With many positive solutions, Orient Commercial Bank (OCB ) is urgently promoting support for customers to complete the procedure of updating biometrics and expired identification documents. Up to now, nearly 90% of customers have completed the reconciliation and the entire OCB system is ready to deploy the suspension of online transactions with customers who have not completed the above 2 points from December 30 - 2 days before the circular.

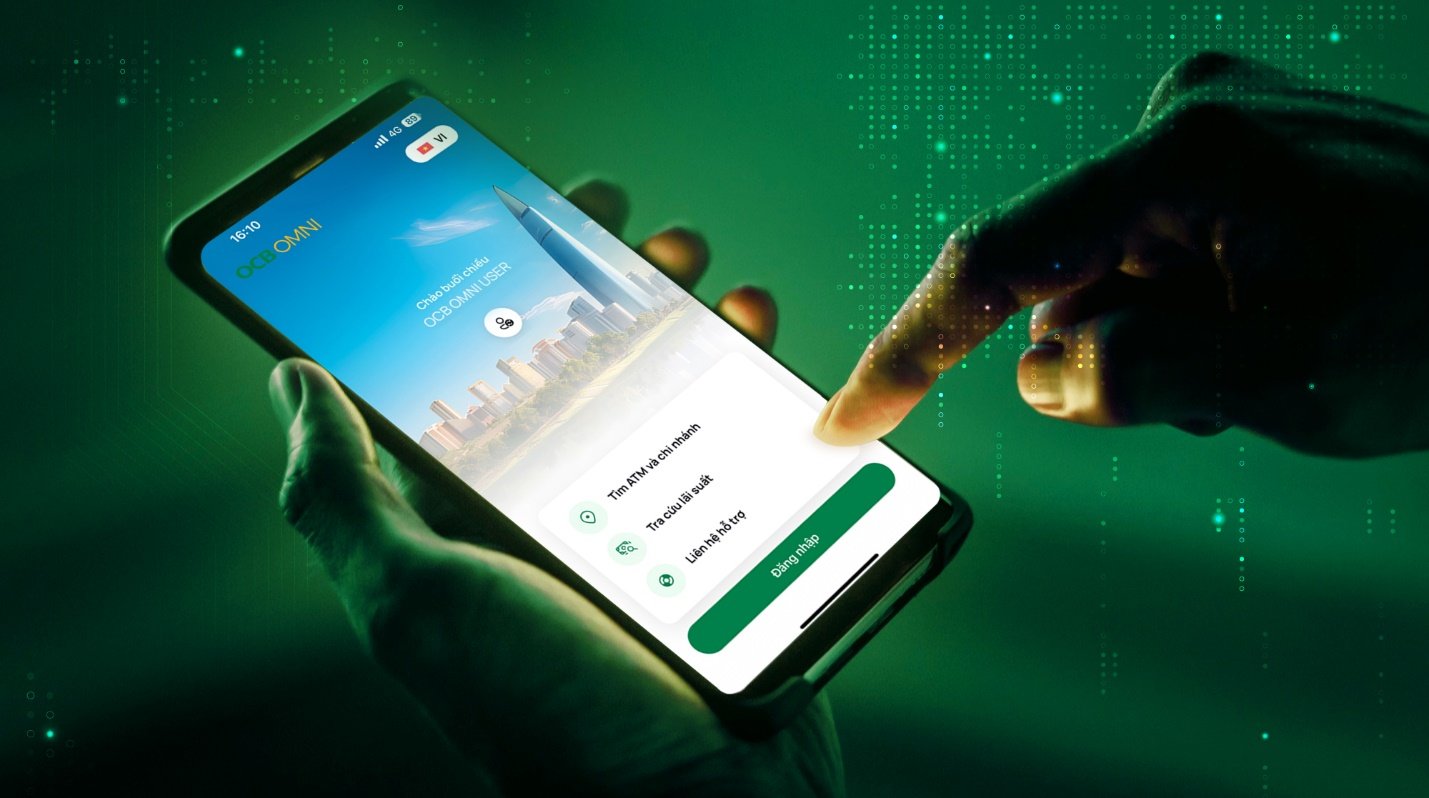

It is known that OCB has continuously promoted information dissemination activities and regulations according to Circular 17 and Circular 18 to customers through all official channels of the bank for many months. At the same time, building a support team and guiding customers to install facial biometrics and update identity document information 24/7; Strengthening the call center team through the free Hotline 18006678 and establishing a rapid response team, providing a focal point for continuous information reception. Feedback on incidents will be reported and resolved in the shortest time. On the digital banking platforms OCB OMNI and Liobank, the feature of updating identity documents and biometrics has been integrated since May 2024. At branches/transaction offices, the bank deployed the OCB Assist application - an internal application developed by OCB for employees to collect customers' biometrics. This feature will support customer groups including: Individual customers who are Vietnamese and cannot register online on the OCB OMNI application because their device does not have NFC, customers who do not know how to register online, or customers of foreign nationality. "According to regulations, from January 1, 2025, account and card holders who have not completed updating valid identification documents will not be able to make any transfer, payment or withdrawal transactions on all banking channels, regardless of the value or type of transaction. In addition, if the account holder has not verified biometrics with the bank, they can only deposit, withdraw or transfer money at the bank counter. Users cannot even use ATMs/CDMs of the interbank system to deposit/withdraw money. Therefore, to ensure smooth customer transactions, we have been making continuous efforts in support work. Up to now, nearly 90% of customers have completed reconciliation and a large number of customers have come to branches/transaction offices to perform. This shows the active interest of customers in applying and complying with the requirements of the State Bank. Particularly at OCB, strictly complying with Circular 17/2024/TT-NHNN and Circular 18/2024/TT-NH, the entire OCB system is ready to suspend online transactions for customers who have not completed the above 2 points from December 30 - 2 days before the circular. Therefore, customers who have not had time to supplement, contact the nearest OCB or access the OCB OMNI application to complete to avoid service interruption". Representative of OCB Leadership said. According to the State Bank, biometric authentication of bank accounts is a technological solution, enhancing and improving service quality, ensuring safety and security of information for customers. Ensuring owner confirmation in online transactions, effectively limiting and preventing risks arising from technology crimes, fraud and appropriation of customer information and account information. Sharing more about the issue of security in online transactions, Mr. Luong Tuan Thanh - Director of Technology and Digital Transformation said: "For OCB, the goal when building online platforms is to provide customers with an optimal experience while ensuring safety and security. Therefore, in addition to investing in technology infrastructure, we also continuously build programs to help customers recognize potential risks regarding data, fraudulent links and fraud methods... through channels: text messages, emails... At the same time, the internal processes and operations of the bank are always strictly controlled by a modern technology system, avoiding loss of customer information or being attacked. We also invest in related platforms on AI safety investment; data analysis and early forecasting to ensure better information security and safety operations of the bank".

It is known that OCB has continuously promoted information dissemination activities and regulations according to Circular 17 and Circular 18 to customers through all official channels of the bank for many months. At the same time, building a support team and guiding customers to install facial biometrics and update identity document information 24/7; Strengthening the call center team through the free Hotline 18006678 and establishing a rapid response team, providing a focal point for continuous information reception. Feedback on incidents will be reported and resolved in the shortest time. On the digital banking platforms OCB OMNI and Liobank, the feature of updating identity documents and biometrics has been integrated since May 2024. At branches/transaction offices, the bank deployed the OCB Assist application - an internal application developed by OCB for employees to collect customers' biometrics. This feature will support customer groups including: Individual customers who are Vietnamese and cannot register online on the OCB OMNI application because their device does not have NFC, customers who do not know how to register online, or customers of foreign nationality. "According to regulations, from January 1, 2025, account and card holders who have not completed updating valid identification documents will not be able to make any transfer, payment or withdrawal transactions on all banking channels, regardless of the value or type of transaction. In addition, if the account holder has not verified biometrics with the bank, they can only deposit, withdraw or transfer money at the bank counter. Users cannot even use ATMs/CDMs of the interbank system to deposit/withdraw money. Therefore, to ensure smooth customer transactions, we have been making continuous efforts in support work. Up to now, nearly 90% of customers have completed reconciliation and a large number of customers have come to branches/transaction offices to perform. This shows the active interest of customers in applying and complying with the requirements of the State Bank. Particularly at OCB, strictly complying with Circular 17/2024/TT-NHNN and Circular 18/2024/TT-NH, the entire OCB system is ready to suspend online transactions for customers who have not completed the above 2 points from December 30 - 2 days before the circular. Therefore, customers who have not had time to supplement, contact the nearest OCB or access the OCB OMNI application to complete to avoid service interruption". Representative of OCB Leadership said. According to the State Bank, biometric authentication of bank accounts is a technological solution, enhancing and improving service quality, ensuring safety and security of information for customers. Ensuring owner confirmation in online transactions, effectively limiting and preventing risks arising from technology crimes, fraud and appropriation of customer information and account information. Sharing more about the issue of security in online transactions, Mr. Luong Tuan Thanh - Director of Technology and Digital Transformation said: "For OCB, the goal when building online platforms is to provide customers with an optimal experience while ensuring safety and security. Therefore, in addition to investing in technology infrastructure, we also continuously build programs to help customers recognize potential risks regarding data, fraudulent links and fraud methods... through channels: text messages, emails... At the same time, the internal processes and operations of the bank are always strictly controlled by a modern technology system, avoiding loss of customer information or being attacked. We also invest in related platforms on AI safety investment; data analysis and early forecasting to ensure better information security and safety operations of the bank".

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)