► Some stocks to watch on December 16

Investors should continue to hold their current portfolio and temporarily prioritize an observation position.

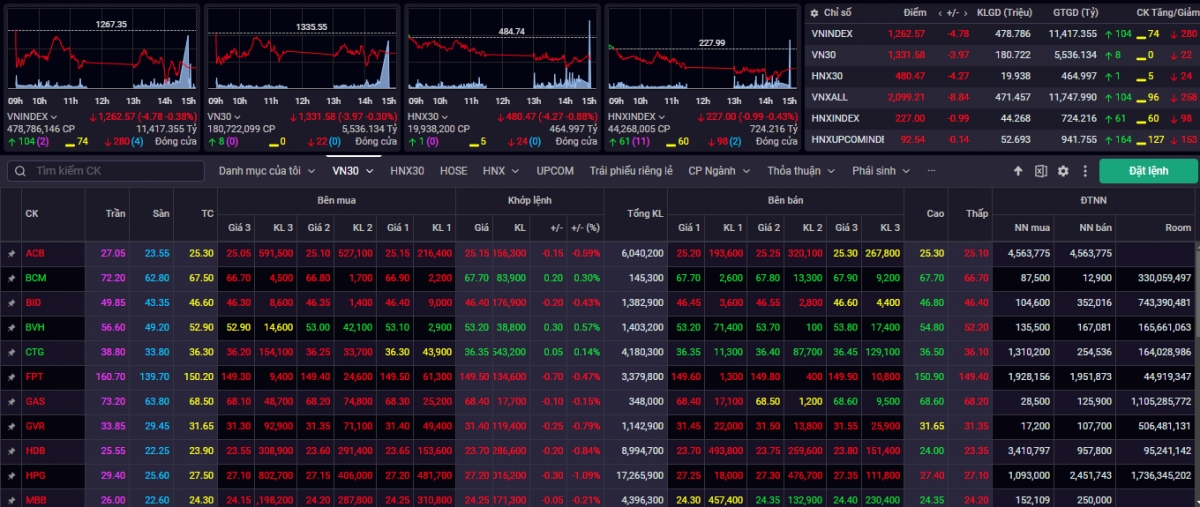

In contrast to the explosive trading week in early December, the stock market performed relatively poorly last week with a sideways down trend as the main trend. The VN-Index ended the week at near the lowest level of the week with a sharp drop in liquidity, showing a lack of demand. After a slight increase in the first session of the week, the index had 4 consecutive sessions of decline with selling pressure tending to increase. The last trading session of the week also witnessed the sharpest decline in the market, with red spreading across the group of small and medium-sized stocks. Order-matching liquidity also tended to decrease following the market slide and fell to the lowest level since the beginning of the month in the last session of the week. Closing the trading week from December 9 to December 13, the VN-Index closed at 1,262.57 points, -4.78 points (-0.38%), successfully defending the support line of 1,260 points equivalent to the MA200 area.

Market order matching liquidity weakened, down -13.4% compared to the average level of 20 trading weeks. Accumulated to the end of the trading week, average trading liquidity on the HSX floor reached 579 million shares (-7.84%), equivalent to VND 14,266 billion (-11%) in trading value.

Red gradually dominated last week with 13/21 industry groups adjusting. Putting great pressure on the market and trading sentiment last week were industry groups such as: Consumer goods (-3.65%), Fertilizer (-2.16%), Residential real estate (-1.7%), Construction (-1.68%),... On the contrary, some industry groups successfully reversed the trend and maintained the growth momentum including: Plastic (+1.97%), Insurance (+1.74%), Seaport (+1.03%),...

According to experts from Construction Securities Company (CSI), VN-Index had its 4th consecutive decline with declining liquidity. The matched volume on HSX was the lowest in the past 2 weeks and decreased (-20.36%) compared to the average of 20 sessions. It is worth noting that VN-Index had a session to retest the support level of 1,260 points, corresponding to the 200-day MA line and bounced up, showing that this is still a support level that attracts investors' attention.

At the end of the week, although the points decreased, it had a lot of meaning in terms of a correction to regain the balance at the long-term support level MA200. Therefore, the correction of the last 4 sessions and last week is not a signal for the market to continue to decrease in the coming weeks, but only tends to be a technical correction.

“Investors should continue to hold their current portfolio and temporarily prioritize the observation position after opening new buying positions and increasing the proportion of stocks at the support level of 1,260 points during the last session of the week. It is not excluded that the VN-Index will have a session of falling points to lower than the 1,260 point mark in today's session, December 16, but they need to be patient and prioritize holding positions,” CSI experts noted.

The market is likely to continue to fluctuate in the short term.

According to the analysis team of ASEAN Securities Company (ASEANSC), the market's decline with relatively low liquidity shows the negative sentiment of investors. The index is showing a slight negative trend as it has decreased for the fourth consecutive session with the continuous net selling status of foreign investors. However, the positive perspective is that the current price is still in a short-term uptrend, so the current adjustment is necessary to give the market the momentum to move to higher levels.

On the macro side, the DXY continued to increase tension, reaching 107.2 points at one point during the day and the US market (DJI) continued to decline for 6 consecutive sessions. In addition, the USD exchange rate at domestic commercial banks and interbank overnight interest rates also showed signs of gradually increasing since the beginning of the week, which are factors that are negatively affecting market sentiment and liquidity.

“The market is likely to continue to fluctuate in the short term during the re-accumulation process to return to the old peak of 1,300 points in the absence of obvious negative factors from exchange rates and the international market. During this period, investors should have appropriate portfolio management and risk prevention plans, focusing on long-term investment stocks with positive fundamentals and business prospects, and should only disburse when the recovery trend is clearly confirmed with good trading volume again and stocks are at attractive valuations,” said ASEANSC experts.

Experts from Saigon - Hanoi Securities Company (SHS) assessed that in the short term, VN-Index is still growing above the support level of around 1,260 points, corresponding to the average price of 200 sessions, and is facing a resistance zone of 1,280 points -1,300 points. This is a very strong resistance zone, the peak zone of March-July 2024 and September-October 2024 from the beginning of the year until now. To be able to overcome this very strong resistance zone, the market needs momentum, strong support from fundamental factors, and outstanding growth prospects. In the medium term, VN-Index has maintained a wide accumulation channel since the beginning of the year until now in the range of 1,200 points to 1,300 points, with a balanced price zone around 1,250 points.

Currently, the market's intrinsic quality is still improving after a long accumulation period from the beginning of 2024 until now. Many codes and groups of codes are at reasonable prices, opening up many good opportunities. On the basis of the total market capitalization of about 296 billion USD, it is still relatively attractive compared to the size of the economy , with GDP growth in 2025 planned to increase by 6.5-7%. In the short term, VN-Index is under pressure to adjust, accumulating above the support zone around 1,260 points.

“The market is also entering the stage of closing NAV for investors in 2024. This is a suitable accumulation period, before waiting for new growth drivers such as expectations for growth in business results in the fourth quarter of 2024 and prospects for 2025. The market may surpass the accumulation trend that has lasted since the beginning of the year. Investors should maintain a reasonable proportion. Consider selectively disbursing good fundamental stocks, expecting continued growth. The investment target is towards leading stocks with good fundamentals,” SHS experts recommended.

Source: https://vov.vn/thi-truong/chung-khoan/nhan-dinh-chung-khoan-16-2012-thi-truong-co-kha-nang-tiep-dien-rung-lac-post1141962.vov

Comment (0)