|

From REE and SAM to billions of dollars in transactions

On July 28, 2000, the electronic board of the Ho Chi Minh City Stock Exchange (now Ho Chi Minh City Stock Exchange - HoSE) officially lit up and became the place to record the first buying and selling orders of the Vietnamese stock market. The supply was cautious because of higher expectations in the future, the trading session ended with 1,000 REE shares and 3,200 SAM shares transferred.

A quarter of a century after the historic trading session with a transaction value of more than 70 million VND, the stock market in July 2025 is recording an average trading cash flow per session of approximately 33,000 billion VND, with the number of shares "changing hands" exceeding 1.5 billion units per session.

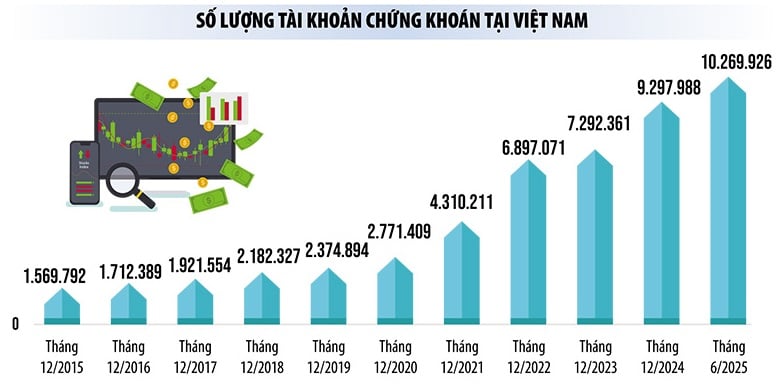

According to the latest update on June 30, 2025, the number of securities accounts has increased to nearly 10.27 million accounts, surpassing the 10% population milestone. In June 2025 alone, the number of newly opened accounts climbed to the highest level since August 2024, approximately 200,000 accounts. Meanwhile, by the end of 2000, this number had not reached the 5,000 account mark.

From the initial foundation of a centralized securities trading “market”, the Vietnamese stock market, with its role as a medium- and long-term capital channel, has become a convergence of both domestic and international capital flows. For foreign capital flows, the upgrading goal has promoted many changes in law and infrastructure.

Accordingly, in terms of law, to meet the criteria set by rating organizations such as FTSE Russell and MSCI, Circular 68/2024/TT-BTC is an initial step to remove the barrier, allowing foreign institutional investors to temporarily not need to deposit before placing orders. Along with that is the balance checking mechanism between foreign custodian banks and domestic securities companies, the simplification of online transaction code issuance, indirect money accounts...

Regarding infrastructure, the KRX technology system will officially go into operation from May 2025, ready to support new operations. According to Mr. Nguyen Son, Chairman of the Board of Members of the Vietnam Securities Depository and Clearing Corporation (VSDC), the central counterparty (CCP) mechanism is being prepared step by step towards completion in the first quarter of 2027, thereby allowing investors to not need or only need to deposit a part of the deposit before trading.

Not only is it a story of the future, during this time, the State Securities Commission has been welcoming foreign investment funds and financial institutions almost every week to learn about and survey the market. Sharing at a recent discussion organized by the Finance - Investment Newspaper, Vice Chairman of the Commission, Mr. Bui Hoang Hai revealed that never before has the management agency recorded such great interest from international institutional investors as it does now.

From the fund’s perspective, Mr. Nguyen Phan Dung, Deputy General Director of SSIAM Fund Management Company, also said that many large investors are in a “waiting” state, just waiting for Vietnam to be upgraded to disburse according to the predetermined capital allocation mechanism. With domestic capital flows, there is still a lot of room.

Sharing the same view, looking from international experience, Ms. Dang Nguyet Minh, Director of Dragon Capital Research, pointed out that Vietnam is entering the "second wave" in capital market development. If the first wave appeared when per capita income reached from 2,000 to 5,000 USD, then the second wave with GDP/capita from 5,000 to 10,000 USD is the period when the rate of individual investors can double, exceeding 15% of the population. Normally, this will also be the wave that coincides with the time when the market develops strongly.

Currently, individual investors still account for a very large proportion, both in terms of account numbers and transaction values. However, support policies, especially the investor development and training project being completed by the State Securities Commission, will be an important catalyst. According to a representative from the Commission, the Draft Investor Restructuring Project, including the content of developing institutional investors, is almost completed and is preparing to be submitted to the Ministry of Finance for early issuance, possibly this month.

|

Enhancing the mettle of Vietnamese businesses

From the first two stocks, REE and SAM, to date, the stock market has 718 listed stocks and fund certificates and 888 stocks registered for trading on UPCoM. Looking back 25 years ago, to have the first trading session, finding the pioneering listed enterprise was a challenging journey, because there were concerns of many business leaders when having to publicly disclose business data for "public scrutiny".

Sharing the reason for volunteering to be the first to list, Chairwoman of the Board of Directors Nguyen Thi Mai Thanh once said that REECorp considers the capital mobilization channel through issuing shares on the stock market and issuing corporate bonds as two extremely important and useful channels for businesses to serve the Company's development in the medium and long term. Time has proven that the female general of REECorp did not put her trust in the wrong place. With nearly ten times of issuing shares, the Company has mobilized thousands of billions of VND to invest in expansion and continued development.

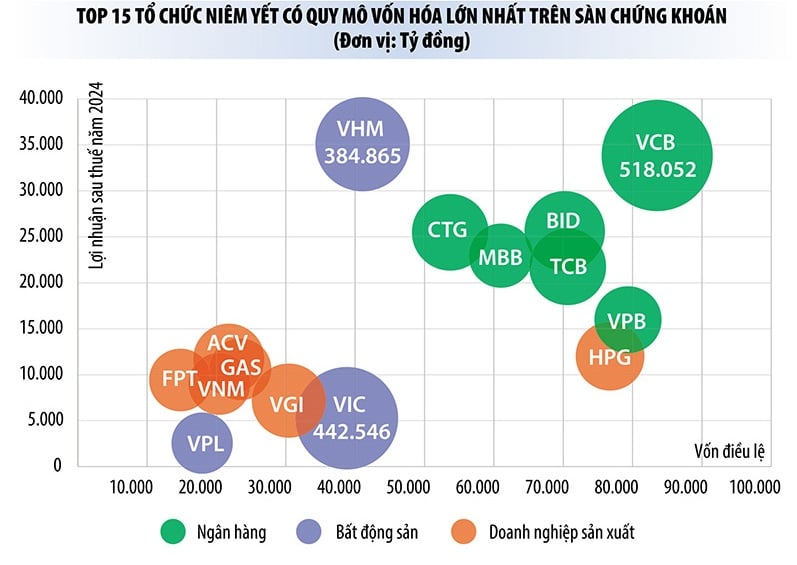

At the stock exchange today, the number of billion-dollar enterprises is approximately 60 organizations. Each industry has leading enterprises, representing the economy , listed or registered for trading.

At the stock exchange today, the number of billion-dollar enterprises is approximately 60 organizations. Each industry has leading enterprises, representing the economy , listed or registered for trading.

Looking at the bigger picture, according to Ms. Tran Anh Dao, Deputy General Director in charge of the HoSE Executive Board, the capital of enterprises increased from accumulation and external mobilization through the stock market on average has increased 3-4 times.

Updating on recent developments, Ms. Dao said that the regulatory agency is promoting a shortening of the process from initial public offering (IPO) to listing, including the consolidation of two previously separate processes. It is expected that with the Decree amending and supplementing a number of articles of Decree 155/2020/ND-CP detailing the implementation of a number of articles of the Securities Law, after issuance, businesses will only take a short time to be listed on the stock exchange. When stocks have good liquidity and attract investors in the market, there will be a roadmap to shorten this process.

Capital is not the only thing that the stock market brings to businesses. This is also the place to "train" listed companies to meet the requirements of governance, information transparency, responsibility and obligations to related parties, indirectly training managers with regulations on information disclosure, board structure, responsibilities of major shareholders, management, regulations on conflicts of interest, transactions with related parties...

Vietnam's first set of corporate governance principles according to best practices issued in 2019, or the initiative to build a set of indicators to measure corporate governance criteria, both encourage businesses to "upgrade" the capacity of Vietnamese businesses to meet higher standards.

Becoming a good “commodity”, the reward that is difficult to measure is reputation. This is also a soft asset that helps investors willingly pay high prices, raising the valuation of the enterprise. On the stock exchange today, the number of billion-dollar enterprises is approximately 60 organizations. Each industry has leading enterprises, representing the entire economy, listed or registered for trading.

“In addition to the hard criteria such as operating time, shareholder structure, governance and transparency, HoSE and the State Securities Commission are promoting the improvement of business quality standards, aiming for a level comparable to regional markets, thereby attracting international capital flows more effectively,” the HoSE representative also emphasized.

Talking about the 25-year mark of the market, the representative of HoSE said that the development of the stock market is linked to the development of the economy, with important events of the country, with policy changes. In the upcoming journey, there are foundations to expect great steps ahead when the Vietnamese stock market is upgraded to an emerging market, with clear and unified policies to create momentum for the development of private enterprises.

Source: https://baodautu.vn/hanh-trinh-25-nam-thi-truong-chung-khoan-viet-nam-toi-luyen-ban-linh-doanh-nghiep-viet-d341529.html

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

Comment (0)