VNDIRECT Securities Company has just warned about fraud and impersonation aimed at appropriating customers' assets.

Accordingly, an investor had a need to trade securities and was instructed by someone to deposit money into account number 456932158, account holder is "VNDIRECT JOINT STOCK COMPANY". This investor transferred money into the above account.

"After receiving the feedback, the company checked and found that the above account number belongs to VNDIRECT DRILLING JOINT STOCK COMPANY (MSDN: 4300897250) and not to VNDIRECT Securities Company (MSDN: 0102065366). Taking advantage of the loophole of displaying the same name without accents when transferring money via bank accounts, the subjects established a fake enterprise to lure and trick investors into transferring money and appropriating it," VNDIRECT Securities Company warned.

Currently, the company said it is carrying out necessary procedures and working with competent state agencies to handle violations of impersonation to commit fraud and appropriate investors' assets.

Despite repeated warnings, many people are still being fooled by increasingly sophisticated tricks of financial fraudsters. Illustrative photo AI

To prevent acts of taking advantage of loopholes in money transfer transactions to fraudulently appropriate assets, and to avoid risks from organizations and investment fraud groups that are increasing day by day, VNDIRECT Securities Company recommends not accessing links in SMS, strange emails, of unknown origin... Carefully choose legal and official transaction channels to avoid being scammed and losing money.

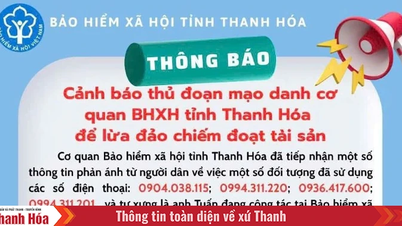

Banks also continuously warn about bank brand impersonation and many other fraudulent tricks.

SHB said that to enhance information security for customers when using the SHB Mobile application on Android devices, the bank will display a warning that the application is being granted accessibility rights on the device and ask customers to turn off accessibility rights before logging in or making financial transactions.

This warning was issued by SHB after the market saw the emergence of increasingly sophisticated and diverse forms of fraud, but with the common point of requiring customers to download fake apps of state agencies such as: Public Services, General Department of Taxation, Ministry of Public Security ...

Through websites, links are disguised as app stores such as Play Store and App Store or ask customers to provide personal information, account security information. After customers provide, criminals will illegally access electronic bank accounts, take control to steal money in customers' accounts, or request money transfers to complete transactions and pay fees.

In particular, the form of Accessibility fraud on phones using the Android operating system has recently flourished. Phones installed with fake applications will show many suspicious signs such as the phone running out of battery quickly and running slowly, strange applications appearing on the phone, or applications automatically popping up even when the phone is not in use...

Source: https://nld.com.vn/nha-dau-tu-sap-bay-thu-doan-moi-mao-danh-cong-ty-chung-khoan-196240510160243057.htm

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

Comment (0)