A series of domestic commercial banks such as Vietcombank, Techcombank, MB, SeABank , Vikki Bank... have recently announced to give additional interest rates to customers making savings deposits, with common additional rates from 0.2% - 0.5%/year depending on the term or deposit amount.

MB Bank even offers an additional savings interest rate of up to 0.8%/year when making online savings deposits via the MB Bank app from September 29 to October 14.

The condition to apply the preferential bank interest rate is that customers deposit savings with a term of 2 - 3 - 6 - 9 months, with an amount of 30 million VND or more. The program only applies to customers who deposit savings and receive interest at the end of the term on the MB Bank application.

Not only domestic commercial banks, foreign banks are also not out of the race to mobilize capital from individual customers.

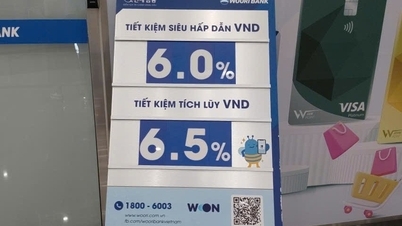

Most recently, Woori Bank, a bank from Korea, announced an additional interest rate of 0.2%/year for customers who deposit money and register for new Internet/Mobile Banking within the last 3 months.

Accordingly, Woori Bank's online deposit interest rate after incentives is up to 6%/year for terms of 24 months or more. This is a bank interest rate that not all banks can meet, especially foreign banks.

Meanwhile, online savings interest rates for the remaining terms after Woori Bank's preferential interest rates include: 1-month term is 2.5%/year, 3-month term is 4%/year, 6-9-month term is 4.7%/year and 12-month term is 5.5%/year.

Notably, the “big guy” from Korea also announced to add interest rates for customers who save money with the highest added interest rate of up to 1.5%/year. This is the most generous added interest rate on the market today.

However, to enjoy the additional interest rate of 1.5%/year, customers must have an initial deposit balance of up to 5 billion VND.

For customers who deposit savings with a lower initial deposit, the additional bank interest rate is also lower.

Woori Bank adds a preferential interest rate of 0.3%/year for initial deposits from 200 million VND to under 500 million VND; adds 0.6%/year for deposits from 500 million VND to under 1 billion VND; 0.9%/year for deposits from 1 billion VND to under 2 billion VND; 1.2%/year for deposits from 2 billion VND to under 5 billion VND. The highest interest rate added is up to 1.5%/year for account opening amount from 5 billion VND.

Woori Bank's cumulative savings products are applied with terms of 6 months, 12 months and 24 months.

| INTEREST RATE TABLE FOR ONLINE DEPOSITS OF BANKS ON OCTOBER 7, 2025 (%/YEAR) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| AGRIBANK | 2.4 | 3 | 3.7 | 3.7 | 4.8 | 4.8 |

| BIDV | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETINBANK | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETCOMBANK | 1.6 | 1.9 | 2.9 | 2.9 | 4.6 | 4.6 |

| ABBANK | 3.1 | 3.8 | 5.3 | 5.4 | 5.6 | 5.4 |

| ACB | 3.1 | 3.5 | 4.2 | 4.3 | 4.9 | |

| BAC A BANK | 4 | 4.3 | 5.4 | 5.45 | 5.5 | 5.8 |

| BAOVIETBANK | 3.5 | 4.35 | 5.45 | 5.5 | 5.8 | 5.9 |

| BVBANK | 3.95 | 4.15 | 5.15 | 5.3 | 5.6 | 5.9 |

| EXIMBANK | 4.3 | 4.5 | 4.9 | 4.9 | 5.2 | 5.7 |

| GPBANK | 3.8 | 3.9 | 5.35 | 5.45 | 5.65 | 5.65 |

| HDBANK | 3.85 | 3.95 | 5.3 | 5.3 | 5.6 | 6.1 |

| KIENLONGBANK | 3.7 | 3.7 | 5.1 | 5.2 | 5.5 | 5.45 |

| LPBANK | 3.6 | 3.9 | 5.1 | 5.1 | 5.4 | 5.4 |

| MB | 3.5 | 3.8 | 4.4 | 4.4 | 4.9 | 4.9 |

| MBV | 4.1 | 4.4 | 5.5 | 5.6 | 5.8 | 5.9 |

| MSB | 3.9 | 3.9 | 5 | 5 | 5.6 | 5.6 |

| NAM A BANK | 3.8 | 4 | 4.9 | 5.2 | 5.5 | 5.6 |

| NCB | 4 | 4.2 | 5.35 | 5.45 | 5.6 | 5.6 |

| OCB | 3.9 | 4.1 | 5 | 5 | 5.1 | 5.2 |

| PGBANK | 3.4 | 3.8 | 5 | 4.9 | 5.4 | 5.8 |

| PVCOMBANK | 3.3 | 3.6 | 4.5 | 4.7 | 5.1 | 5.8 |

| SACOMBANK | 3.6 | 3.9 | 4.8 | 4.8 | 5.3 | 5.5 |

| SAIGONBANK | 3.3 | 3.6 | 4.8 | 4.9 | 5.6 | 5.8 |

| SCB | 1.6 | 1.9 | 2.9 | 2.9 | 3.7 | 3.9 |

| SEABANK | 2.95 | 3.45 | 3.95 | 4.15 | 4.7 | 5.45 |

| SHB | 3.5 | 3.8 | 4.9 | 5 | 5.3 | 5.5 |

| TECHCOMBANK | 3.45 | 4.25 | 5.15 | 4.65 | 5.35 | 4.85 |

| TPBANK | 3.7 | 4 | 4.9 | 5 | 5.3 | 5.6 |

| VCBNEO | 4.35 | 4.55 | 5.6 | 5.45 | 5.5 | 5.55 |

| VIB | 3.7 | 3.8 | 4.7 | 4.7 | 4.9 | 5.2 |

| VIET A BANK | 3.7 | 4 | 5.1 | 5.3 | 5.6 | 5.8 |

| VIETBANK | 4.1 | 4.4 | 5.4 | 5.4 | 5.8 | 5.9 |

| VIKKI BANK | 4.35 | 4.45 | 6 | 6 | 6.2 | 6.2 |

| VPBANK | 3.7 | 3.8 | 4.7 | 4.7 | 5.2 | 5.2 |

| Woori Bank | 2.3 | 3.8 | 4.5 | 4.5 | 5.3 | 5.3 |

Source: https://vietnamnet.vn/lai-suat-ngan-hang-hom-nay-7-10-2025-nha-bang-tang-lai-suat-toi-1-5-nam-2449847.html

![[Photo] Super harvest moon shines brightly on Mid-Autumn Festival night around the world](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/07/1759816565798_1759814567021-jpg.webp)

Comment (0)