Vietnam Social Security has just instructed local Social Security agencies to resolve retirement, one-time social insurance, sickness, maternity, and death benefits for employees at bankrupt enterprises and runaway employers according to the principle of paying in as much as they receive.

Specifically, regarding the pension regime, employees who are of retirement age and have actually paid social insurance for 20 years or more, not including the time of social insurance debt, will receive pension at the time of eligibility.

In case the owed social insurance premium is later paid by the enterprise or there is other additional financial source, this time can be added to recalculate the benefit level and pay the additional difference.

People who are of retirement age and have participated in social insurance for less than 20 years, including more than 10 years of actual contributions, can voluntarily make a one-time payment for the missing years to receive pension. The time of receiving pension is calculated from the first day of the month following the month of full payment.

In case the debt is later compensated by the enterprise or supplemented by other financial sources, the Social Insurance agency will add the debt period to recalculate the benefit level and pay the difference. The amount voluntarily paid by the employee for the remaining years will not be refunded.

Regarding the one-time social insurance regime, Vietnam Social Security clearly states the groups of subjects that are resolved: Cases of employees working in normal conditions, who have not paid enough 20 years of social insurance (including the time of debt); people settling abroad; people with one of the life-threatening diseases as prescribed by the Ministry of Health ; officers, professional soldiers, professional non-commissioned officers, people working in the key positions in the armed forces who are demobilized, discharged, or quit their jobs without meeting the conditions for pension; employees paying compulsory social insurance after 1 year of leaving work and people paying voluntary social insurance after 1 year of not paying again but have not paid enough 20 years.

For the above subjects, the lump sum benefit is calculated based on the actual number of years of payment, not including the time of debt. If the debt is later paid by the enterprise or other financial sources, the one-time social insurance supplement will be settled.

In addition, sickness and maternity benefits are also settled based on the actual payment period. For employees who give birth or adopt a child and the enterprise still owes insurance premiums, they will still receive benefits if they have paid for 6 months or more into the Sickness and Maternity Fund. If the debt is later paid in compensation, the employee's benefit level will be adjusted.

Death benefits are settled for people who have paid compulsory social insurance for 12 months or more, or the total period of compulsory and voluntary payment is 60 months or more, not including the period of debt.

Employees who have actually paid 15 years or more of compulsory social insurance and have relatives who are eligible for monthly death benefits but do not want to receive them all at once can receive them monthly.

The one-time death benefit is paid to employees who have not paid 15 years of compulsory social insurance; those who have paid 15 years or more; those who have paid 15 years or more but do not have relatives eligible for monthly death benefit. If the social insurance debt is later paid, the employee will be paid an additional one-time death benefit as with one-time social insurance.

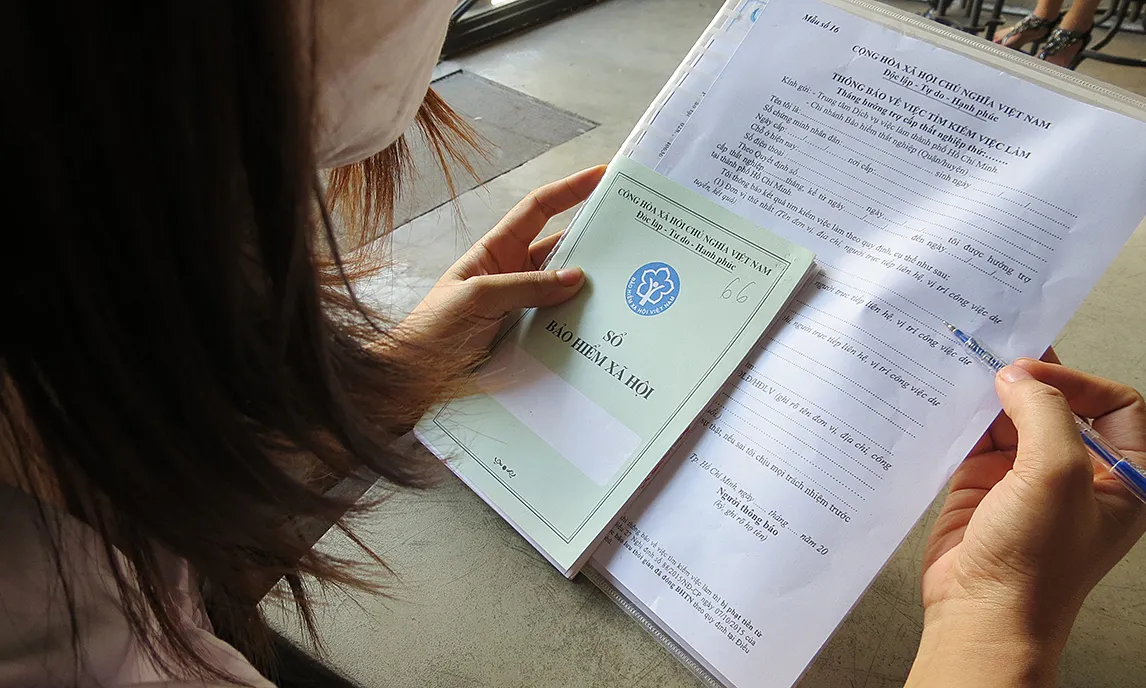

Vietnam Social Security said that nationwide, there are more than 2.13 million workers whose businesses have delayed paying social insurance from 1 to less than 3 months; 440,800 people owe payment for 3 months or more and nearly 213,400 people have their books "suspended" at dissolved or inactive businesses, with social insurance debts that are difficult to collect. The number of people who are owed social insurance accounts for 17.4% of the total number of workers participating in compulsory social insurance.

Source

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)