In the coming days, the EU will make an official decision on the implementation of the EUDR. What will be the impact on domestic and world coffee prices?

Since the beginning of the year, every change in the EU's implementation of the EUDR has had a significant impact on world and Vietnamese coffee prices. On November 13-14, the EU will make an official decision on the implementation date of this regulation. According to the Vietnam Commodity Exchange (MXV), no matter what happens, there will still be two corresponding scenarios for coffee prices in the following period...

Coffee market fluctuates with every move of EUDR

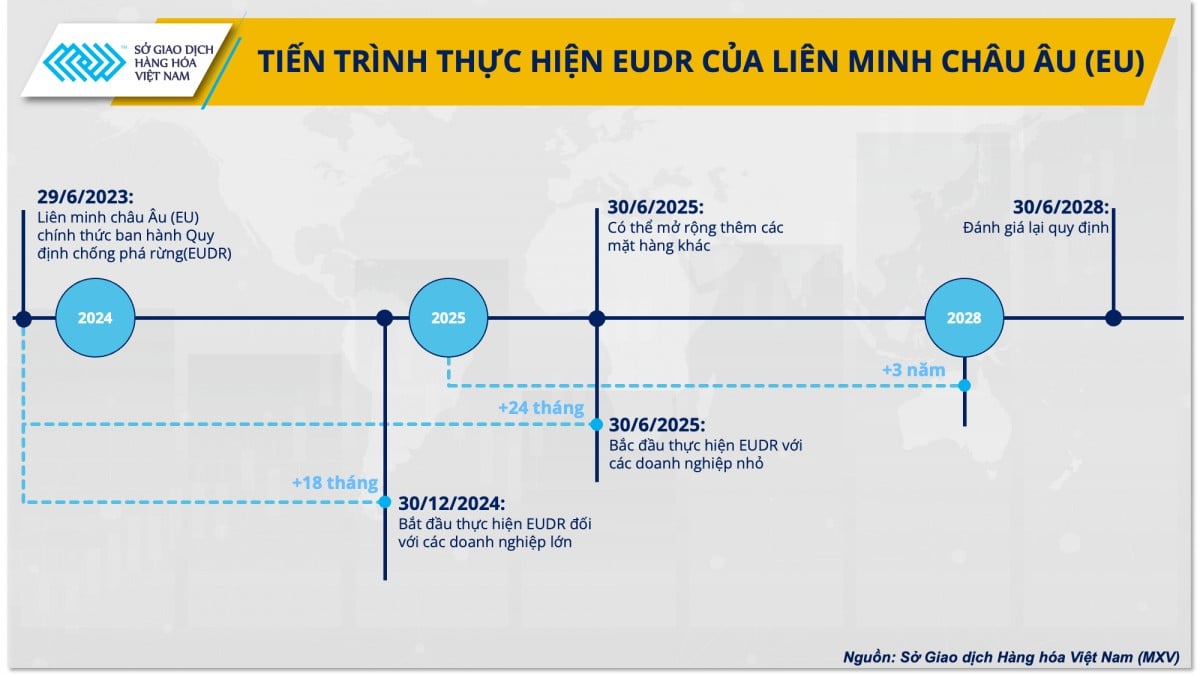

On May 16, 2023, the European Parliament (EP) adopted the European Deforestation Regulation (EUDR). The regulation is expected to take effect from December 30, 2024. Accordingly, coffee is one of seven groups of commodities banned from import into the EU if the production process causes deforestation after December 31, 2020.

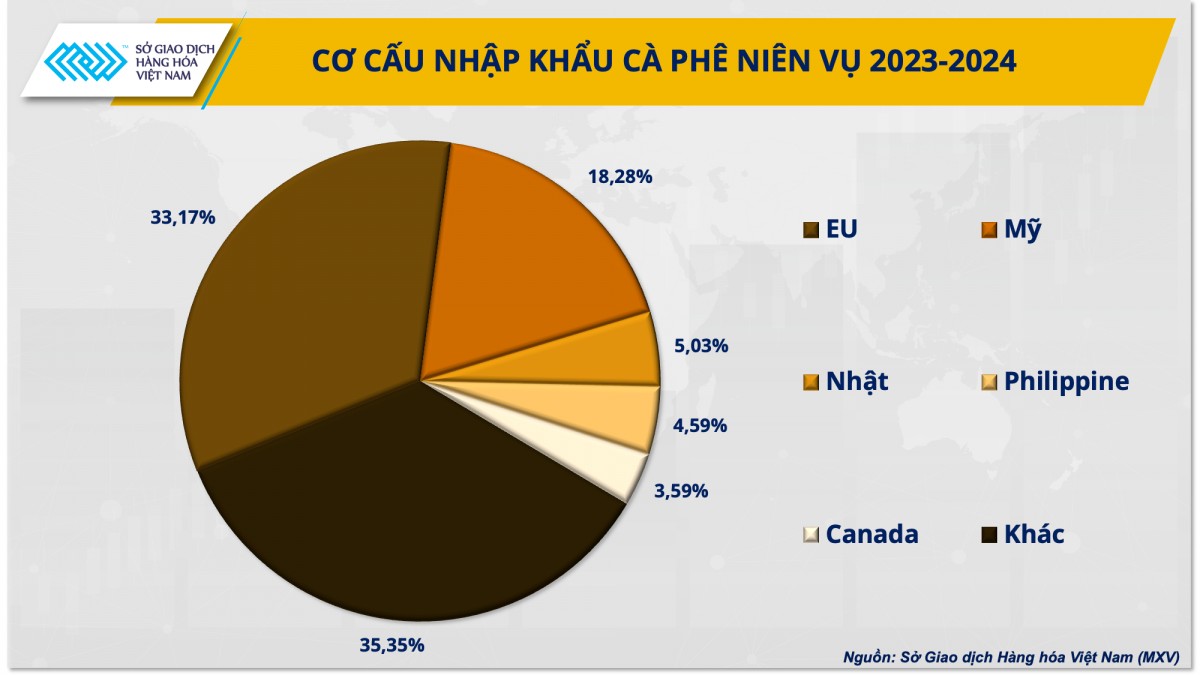

The EU is currently the world's largest coffee importer, accounting for about 33-35% of the global market share. In Vietnam, the EU is the largest coffee exporter, accounting for about 38% of total coffee exports each year. Therefore, as soon as the EU issued new regulations related to coffee imports, the domestic and international markets raised concerns about changes in the supply-demand situation.

|

| Coffee import structure for crop year 2023-2024 |

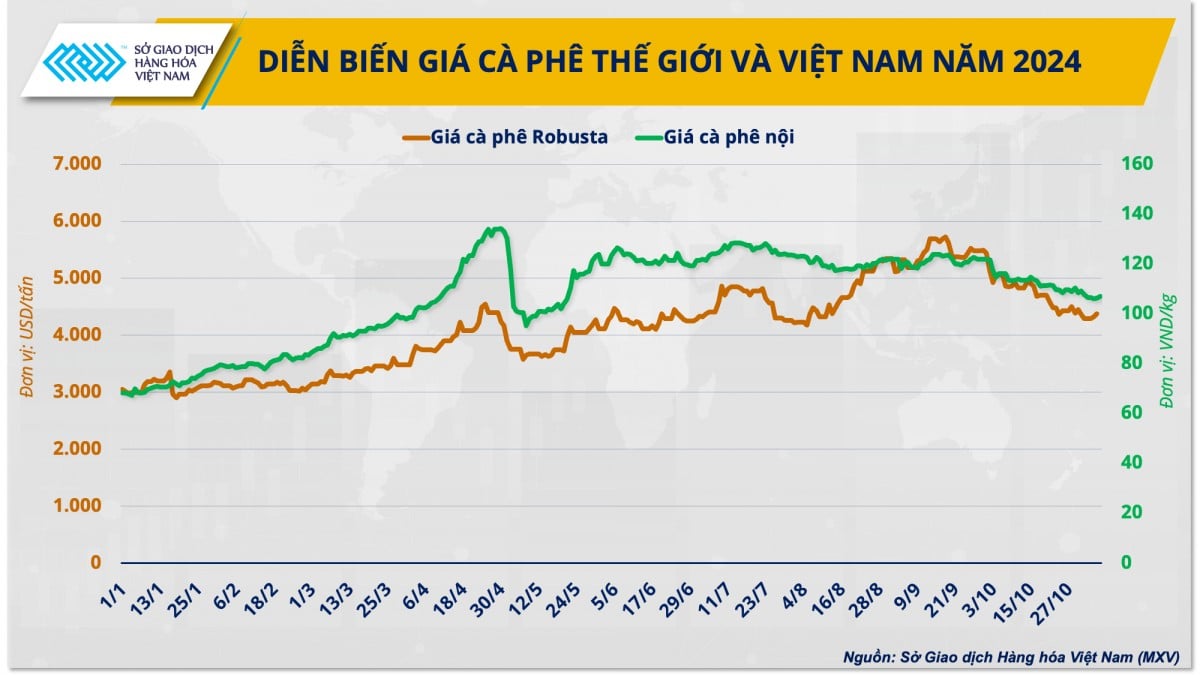

Market concerns have quickly reflected in coffee price developments in 2024. Since the beginning of the year, the approaching EUDR implementation deadline combined with historically low European inventories, EU countries have been racing to import coffee to ensure supply before December 30. Pressure has increased as 2024 is also the year of reduced coffee production in many leading producing countries due to prolonged drought. Demand has increased while supply has decreased, causing the market to fall into a state of local supply-demand imbalance. Moreover, changes in supply and demand have also fueled speculation in the coffee derivatives market, contributing to supporting prices to continuously break the peak.

However, the turning point appeared in early October, the European Commission (EC) proposed to postpone the implementation of the EUDR for another year and quickly received consensus from the EU Council (EUCO). At this time, coffee prices quickly reacted when speculators did not bet on prices continuing to increase. According to MXV, Robusta coffee prices on the Intercontinental European Exchange (ICE-EU) fell 10% in just two trading sessions when information about the EC's proposal was announced. At the same time, prices formed a downward trend throughout October and lost the historical peak.

However, the delay was quickly met with opposition from environmental groups. The final outcome of the EUDR roadmap will be voted on by the EP on 13-14 November. In the meantime, the market is focused on the outcome of the EP meeting.

|

| World and Vietnamese coffee price developments in 2024 |

Commenting on the impact of EUDR on the coffee market, Mr. Nguyen Ngoc Quynh, Deputy General Director of MXV, said that the EU is not only the largest trading partner of Vietnam but also of many other supplying countries in the world. Therefore, any major policy on imported goods will immediately affect price movements. However, Mr. Quynh added that the strong fluctuations in coffee prices in recent times also stemmed from the change in speculative psychology in the market before the EP approved EUDR. However, the official decision on EUDR will still strongly affect the subsequent coffee price movements.

Coffee prices fluctuate according to EUDR scenarios

In less than a week, the EP will officially decide on the implementation date of the EUDR. At this time, the market is divided into two opinions. One side believes that the EU should continue to implement the EUDR according to the original roadmap to ensure the commitment on climate change (IPCC). The other side believes that the EU should postpone the implementation of the anti-deforestation regulation as proposed by the EC. According to MXV, there will be two price scenarios that will occur after the EP decides on the implementation date of the EUDR.

In the first scenario, the EU decides to maintain the EUDR implementation roadmap, starting from December 30, 2024. This decision will receive support from environmental protection organizations but is a major barrier to the current coffee flow. Coffee producing countries in the world cannot fully meet the requirements of the EUDR while importing countries have to race to find sources of goods to ensure consumption. Thus, the market will have two reactions.

In the short term, importing countries will increase purchases in the remaining months of 2024, causing a surge in coffee demand in the market. Meanwhile, market supply will find it difficult to meet the sudden increase in demand, especially when Vietnam has just started harvesting coffee in the 2024-2025 crop. This will cause a situation where supply is lower than demand, thereby creating important support for coffee prices in the last two months of the year. In the long term, exporting countries that cannot supply large customers such as the EU will have to find new customers. Similarly, importing countries will also have to find new sources of goods that meet the requirements to serve consumption. Thus, the market needs a period of time for supply and demand to return to a stable state.

In the second scenario, the EU decides to delay the implementation of the EUDR, most likely by 12 months as proposed by the European Commission (EC). This decision will receive consensus from units in the coffee supply chain instead of environmental organizations. With this scenario, producing countries will have more time to fully comply with the new standards. At the same time, importing countries in the EU will not need to import massively in late 2024. Coffee supply and demand in the market will temporarily stabilize, along with the additional supply from coffee harvested in the 2024-2025 crop year in Vietnam, the world coffee price will likely only stay below 4,700 USD/ton. Similarly, domestic coffee prices will also fluctuate between 100,000 - 110,000 VND/kg.

Commenting on the EU's decision-making ability, according to Mr. Quynh, all scenarios are possible, but the EU will lean towards the possibility of extending the time to start implementing the EUDR regulation. Because after all, this bloc still needs to consider ensuring the internal supply situation. Especially in the context of the market tending towards a supply deficit. Moreover, greening the market or ensuring environmental issues includes long-term roadmaps, although not implemented immediately, but is still an inevitable trend.

Since the announcement in 2023, Vietnamese manufacturers, businesses and the government have been proactive and actively preparing to meet the European EUDR standards. This proactive and rapid adaptation needs to continue to be promoted more strongly in the coming time, to ensure the highest level of standardization according to the new standards and be ready to respond to any scenario.

|

| Progress in implementing the EUDR |

Source: https://congthuong.vn/gia-ca-phe-se-ra-sao-sau-quyet-dinh-thoi-diem-thuc-thi-eudr-cua-eu-357363.html

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

![[Infographic] Notable numbers after 3 months of "reorganizing the country"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/ce8bb72c722348e09e942d04f0dd9729)

Comment (0)