In the special session celebrating the 25th anniversary of the Vietnamese stock market, VN-Index recorded explosive trading not only at an unprecedented 1,557.42 points in history with an impressive increase (more than 26 points) but also thanks to the excitement of cash flow.

VN-Index closed up 1.72% and was the stock market with the strongest increase in Asia in the first session of the week. Similarly, HNX-Index and UPCOM-Index also agreed to increase by 9.23 and 1.17 points, respectively, increasing by 3.63% and 1.11%.

Green color covered the whole market with the number of stocks increasing and hitting the ceiling overwhelmingly with 74 stocks and 537 stocks respectively. Meanwhile, the number of stocks decreasing was only nearly 260 stocks. The stock market became a bright spot with the average increase of the whole group reaching more than 5%. A series of stock markets increased sharply such as VIX, VND, MBS, SHS, AGR, ORS...

According to Mr. Dao Hong Duong, Director of Industry and Stock Analysis at VPBankS, the average liquidity of HoSE (VND20-21,000 billion/session), the total market margin debt is VND280,000 billion and the average portfolio yield difference in the last 8 quarters. The data released in the second quarter of 2025 is relatively more positive than our assumption. Therefore, the growth rate of securities stocks can be much higher than previous forecasts.

The current market developments will be reflected in the third quarter business results, creating driving forces for securities stocks. However, investors should note that securities stocks belong to the group with very high beta. The beta of the securities industry fluctuates from 1.25 to 1.45, more than 35% compared to the VN-Index, making correction waves very significant. High beta also means that stocks have short-term risk factors.

Leading the increase of VN-Index today is VPBank (VPB) with 2 points increase. Followed by VHM (+1.83 points), VCB (+1.55 points), VIC (+1.35 points) andSHB (+1.05 points). While the "big guys" banks and two Vingroup stocks contributed the most positively to the general index, Vincom Retail (VRE) shares had the most negative impact, but only pulled back 0.08 points, not affecting the general trend.

Liquidity surged strongly with total transaction value on all three exchanges reaching over VND52,000 billion, with HOSE alone reaching over VND46,700 billion. This is also the highest level in recent months of the Ho Chi Minh City Stock Exchange.

The highest cash flow was in Hoa Phat and SHB shares with transaction values of VND2,619 billion and VND2,177 billion respectively. Some other stocks also reached liquidity of over VND1,000 billion such as SSI, VPB or TCB.

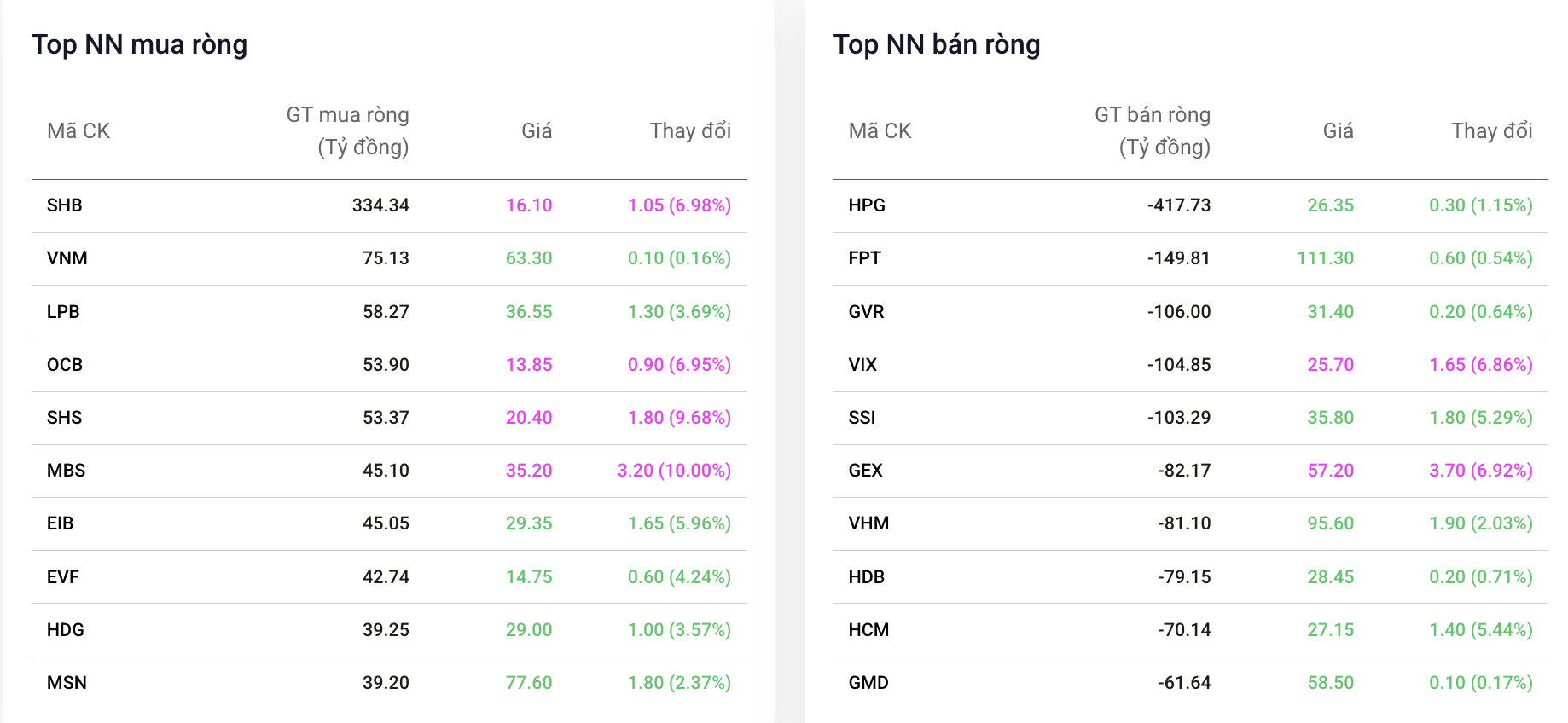

Foreign investors sold a net worth of nearly VND985 billion on all three exchanges. However, even with the stocks that were sold the most, profit-taking pressure from foreign investors did not drag down stock prices. HPG led the list of net sellers with a value of VND417.73 billion. However, this stock still recorded an increase of 1.15%.

Other stocks that were sold off heavily includedFPT , GVR, VIX, and SSI. On the net buying side, SHB impressed with a value of up to VND334.34 billion. Foreign cash flow also helped this bank's shares increase by a huge margin (+6.98%).

Other stocks receiving large foreign capital flows such as VNM, LPB,OCB and SHS also increased positively in price.

|

| Top stocks net bought and sold in session 7/28. |

According to analysts from BIDV Securities, market liquidity supports the index's upward momentum. The VN-Index still has the momentum to continue conquering new peaks.

Sharing the same view, Mr. Dao Hong Duong also believes that the market picture is very positive when the cash flow is strong and there are no signs of reversal. Giving recommendations to investors who are holding all cash at the present time, Mr. Duong believes that this is the right time to consider re-entering the market as a new investment, even in the case of having previously closed profits or just starting to invest. It is important that investors clearly define their risk appetite, thereby building an overall strategy and choosing the appropriate trading strategy.

"In the context of a strongly differentiated market, even in the VN30 basket, there are many stocks that have not increased despite having a good profit base. This opens up opportunities to proactively select stocks," the expert from VPBankS also emphasized.

Source: https://baodautu.vn/giao-dich-bung-no-vn-index-tiep-tuc-tang-toc-tien-gan-1560-diem-d342987.html

Comment (0)