The sudden increase in selling pressure has pushed a series of large stocks down sharply, causing the VN-Index to sink into the red. This is the third session of declining stocks and also the eighth consecutive session of net selling by foreign investors on the floor.

|

| Session 10/22, 3 stock indexes simultaneously closed in red - Photo: Dung Minh |

Entering the trading session on October 22, the market remained gloomy and cautious sentiment continued to dominate the market. At the end of today's session, all three indices traded in red for most of the trading time. The strong tug-of-war continued until around 2:00 p.m. After that, rising selling pressure pushed a series of stock groups to plummet in the last 45 minutes of the session. The indices therefore simultaneously fell deep below the reference level.

In the first half of the trading session, EIB was the center of attention when it continued to increase sharply. At one point, EIB increased by nearly 6% to VND22,000/share. However, under strong selling pressure from the general market, EIB increased by 3.9% to VND21,600/share. Thus, EIB increased by nearly 19% within just 1 trading week. Right before this increase, EIB had a sharp decrease after information on social networks spread a document with recommendations on serious risks in Eximbank's operations, leading to unsafe operations and the risk of collapse of the Eximbank system. Responding to this issue, Eximbank affirmed that the above-mentioned document circulating on social networks was not a document of Eximbank's Supervisory Board and did not originate from the bank.

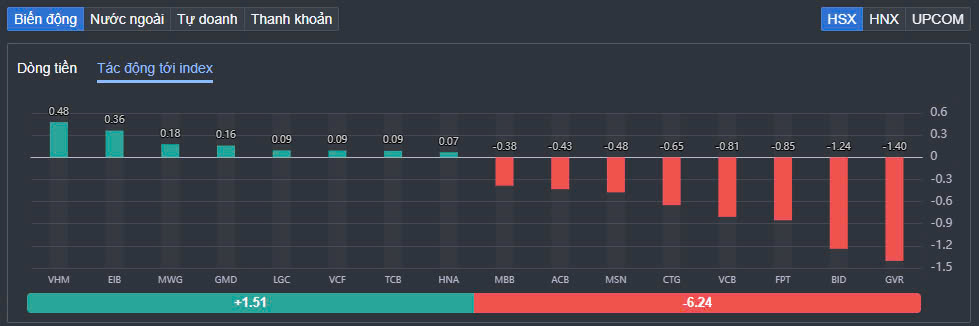

EIB is also the second most positive stock on the VN-Index, contributing 0.36 points. Meanwhile, VHM is the stock with the most positive contribution, contributing 0.48 points. VHM continued to increase by 0.94% today to 48,250 VND/share. Stocks such as MWG, GMD... also had a positive impact on the index. MWG increased by 0.76% after the news of being returned to the VN Diamond index "basket" in the next restructuring period.

The focus of the second half of the session was on GVR. This was one of the stocks that triggered widespread sell orders across many stock sectors in the context of fragile investor sentiment. GVR was suddenly sold heavily and at one point hit the floor price of VND32,750/share. At the end of the session, GVR fell more than 4% and put the most pressure on the VN-Index, taking away 1.4 points.

|

| GVR is the stock with the most negative impact on VN-Index |

A series of other large stocks also fell sharply in price such as VRE, VIB, BCM, POW,FPT , MSN... FPT continued to decrease by 1.8% to 133,100 VND/share and took away 0.85 points from VN-Index. BID also took away 1.24 points when recording a decrease of 1.8%. Red covered the group of securities stocks, in which, VDS decreased by 3.5%, CTS decreased by 2.5%, FTS decreased by 2.35%, HCM decreased by 2.2%, AGR decreased by 1.9%.

Meanwhile, real estate stocks were differentiated. Codes such as SGR, HDC, DXS, TCH, KDH... were pulled up above the reference level. In the opposite direction, VRE decreased by 2.6%, BCM decreased by 2.3%, HPG decreased by 1.5%...

At the end of the trading session, VN-Index decreased by 9.88 points (-0.77%) to 1,269.89 points. The entire floor had 107 stocks increasing, 269 stocks decreasing and 58 stocks remaining unchanged. HNX-Index decreased by 1.93 points (-0.85%) to 225.5 points. The entire floor had 61 stocks increasing, 93 stocks decreasing and 60 stocks remaining unchanged. UPCoM-Index decreased by 0.41 points (-0.44%) to 91.73 points.

|

| Foreign investors net sold for the 8th consecutive session |

The total trading volume on the HoSE floor reached 794 million shares, equivalent to a trading value of VND19,090 billion (up 33% compared to the previous session), of which the negotiated value accounted for VND1,550 billion. The trading value on the HNX and UPCoM reached VND1,517 billion and VND548 billion, respectively.

Foreign investors net sold for the 8th consecutive session on HoSE with a value of 130 billion VND. Of which, this capital flow net sold the most FUEVFVND ETF certificates with 100 billion VND. KDH and VRE were net sold 69 billion VND and 51 billion VND respectively. In the opposite direction, MWG was net bought the most with 77 billion VND. TCB and BVH were net bought 65 billion VND and 60 billion VND respectively.

Source: https://baodautu.vn/roi-sau-cuoi-phien-chieu-2210-vn-index-giam-gan-10-diem-d228057.html

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

Comment (0)