Investors sell off, causing VN-Index to drop 21 points, losing the 1,300 point mark

After consecutive increases to a 2-year peak, VN-Index experienced its sharpest decline since April and closed at 1,279 points.

The stock market entered the weekend trading session with high caution from investors after the VN-Index conquered the 1,300 point zone but could not make a strong breakthrough.

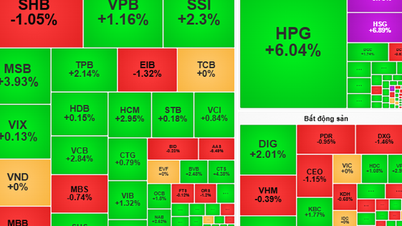

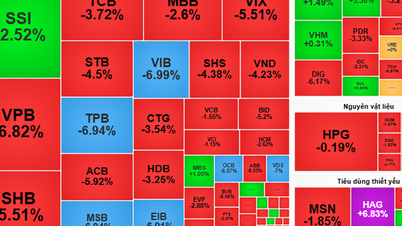

The index representing the Ho Chi Minh City Stock Exchange recorded many alternating ups and downs. However, profit-taking pressure gradually increased from the second half of the afternoon session, causing many electronic boards to turn red with a series of pillar stocks such as banks, real estate, securities, etc. falling sharply.

VN-Index closed the weekend session at 1,279.91 points, down 21.6 points (equivalent to 1.66%) compared to the reference. This is the sharpest decline in the past 2 months, thereby bringing the index to its lowest price range since the beginning of June.

Market breadth was completely skewed to the downside with 366 stocks falling, more than 4 times the number of stocks rising. The large-cap basket was also on fire with 28 stocks closing below reference, while on the upside, onlyFPT and SSB remained.

|

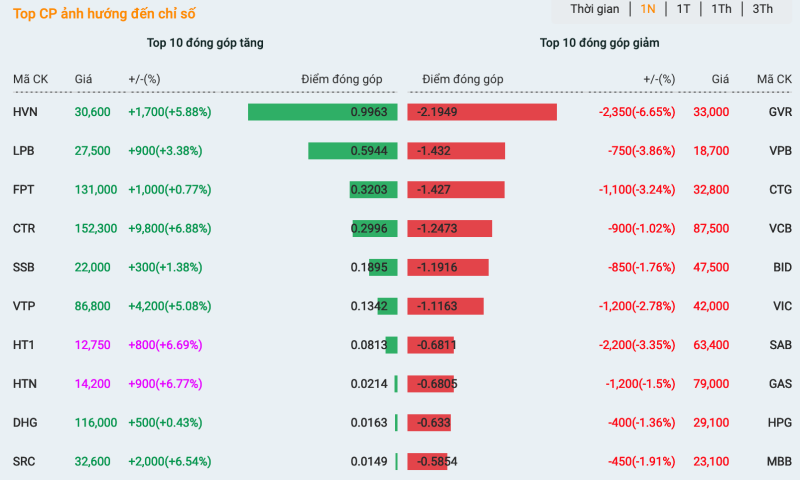

| List of stocks that most affected VN-Index in the session of June 14. |

Banking stocks led the decline as almost all closed below reference. Of the 10 stocks with the most negative impact on the VN-Index, 5 were in this group. Specifically, VPB fell 3.86% to 18,700 VND, followed by CTG down 3.24% to 32,800 VND, BID down 1.76% to 47,500 VND, MBB down 1.91% to 23,100 VND and VCB down 1.02% to 87,500 VND.

Most real estate stocks also fell into negative territory. Two pillar stocks, VHM and VIC, lost 0.13% to VND38,200 and 2.78% to VND42,000, respectively.

Similarly, the securities group also put great pressure on market developments. Specifically, SSI decreased by 1.1% to 36,100 VND, VND decreased by 1.65% to 17,850 VND and MBS decreased by 3.42% to 33,900 VND.

In the food group, MSN fell 0.76% to VND78,000 and matched more than 0.8 million units. This stock was sold heavily, making the already weak investor sentiment more negative and spreading to many other stocks in this group. Specifically, VNM fell 1.05% to VND66,200 and SAB fell 3.35% to VND63,400.

On the other hand, HVN increased by 5.88% to VND30,600, thereby becoming the market's support in today's session. LPB ranked next on this list when it increased by 3.38% to VND27,500 and FPT increased by 0.77% to VND131,000.

Market liquidity today reached VND29,362 billion, an increase of VND6,288 billion compared to the previous session. This is the session with the highest matched value in more than half a month. This value comes from about 1.1 billion shares traded, an increase of 219 million shares compared to yesterday's session. The VN30 basket contributed a trading volume of more than 359 million shares and liquidity of approximately VND11,819 billion.

HPG ranked first in terms of order matching value, reaching over VND1,015 billion (equivalent to 34 million shares). This figure far exceeded the following stocks, SSI by nearly VND983 billion (equivalent to 27 million shares) and GEX by about VND869 billion (equivalent to nearly 36 million shares).

Foreign investors have been net sellers for the 7th consecutive session. Specifically, in today's session, this group sold nearly 69 million shares, equivalent to a transaction value of VND2,538 billion, while only disbursing VND1,969 billion to buy about 52 million shares. The net selling value accordingly reached VND568 billion.

On the Ho Chi Minh City Stock Exchange, foreign investors focused on selling FPT with a net value of about VND149 billion, followed by VHM with more than VND123 billion, MWG with nearly VND93 billion and VRE with about VND72 billion. In contrast, foreign cash flow focused on SSI shares with a net value of VND75 billion. MSN ranked next with a net absorption of about VND73 billion, followed by DGC with more than VND63 billion.

Source: https://baodautu.vn/nha-dau-tu-ban-thao-khien-vn-index-giam-21-diem-mat-moc-1300-diem-d217689.html

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

Comment (0)