China is ramping up spending on chipmaking equipment, outpacing the combined spending of the US, South Korea and Japan in the first half of this year.

|

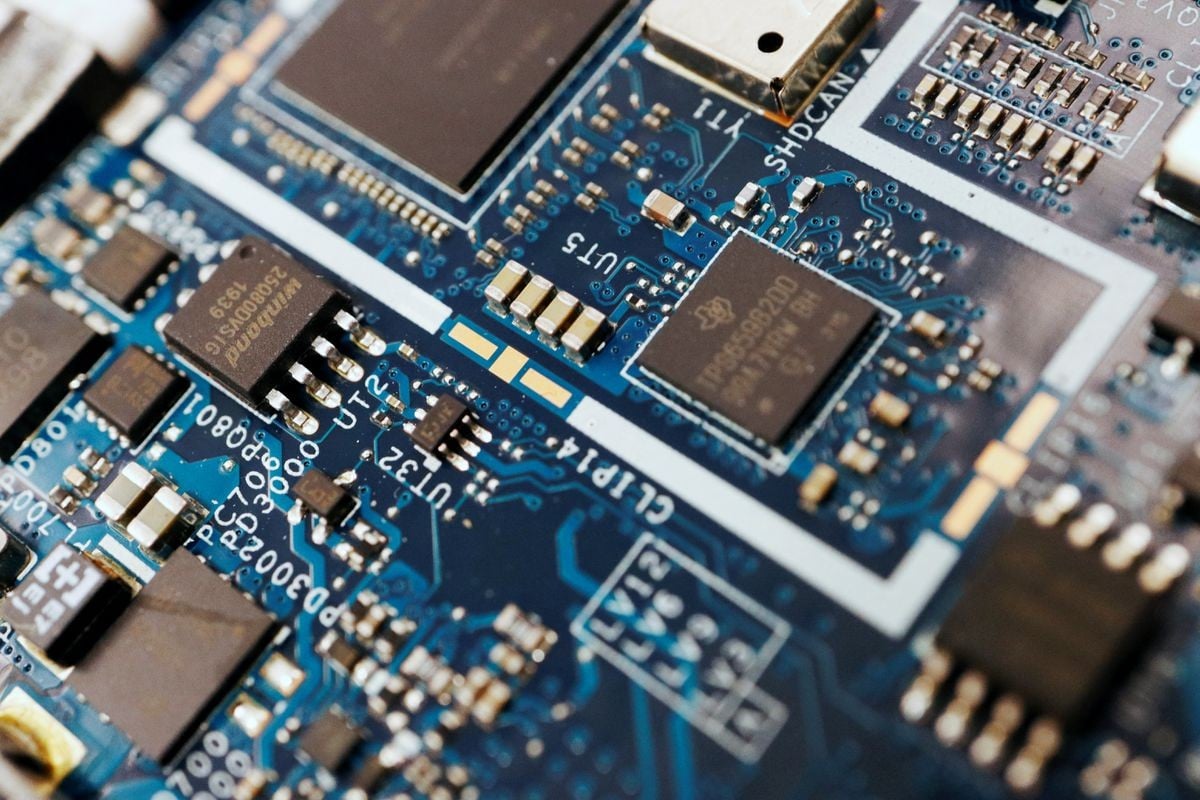

| China has sharply increased spending on chip manufacturing equipment. (Source: Reuters) |

The massive investment is driven by the Chinese government 's efforts to become self-sufficient in chips and mitigate the risk of Western restrictions that could hinder access to crucial technology.

According to data from SEMI, a global semiconductor industry association, China spent $24.73 billion on chipmaking equipment in the first half of 2024. This is much higher than the combined spending of South Korea, Taiwan (China), North America and Japan, which was $23.68 billion in the same period.

Of these, the US is the country that accounts for the majority of spending in North America.

Beijing has sharply increased spending on chipmaking equipment since the US imposed strict export restrictions in October 2022.

According to SEMI, annual spending increased from $28 billion in 2022 to $36.6 billion in 2023 and is expected to surpass $35 billion this year.

The equipment hoarding could last into the second half of this year, said Clark Tseng, senior director at SEM.

However, Mr. Tseng warned that China's strong investment could lead to inefficiencies in the future and put pressure on industry rivals outside the country.

The world's second-largest economy has considerable experience in producing older-generation chips, but the world could soon face a glut of such chips.

Meanwhile, China still has a long way to go in producing more advanced and powerful chips.

US export controls will be effective in cutting off China from advanced manufacturing technology, noted Alex Capri, a lecturer at the National University of Singapore.

These restrictions could deal a serious blow to Beijing's efforts to move into more advanced chip manufacturing.

However, he also noted, Huawei launched the Mate 60 Pro last year with a 7-nanometer chip.

"Chinese companies may be stockpiling chipmaking equipment as a precaution against the possibility that the US may impose further export restrictions on the industry ahead of the presidential election," said Alex Capri.

Still, the sweeping export restrictions have not cost Beijing its position as the biggest source of revenue for many of the world's largest semiconductor makers.

Dutch semiconductor equipment maker ASML said its revenue from Chinese customers as a percentage of total sales will more than double from 17% in the fourth quarter of 2022 to 49% in the second quarter of 2024.

Source: https://baoquocte.vn/trung-quoc-chi-dam-mua-thiet-bi-san-xuat-chip-vuot-loat-ong-lon-trong-nganh-285109.html

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

Comment (0)