According to the online deposit interest rate table on November 14, BIDV kept the deposit interest rate for 1-2 month term at 3.2%/year, and for 3-5 month term at 3.5%/year.

However, BIDV has increased the interest rate for 6-36 month deposits by 0.2 percentage points since today. With this increase, the new deposit interest rate for 6-11 month term at BIDV is 4.6%/year, and for 12-36 month term is 5.5%/year.

Previously, this bank reduced interest rates for all terms on October 11.

Thus, after the unexpected increase in interest rates, the interest rates for 6-36 month deposits at BIDV have returned to the level before October 11.

Currently, the interest rate for 6-11 month term at BIDV is equal to the listed interest rate at VietinBank, and the interest rate for 12-36 month term is equal to the interest rate at Agribank .

However, BIDV is not the only bank that has increased deposit interest rates since the beginning of November. Previously, yesterday,OCB Bank also increased deposit interest rates for terms of 18 - 36 months.

On the contrary, commercial banks continue to lower deposit interest rates.

This morning, November 14, Ocean Commercial Joint Stock Bank (OceanBank) announced a reduction in interest rates for deposits with terms from 12-36 months by 0.1-0.4%/year.

Accordingly, online deposit interest rates for these terms were simultaneously reduced to 6%/year, and over-the-counter deposit interest rates for these terms were also reduced to 5.9%/year.

OceanBank is currently the bank paying the highest interest rate in the system for 1-9 month term deposits.

The bank interest rate (at the counter and online) for a term of 1-5 months applied by OceanBank is 4.6%/year. The bank's online deposit interest rate for a term of 6-8 months at this bank is 5.8%/year (at the counter 5.7%/year), while the term of 9-11 months is 5.9%/year (at the counter 5.8%/year).

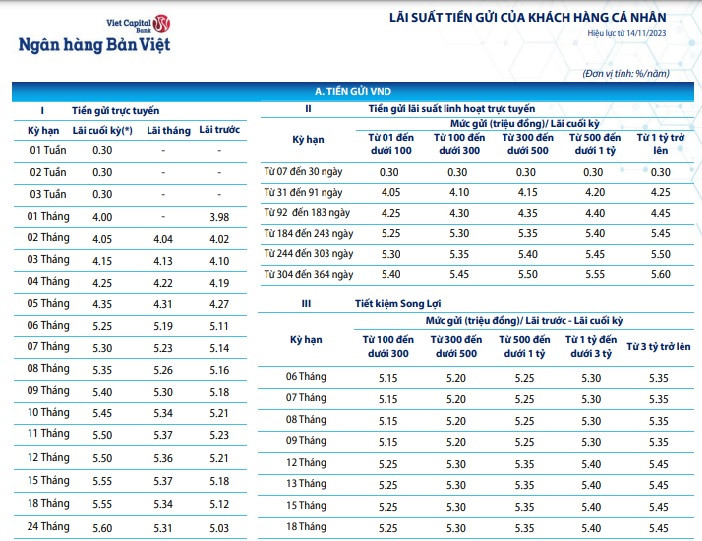

Bao Viet Commercial Joint Stock Bank (BVBank) also adjusted down deposit interest rates from today with a reduction in all deposit terms.

According to the latest online interest rate table, the 1-month term bank interest rate has dropped sharply by 0.4 percentage points to 4%/year, the 2-month and 3-month terms have dropped by 0.55 percentage points, to 4.05%/year and 4.15%/year, respectively.

BVBank reduced the 4-month deposit interest rate by 0.45 percentage points to 4.25%/year, while the 5-month term decreased by 0.4 percentage points to 4.35%/year.

BVBank adjusted interest rates for the remaining terms down from 0.25 to 0.3 percentage points.

Accordingly, the online deposit interest rate for a 6-month term is 5.25%/year, a 7-month term is 5.3%/year, an 8-month term is 5.35%/year, a 9-month term is 5.4%/year, a 10-month term is 5.45%/year, the 11- and 12-month terms have a new interest rate of 5.5%/year, while the deposit interest rate for a 15-18-month term is 5.55%/year and the 24-month term has the highest interest rate of 5.6%/year.

Also today, Orient Commercial Joint Stock Bank (OCB) adjusted down deposit interest rates for terms from 1 month to 11 months.

Online savings interest rates for 1 and 2 months at OCB decreased by 0.3 percentage points to 3.8%/year and 3.9%/year. Interest rates for 3-5 months decreased by 0.15 percentage points to 4.1%/year.

OCB also adjusted the interest rate for 6-11 month deposits down slightly by 0.1 percentage points. Thereby, the interest rate for 6-8 month deposits is now 5.2%/year, and for 9-11 month deposits is now 5.3%/year.

OCB keeps the interest rates unchanged for terms of 12 months or more. The interest rate for online deposits of 12-15 months is 5.5%/year, 18-21 months is 6.2%/year, 24 and 36 months are 6.3% and 6.4%/year respectively.

Since the beginning of November, 21 banks have reduced their deposit interest rates, including Sacombank, NCB, VIB, BaoVietBank, Nam A Bank, VPBank, VietBank, SHB, Techcombank, Bac A Bank, KienLongBank, ACB, Dong A Bank, PG Bank, PVCombank, VietA Bank, SCB, Eximbank, OceanBank, BVBank, OCB. Of which, VietBank has reduced interest rates twice this November.

On the contrary, OCB and BIDV are the banks that have increased their deposit interest rates since the beginning of the month. With OCB, the bank increased interest rates for terms from 18 to 36 months. Meanwhile, BIDV increased interest rates for terms from 6 to 36 months.

| HIGHEST INTEREST RATE TABLE ON NOVEMBER 14 (%/year) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| OCEANBANK | 4.6 | 4.6 | 5.8 | 5.9 | 6 | 6 |

| CBBANK | 4.2 | 4.3 | 5.7 | 5.8 | 6 | 6.1 |

| HDBANK | 4.05 | 4.05 | 5.7 | 5.5 | 5.9 | 6.5 |

| PVCOMBANK | 3.65 | 3.65 | 5.6 | 5.6 | 5.7 | 6 |

| BAOVIETBANK | 4.4 | 4.75 | 5.5 | 5.6 | 5.9 | 6.2 |

| NCB | 4.45 | 4.45 | 5.5 | 5.65 | 5.8 | 6 |

| GPBANK | 4.25 | 4.25 | 5.45 | 5.55 | 5.65 | 5.55 |

| VIET A BANK | 4.4 | 4.4 | 5.4 | 5.4 | 5.7 | 6.1 |

| BAC A BANK | 4.35 | 4.35 | 5.4 | 5.5 | 5.6 | 5.95 |

| KIENLONGBANK | 4.55 | 4.75 | 5.4 | 5.6 | 5.7 | 6.2 |

| VIETBANK | 3.9 | 4.1 | 5.4 | 5.5 | 5.8 | 6.2 |

| BVBANK | 4 | 4.15 | 5.25 | 4.5 | 5.5 | 5.55 |

| OCB | 3.8 | 4.1 | 5.2 | 5.3 | 5.5 | 6.2 |

| DONG A BANK | 4.2 | 4.2 | 5.2 | 5.3 | 5.55 | 5.7 |

| SHB | 3.5 | 3.8 | 5.2 | 5.4 | 5.6 | 6.1 |

| SAIGONBANK | 3.4 | 3.6 | 5.2 | 5.4 | 5.6 | 5.6 |

| VIB | 3.8 | 4 | 5.1 | 5.2 | 5.6 | |

| LPBANK | 3.8 | 4 | 5.1 | 5.2 | 5.6 | 6 |

| MB | 3.5 | 3.8 | 5.1 | 5.2 | 5.4 | 6.1 |

| EXIMBANK | 3.6 | 3.9 | 5 | 5.3 | 5.6 | 5.7 |

| SACOMBANK | 3.6 | 3.8 | 5 | 5.3 | 5.6 | 5.75 |

| VPBANK | 3.7 | 3.8 | 5 | 5 | 5.3 | 5.1 |

| TPBANK | 3.8 | 4 | 5 | 5 | 5.55 | 6 |

| MSB | 3.8 | 3.8 | 5 | 5.4 | 5.5 | 6.2 |

| SCB | 3.75 | 3.95 | 4.95 | 5.05 | 5.45 | 5.45 |

| PG BANK | 3.4 | 3.6 | 4.9 | 5.3 | 5.4 | 6.2 |

| NAMA BANK | 3.6 | 4.2 | 4.9 | 5.2 | 5.7 | 6.1 |

| ABBANK | 3.7 | 4 | 4.9 | 4.9 | 4.7 | 4.4 |

| SEABANK | 4 | 4 | 4.8 | 4.95 | 5.1 | 5.1 |

| TECHCOMBANK | 3.55 | 3.75 | 4.75 | 4.8 | 5.25 | 5.25 |

| AGRIBANK | 3.4 | 3.85 | 4.7 | 4.7 | 5.5 | 5.5 |

| VIETINBANK | 3.4 | 3.75 | 4.6 | 4.6 | 5.3 | 5.3 |

| ACB | 3.3 | 3.5 | 4.6 | 4.65 | 4.7 | |

| BIDV | 3.2 | 3.5 | 4.6 | 4.6 | 5.5 | 5.5 |

| VIETCOMBANK | 2.6 | 2.9 | 3.9 | 3.9 | 5 | 5 |

Will the State Bank flexibly use the credit bill channel? On the open market channel, the State Bank conducts bidding for interest rates on treasury bills. The State Bank has temporarily stopped issuing treasury bills after issuing VND15,000 billion at an interest rate of 1.2% last week. Meanwhile, with VND65 trillion maturing last week, the total volume of treasury bills in circulation on the market dropped sharply to VND154.65 trillion (from VND204.65 trillion) at the end of the week. Regarding interbank interest rates, overnight interest rates continued to cool down and ended last week at 0.74% - down 20 basis points compared to the previous week. Since the end of September, under the unfavorable developments of the international USD and to reduce pressure on exchange rates, the State Bank has issued a large amount of treasury bills to the market to regulate interest rates in the secondary market to a more reasonable level, reducing speculation on interest rate differentials. Pressure on the exchange rate has somewhat cooled down since the beginning of November, when the DXY index reversed and decreased slightly (down -0.8% compared to the end of October) or the currencies of countries that are major trade partners with Vietnam also increased significantly (such as KRW increased by 2.5%, EUR increased by 0.93% or THB increased by 0.82%). Therefore, the move to stop issuing treasury bills by the State Bank is partly due to the above reason, and partly due to the fact that demand from commercial banks on treasury bills will decrease in the context that commercial banks need to prepare liquidity for the peak credit season at the end of the year. However, according to SSI Research's assessment, exchange rate risks still exist when the interest rate gap remains large, and it is likely that the State Bank will flexibly use the credit bill channel (possibly with shorter terms) if necessary. |

Source

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

Comment (0)