The stock market last week (September 22-26) continued to move sideways and the VN-Index tested the 1,600-point support zone for the third time this month. Liquidity decreased but is not too worrying because it is quite suitable in a sideways context.

Although the sideways trend is expected to continue, the market in the new week may be more exciting when sentiment improves thanks to information about upgrades or upcoming third quarter business results.

Global stock markets had a volatile week despite the US Federal Reserve cutting interest rates for the first time this year. Sentiment also became more cautious as investors awaited upcoming macroeconomic data.

At the end of the week, major US stock market indexes fell for three consecutive sessions from historical highs, causing indexes such as Nasdaq to fall -0.7%; S&P 500 to lose -0.3%; and Dow Jones to also fall -0.2%.

On the other hand, Japanese stocks with the Nikkei 225 index increased +0.7%, while the mainland Chinese market with the Shanghai index increased +0.2%.

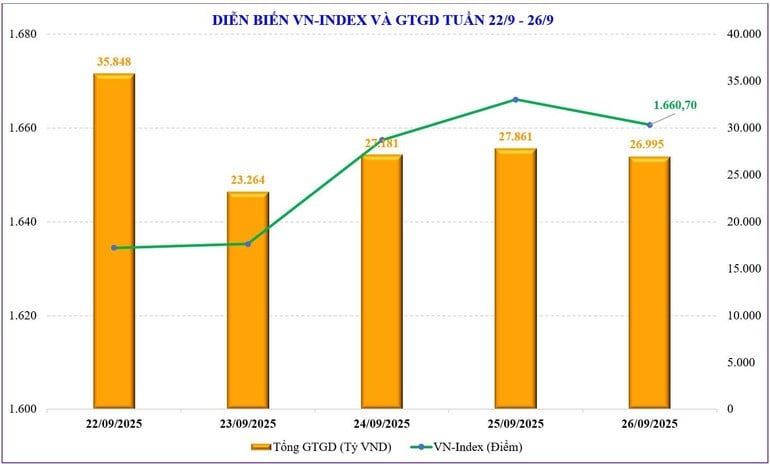

With the domestic stock market, last week, the market continued its sideways trend as sentiment and cash flow remained cautious. VN-Index successfully tested the 1,600-point support zone for the third time in the past month, closing the week at 1,660.7 points, equivalent to an increase of +2.08 points (or +0.13%) compared to the previous week. The VN30 group of stocks decreased -0.37%, the second consecutive week of decrease, to 1,852.65 points, below the old peak resistance zone around 1,880 points.

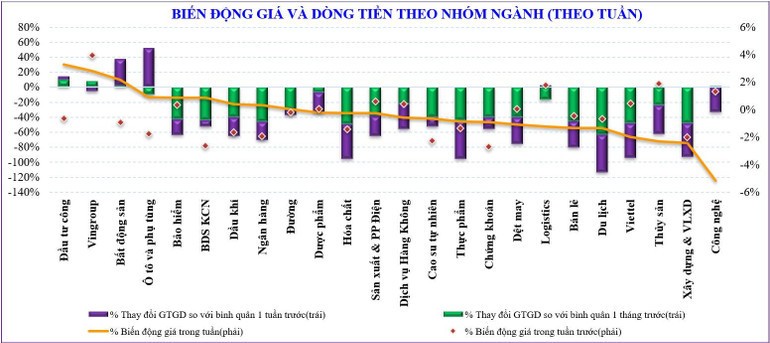

Pressure on the downward trend from bluechip stocks, especially banking stocks, caused cash flow to shift to small stocks. Midcap stocks also decreased for 4 consecutive weeks while smallcap stocks maintained an upward trend for 2 consecutive weeks and increased 4/5 recent weeks.

Some groups of stocks with strong increases in the market last week include: Public investment (+4.8%), real estate (+2.5%), insurance (+1.5%)... On the contrary, the groups of stocks that put pressure on the market include: Technology (-4.8%), seafood (-2.2%), Viettel (-1.6%)...

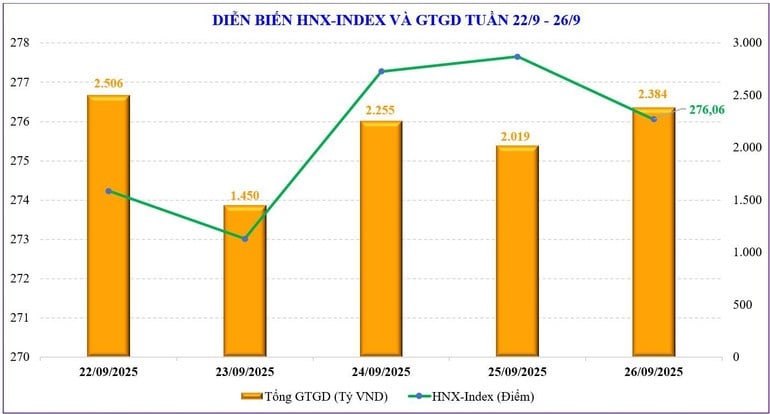

On the Hanoi Stock Exchange, the HNX-Index recorded 2 increasing sessions and 3 decreasing sessions, ending the week at 276.06 points, down -0.18 points, equivalent to 0.07% compared to the previous week. The UPCoM-Index UPCoM-Index decreased to 110.75 points, down -0.55 points, equivalent to 0.49%.

Market liquidity continued to decline compared to the previous week. Specifically, the total trading value of the entire market was only 31,920 billion VND/session, down -17% compared to the previous week. Order matching liquidity also dropped -16.6% to 27,863 billion VND.

Cash flow was divergent during the week. Previously strong stocks such as banks and securities continued to be sold. Meanwhile, money went to the mid- and small-cap groups, thus not creating a better effect on the general index.

Foreign investors continued to sell net and continued to sell net for 10 consecutive weeks. Specifically, foreign investors sold net -7,700 billion VND, bringing the cumulative net selling since the beginning of the year to -102,559 billion VND. Last week, foreign investors bought net CII (+22 billion VND), BID (+201 billion VND), BSR (+129 billion VND); while selling net FPT (-1,039 billion VND), VHM (-959 billion VND), SSI (-782 billion VND)...

| Last week, the securities companies' self-trading sector net bought stocks such as: GEE (+593 billion VND), TCB (+58 billion VND), ACB (+41 billion VND)...; while net selling other stocks such as: VPB (-332 billion VND), FPT (-156 billion VND), HPG (-95 billion VND)... | |

Liquidity is down but is it worrying?

The domestic stock market has officially tested the 1,600-point threshold successfully, thanks to the push from VIC. The market has maintained quite good stability although the supporting factors have weakened significantly and short-term profit-taking pressure is still high. With the VN-Index successfully testing this support level, the market is expected to return to the peak of 1,700 points.

However, the increase is likely to be limited, as the main trend is still sideways. The market still needs to wait for stronger information to create momentum to break out of the 1,700 point zone. Currently, information may be stronger next week, such as official information on upgrading or the gradually announced third quarter business results.

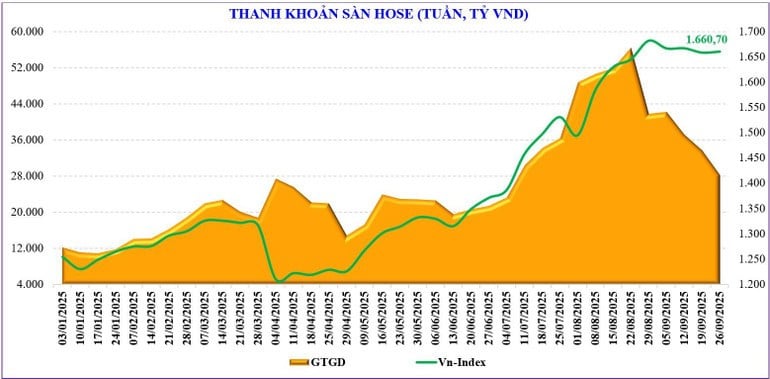

What is more concerning now is liquidity. The transaction value has decreased significantly, with the total matched value only reaching about 27,000 billion VND/session - this is the lowest level since the beginning of July. Compared to the peak at the end of August, the transaction value has decreased by half.

However, the decrease in cash flow in the context of a prolonged sideways market is also understandable. The accumulation trend is very clear, so money does not flow much into the bluechip group, but often rotates to small and medium groups, or looks for single opportunities. From a certain perspective, shrinking money is also a manifestation of limited supply, or in other words, many investors choose to hold and wait.

Statistics show that liquidity since the beginning of September has increased by +115% compared to the same period but decreased by -31% compared to August, to VND 38,158 billion. Accumulated from the beginning of the year, total market liquidity reached VND 28,800 billion, up +36.7% compared to the average level in 2024, and up +27.8% compared to the same period.

On the other hand, seasonally, the market in the last week of September is usually calm, entering the information valley. Currently, the VN-Index also shows this quite clearly.

Technically, the market is still forecasted to continue to move sideways in the short term, in the range of 1,600 - 1,700 points. The market may need a few sessions of stronger fluctuations to create emotions and to move up, it needs the support of cash flow again, as well as a few leading groups. However, that is only a technical forecast, the psychology of anticipating positive information may also appear and therefore it is not excluded that positive psychology can push cash flow to enter more strongly. The market may increase again after 3 weeks of sideways movement.

Source: https://baolangson.vn/thi-truong-chung-khoan-tuan-moi-vn-index-di-ngang-ky-vong-thong-tin-nang-hang-5060326.html

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

Comment (0)