The domestic gold price opening today's trading session (November 26) was listed by DOJI Group at 71.2 million VND/tael for buying; the selling price was 72.3 million VND/tael.

The difference between buying and selling price of gold at DOJI is 1.1 million VND/tael.

Compared to the closing price of last week's trading session, gold price at DOJI increased by 1.25 million VND/tael for buying and increased by 1.55 million VND/tael for selling.

Meanwhile, Saigon Jewelry Company listed the buying price of gold at 71.3 million VND/tael; the selling price is 72.3 million VND/tael.

The difference between buying and selling price of SJC gold is 1 million VND/tael.

Compared to the closing price of last week's trading session, the gold price at Saigon Jewelry Company SJC increased by 1.35 million VND/tael for buying and increased by 1.55 million VND/tael for selling.

Last week, the domestic gold price increased sharply, helping buyers earn a profit of up to 550,000 VND/tael. Specifically, if buying gold at DOJI Group in the session of November 19 at the price of 70.3 million VND/tael and selling it in today's session (November 26), investors will earn a profit of 450,000 VND/tael.

Similarly, gold buyers at Saigon Jewelry Company SJC earned up to 550,000 VND/tael.

Currently, the difference between buying and selling gold in the country is very high. This can put buyers at risk of losing money when investing in the short term.

The world gold price closed the trading session of the week listed on Kitco at 2,002.7 USD/ounce, up 21.6 USD/ounce compared to the closing session of the previous week. In the past two weeks alone, the gold price has increased by 64 USD/ounce.

Data from the CME FedWatch Tool shows that the interest rate futures market is betting on a 100% chance that the US Federal Reserve (FED) will continue to keep interest rates unchanged at its December meeting. Interest rates not continuing to rise is beneficial for gold prices.

Daniel Ghali, commodity strategist at TD Securities, said the market expects the Fed to start its rate-cutting cycle earlier in 2024. This is the main driver behind the gold price increase last week.

Matt Simpson, an expert at financial firm City Index, said gold prices were trading below around $2,000 an ounce. Without a new catalyst, gold appears to lack the momentum to increase prices.

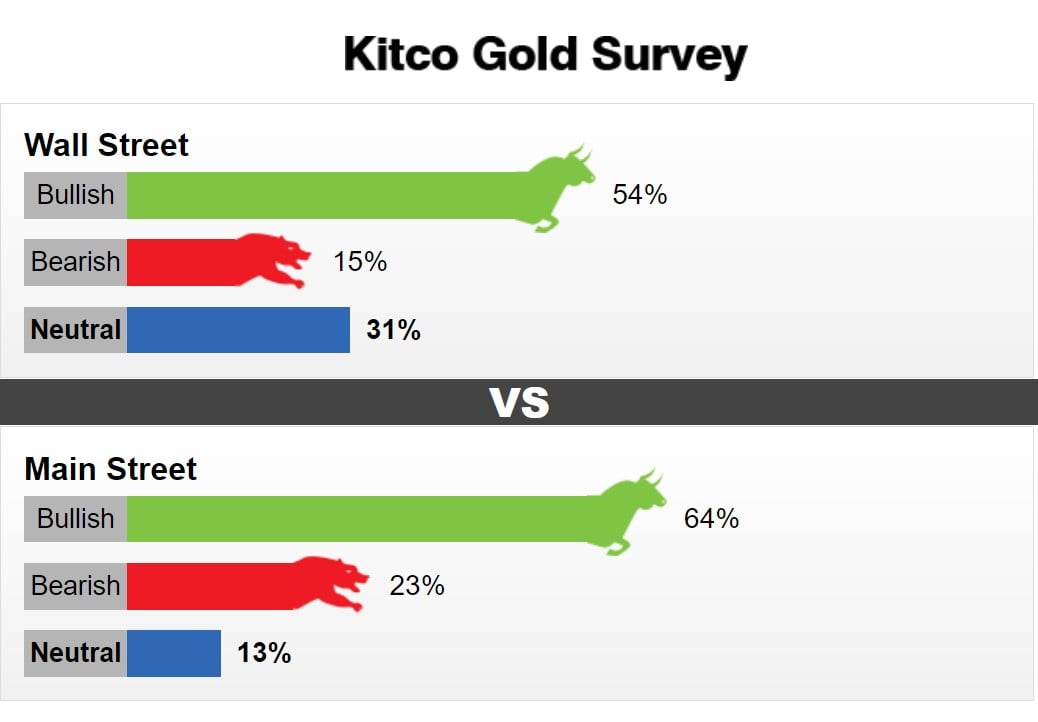

Thirteen Wall Street analysts participated in the Kitco News Gold Survey this week. Seven experts, or 54%, predicted higher prices next week. Two analysts, or 15%, predicted lower prices. Four experts, or 31%, were neutral on gold next week.

Meanwhile, 672 votes were cast in Kitco’s online poll. As usual, the majority of market participants remained bullish on gold. 431 investors, or 64 percent, expect gold to rise next week. Another 156, or 23 percent, predict lower prices. Meanwhile, 85 respondents, or 13 percent, are neutral on the precious metal’s near-term outlook.

Source

![[Photo] General Secretary To Lam attends the 8th Congress of the Central Public Security Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/79fadf490f674dc483794f2d955f6045)

![[Photo] Bustling Mid-Autumn Festival at the Museum of Ethnology](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/da8d5927734d4ca58e3eced14bc435a3)

![[Photo] Solemn opening of the 8th Congress of the Central Public Security Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/f3b00fb779f44979809441a4dac5c7df)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)