification Annual Report September 2025 will be published after the US market closes on Tuesday, 7 October 2025 (equivalent to 8 October 2025 Vietnam time).

The classification of markets within the FTSE global equity indices is continually reviewed. To ensure transparency, markets that are under consideration for reclassification from/to Developed, Advanced Emerging, Secondary Emerging or Frontier markets will be placed on the FTSE Watch List.

As of March 2025, Vietnam is on FTSE's watch list and is assessed by FTSE to be a potential reclassification from Frontier Market to Secondary Emerging Market. The results of the review will be announced in the next review period.

|

| Latest FTSE announcement. |

Before publishing the FTSE Equity Country Classification Annual Report, FTSE Russell will consult with members of the FTSE Equity Country Classification Advisory Committee, regional advisory committees, the FTSE Russell Policy Advisory Council and other stakeholders on the Watchlist markets and other relevant markets. The feedback gathered will be considered, and the final report will be approved at a meeting of the FTSE Russell Index Governing Council.

This is an assessment that both the Vietnamese market and foreign investors have been waiting for, given that Vietnam has met most of the FSTE criteria.

According to information from the Ministry of Finance , regarding the issue of upgrading the Vietnamese stock market, the rating organization FTSE Russell highly appreciated the recent reforms. In particular, Circular 68/2024/TT-BTC, effective from November 4, 2024, and Circular 18/2025/TT-BTC, issued on April 26, 2025, have removed the pre-deposit mechanism, helping the market get closer to international standards.

In addition, the deployment of the KRX information technology system, the issuance of new circulars on registration, depository, clearing, payment and the legal corridor for the new transaction mechanism are also highly appreciated.

A recent analysis by HSBC said that the upgrade means Vietnam will be automatically included in indices such as FTSE All-World, FTSE EM and FTSE Asia. Passive funds that reference these indices will have to buy Vietnamese stocks or ETFs. Active funds will have the right to choose.

It is estimated that if Vietnam were upgraded at its current capitalization level, its weight would be around 0.6% in FTSE Asia and 0.5% in FTSE EM. Under this scenario, around $1.5 billion in foreign capital would flow into the Vietnamese stock market from passive funds, mainly from funds tracking FTSE EM and FTSE Global ex US.

If Vietnam's weight in FTSE EM Asia reaches 1.3% - similar to Indonesia's weight - capital flows could reach $3 billion.

For active funds, many already have a presence in Vietnam. Adjusting for this factor, HSBC estimates that capital flows from this group of funds could range from $1.9 billion to $7.4 billion, depending on Vietnam’s weighting in the index.

In summary, in the most optimistic scenario, HSBC forecasts that the FTSE upgrade could bring a maximum of US$10.4 billion into Vietnamese stocks, with the actual capital flow being gradually allocated.

Source: https://baodautu.vn/ftse-chot-thoi-gian-cong-bo-ket-qua-xem-xet-nang-hang-thi-truong-chung-khoan-viet-nam-d379622.html

Comment (0)