SGGPO

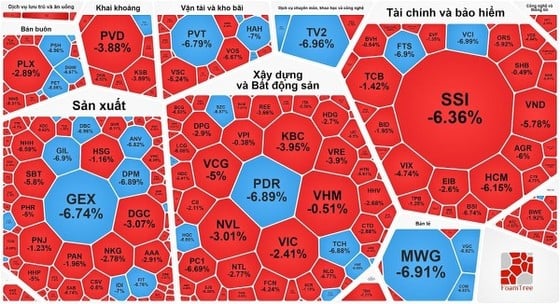

The sell-off at the end of the session caused the last trading session of October to continue to plummet. VN-Index officially lost the 1,030 point mark after losing nearly 126 points in October 2023; in which, the Vingroup trio of VHM, VIC and VRE "took away" about 70 points from VN-Index.

|

| VN-Index lost the 1,030 point mark at the end of October 2023 |

The stock market trading session on October 31 was quite negative due to the fragile sentiment of investors after the previous sharp decline. Although the VN-Index had a moment of green during the session, it quickly fell back due to the large supply. At the end of the afternoon session, the pressure to sell off mortgages pushed many large stocks to the floor, triggering a sell-off across the market, causing the VN-Index to fall sharply. Foreign investors who were net buyers in the morning session also returned to sell, contributing to putting more pressure on the general market.

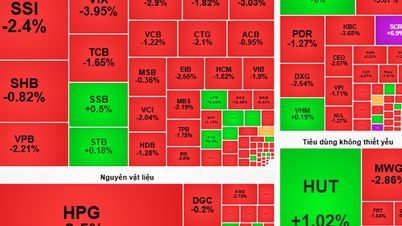

Securities stocks "fell" with FTS, VCI hitting the floor, MBS down 6.98%, CTG down 6.73%, SHS down 6.52%, SSI down 6.36%, HCM down 6.15%, ARG down 6%, ORS down 5.92%, VND down 5.78%, SBS down 4.92%, VIX down 4.74%, VDS down 4.44%, BVS down 4%...

Real estate stocks maintained their green color throughout the morning session but in the afternoon session also fell along with the market: PDR, HQC, SZC, TCH, TDC hit the floor; NLG decreased by 6.77%, DXS decreased by 6.67%, ITA decreased by 5.56%, QCG decreased by 5%, DRH decreased by 4.82%, LDG decreased by 3.72%, HDC decreased by 3.41%, NVL decreased by 3.01%, IDC decreased by 2.97%, HDG decreased by 2.7%; the Vingroup trio also decreased simultaneously with VRE decreased by 3.9%, VIC decreased by 2.41% and VHM decreased by nearly 1%.

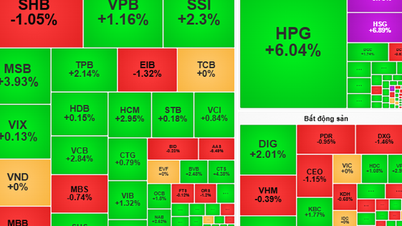

Banking stocks were differentiated with SSB increasing by 1.78%, VIB increasing by 1.7%, OCB increasing by 1.59%, VCB increasing by 1.05%, MBB increasing by nearly 1%. On the contrary, EIB decreased by 2.6%, BID decreased by 1.95%, TCB decreased by 1.42%, TPB decreased by 1.25%;SHB and MSB decreased by nearly 1%.

Except for VNM and MSN, the manufacturing group maintained green, the rest decreased quite deeply: GEX, DPM, DBC, ANV, IDI, GIL decreased by the largest amplitude, GVR decreased by 6.11%, SAB decreased by 6.74%, MSH decreased by 6.56%... The retail group also shared the same fate with MWG and DGW, both hitting the floor....

At the end of the trading session, VN-Index decreased by 14.21 points (1.36%) to 1,028.19 points with 448 stocks decreasing, 66 stocks increasing and 52 stocks remaining unchanged. At the end of the session at Hanoi Stock Exchange, HNX-Index also decreased by 5.17 points (2.45%) to 206.17 points with 131 stocks decreasing, 37 stocks increasing and 50 stocks remaining unchanged. Liquidity increased compared to the previous session, with total transaction value in the whole market of about 17,400 billion VND.

Foreign investors continued to sell off their stocks despite the sharp market decline, continuing to net sell nearly 307 billion VND on the HOSE. The stocks that were heavily net sold were VHM with nearly 258 billion VND, MWG nearly 78.5 billion VND, STB nearly 47.5 billion VND, MSN nearly 42.4 billion VND.

Source

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

Comment (0)