Unfulfilled real estate ambitions

International Dairy Products Joint Stock Company (code IDP) has just announced the Board of Directors' resolution approving the dissolution of its subsidiary, Green Light Investment Joint Stock Company (of which IDP holds 99.98% of capital). The reason for the dissolution given by IDP is to restructure the company's investment portfolio.

Dissolving a subsidiary in the real estate sector after 9 months of establishment, how is International Milk (IDP) doing?

At the end of the first quarter, Green Light was also the only subsidiary of IDP. Green Light operates mainly in the field of real estate business, land use rights owned, used or rented. Head office is located at 217 Nguyen Van Thu, Da Kao Ward, District 1, Ho Chi Minh City.

IDP approved the capital contribution to establish Green Light Investment JSC on August 23, 2022 with a charter capital of VND 500 billion, of which IDP contributed VND 499.9 billion. The move shows the ambition to enter the real estate market of the dairy company that owns famous brands such as Love'in Farm, Ba Vi fresh milk and Love'in. However, after the difficulties of the real estate market in recent times, this ambition of IDP is still unfinished.

Profits go down

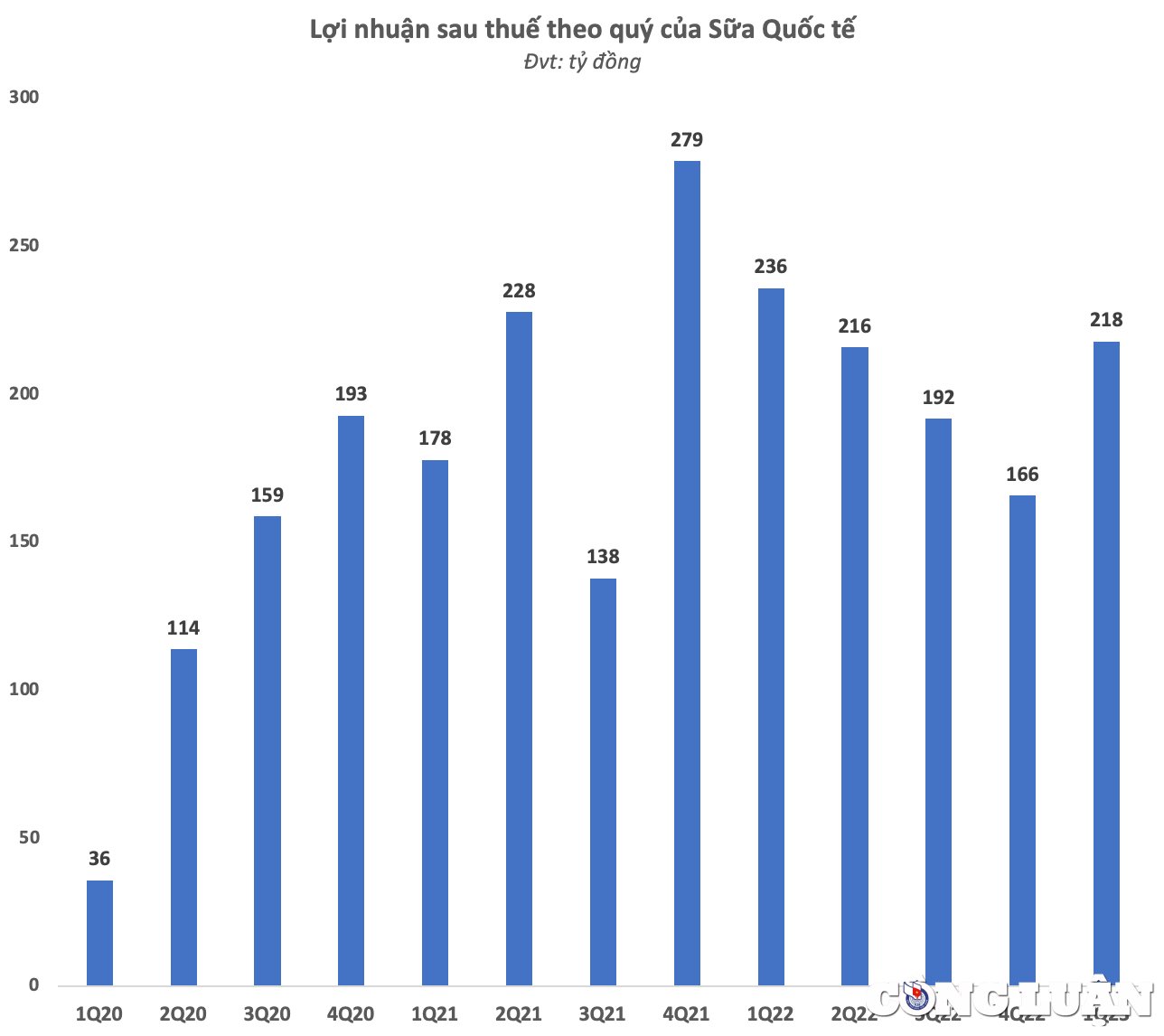

The move to dissolve the subsidiary took place in the context of IDP's not-so-prosperous business situation. In the first quarter of 2023, IDP recorded a significant narrowing of its gross profit margin from 41% to 38%, equivalent to a gross profit of VND606 billion. Sales and administrative expenses during the period both increased sharply, by 68.5% and 40% respectively over the same period. As a result, IDP's net profit was more than VND218 billion, down 8% over the same period.

In 2023, IDP set a revenue target of VND 7,141 billion and after-tax profit of VND 776 billion, up 17% and down 4% respectively compared to last year. With the results achieved, the company has achieved 22% of the revenue plan and 28% of the annual profit target. If there is no breakthrough in business activities in the remaining quarters, International Milk's profit will grow negatively for 2 consecutive years.

In 2022, IDP recorded net revenue of VND 6,086 billion, up 27% over the same period, but profit after tax decreased by 2% compared to the previous year to VND 810 billion. However, with a very low business plan last year, the company still exceeded the revenue target by 11% and the profit target by 79%.

Offering shares to pay off debt, ESOP at "cheap" price

At the 2023 Annual General Meeting of Shareholders, IDP shareholders approved the plan to offer more than 2.4 million individual shares to supplement working capital and support bank loans. The offering price is not lower than the average reference price of 20 consecutive trading days before the date the Board of Directors approved the offering price and not lower than the book value as of December 31, 2022, which is VND 30,615/share.

The total amount IDP expects to collect from the private placement is nearly 471 billion VND. Of this, 230 billion VND will be used to purchase raw materials for production and business and repay bank loans, the remaining 41 billion will be used to pay marketing costs.

In addition, IDP will submit to shareholders for approval the cancellation of the plan to issue shares under the employee stock option program (ESOP) approved by the 2022 General Meeting of Shareholders on April 7, 2022, and replace it with a new issuance plan.

Accordingly, the company will issue nearly 1.2 million ESOP shares to the Board of Directors, managers and employees, to supplement working capital for investment and business activities. The issuance price is 10,000 VND/share, 96% lower than the current market price. Thus, IDP's leaders and employees will be able to buy shares with a market value of more than 280 billion VND for only 12 billion VND.

The expected issuance date is in 2023, after the private offering of shares has been carried out, and the specific date will be decided by the Board of Directors after being approved by the State Securities Commission. The number of shares of both issuances are subject to a 1-year transfer restriction from the date of issuance.

On May 19, IDP closed the list of shareholders receiving the second 2022 cash dividend at a rate of 45% (1 share receives 4,500 VND). With nearly 59 million shares in circulation, IDP plans to spend more than 265 billion VND for this dividend. The expected payment date is June 8, 2023. Previously, IDP had paid the first 2022 dividend at a rate of 15%. Including this period, IDP shareholders will receive a total dividend for 2022 at a rate of 60% in cash.

Source

![[Photo] General Secretary To Lam chairs the meeting of the Central Steering Committee on preventing and combating corruption, waste and negativity](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/fb2a8712315d4213a16322588c57b975)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

Comment (0)