|

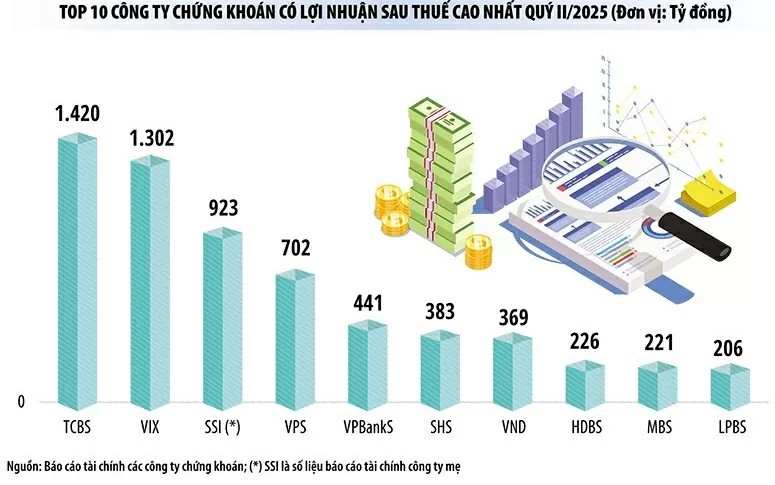

| Top 10 securities companies with the highest after-tax profits in the second quarter of 2025. (Source: Investment Newspaper) |

Statistics on 37 securities companies operating on the stock exchange show strong differentiation in business activities in the second quarter of 2025. The statistics include all leading securities companies with large market shares, which are typical enterprises representing the entire industry.

The total profit of these companies exceeded 7,700 billion VND in the second quarter of 2025, up 26% over the same period last year and marking the highest profit period ever. Although the total profit of the whole industry is at its peak, the differentiation was clear in the second quarter, when many names broke out, pushing profits to skyrocket, while some familiar securities companies fell behind.

In the second quarter of 2025, the market recorded two securities companies reporting profits exceeding thousands of billions, namely Techcom Securities Joint Stock Company (TCBS) and VIX Securities Joint Stock Company (VIX). TCBS still holds the leading position in the industry in terms of profit, bringing in 1,420 billion VND in the second quarter, which is TCBS's highest quarterly profit ever.

The surprise came from VIX when in the second quarter alone, this securities company made a sudden profit of 1,301 billion VND, exceeding the highest profit in its history (in 2023, after-tax profit reached 966 billion VND). The favorable stock market has helped VIX's revenue segments increase sharply, especially self-trading. Profit from financial assets recorded through profit/loss (FVTPL) brought in 1,698 billion VND to VIX, more than 7 times the profit from the same period last year.

Although VIX did not explain in detail the securities codes in the proprietary trading portfolio, the majority of the portfolio is listed stocks, worth VND6,184 billion, accounting for 48% of the portfolio, the rest is investment trusts, unlisted bonds and unlisted stocks. FVTPL assets also account for the majority of VIX's assets with a value of VND12,921 billion, equivalent to 53% of total assets.

Interest income from lending also increased sharply and contributed greatly to VIX's operating revenue, as the securities company continuously increased its margin lending. By the end of the second quarter of 2025, VIX used more than VND9,274 billion for margin lending, an increase of nearly VND3,500 billion within 6 months.

With a large profit from self-trading and margin operations, VIX had its highest profit quarter in history, 10 times higher than the same period last year. This profit helped VIX surpass SSI Securities Corporation and rise to second place in the industry in terms of profit (the profit of SSI's parent company in the second quarter of 2025 reached VND 922 billion).

Just counting the Top 3 (including TCBS, VIX and SSI), the total profit of these 3 companies reached more than 3,600 billion VND, accounting for 47% of the total profit of 37 listed securities companies.

In the second quarter of 2025, the stock market recorded positive growth. At the end of the last trading session of the quarter on June 30, 2025, the VN-Index reached its highest level since 2022. Along with this positive development, the revenue and profits of securities companies also improved significantly.

In the second quarter, if VIX was the securities company that suddenly increased its profit to thousands of billions of VND, LPBank Securities Joint Stock Company (LPBS) had the highest increase when its profit reached 206.2 billion VND, 15 times higher than the same period last year.

Similar to VIX, LPBS's growth momentum this quarter largely comes from proprietary trading activities. If in the second quarter of 2024, proprietary trading did not bring much profit and most of the operating revenue came from interest on held-to-maturity (HTM) investments, which are bank deposits, then this period, interest from FVTPL skyrocketed, pushing LPBS's profit level up. The profit of VND 206 billion is the highest quarterly profit that LPBS has achieved since its operation.

In particular, LPBS quickly changed its strategy by strongly increasing investment in FVTPL assets in the first half of 2025. If at the beginning of 2025, the FVTPL assets of this securities company were only over VND 612 billion, accounting for a low proportion of the total assets of VND 5,066 billion at that time, then in the first quarter, LPBS increased its investment to VND 3,371 billion and continued to push it up to VND 6,742 billion at the end of the second quarter, equivalent to 11 times the value at the beginning of the year.

In the first half of 2025, LPBS also increased capital to invest in business activities. This securities company increased short-term debt from VND 551 billion to VND 13,288 billion within 6 months. In terms of asset allocation, money poured into 2 main asset segments including FVTPL assets (VND 6,742 billion) and HTM assets (VND 6,854 billion). Meanwhile, the lending segment (margin and advance sales) only increased slightly from VND 2,664 billion at the beginning of the year to VND 2,732 billion.

Another bank-related securities company, Vietnam Joint Stock Commercial Bank for Industry and Trade Securities (CTS), also recorded extraordinary results, with after-tax profit reaching VND175.7 billion, equivalent to an increase of 741% compared to the second quarter of last year. Although this is not the largest quarterly profit of CTS in history, it is the best result that this securities company has achieved in more than 3 years, since the old peak wave of the stock market in the fourth quarter of 2021.

Along with increased activities, a number of other securities companies also reached peak profits in the second quarter of 2025 such as VPBank Securities Joint Stock Company (VPBankS),ACB Securities Company Limited (ACBS), HD Securities Joint Stock Company (HDBS).

Source: https://baoquocte.vn/quy-ii2025-nhieu-cong-ty-chung-khoan-hot-bac-pha-dinh-loi-nhuan-323241.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

Comment (0)