Non-Chinese insiders increase stakes

The plan includes spinning off a separate US entity for TikTok and reducing Chinese ownership in the new business below the 20% threshold required by local law, in a bid to save the app from an imminent ban in the United States.

Major non-Chinese investors in parent company ByteDance are expected to increase their stakes and buy the short video app's US operations.

Jeff Yass's Susquehanna International Group and Bill Ford's General Atlantic, both of which have representation on ByteDance's board, are leading discussions with the White House about the plan. Private equity firm KKR is also involved, a source said.

The fate of the short-video app, used by nearly half of Americans, has been unclear since a law took effect on January 19 that requires ByteDance to sell it or face a ban on national security grounds.

The legislation, passed last year with strong bipartisan support, reflects concerns in Washington that TikTok’s ownership makes the app dependent on the Chinese government and that Beijing could use it to conduct influence campaigns against the U.S. Meanwhile, free speech advocates argue the ban threatens to illegally restrict Americans’ access to foreign media, violating the First Amendment of the U.S. Constitution.

ByteDance has said US officials have misunderstood its relationship with China, arguing its content recommendation engine and user data are stored in the US on cloud servers operated by Oracle, while content moderation decisions affecting US users are also made in the US.

Under the plan proposed by existing investors, software giant Oracle would continue to store US user data and ensure it is inaccessible from China, the source added.

Yesterday, the Financial Times also reported that US ByteDance investors were looking to buy out Chinese investors in a proposed deal for a separate US TikTok business, naming investment firm Coatue as another existing investor involved in the talks.

ByteDance retains minority stake in TikTok, Oracle oversees

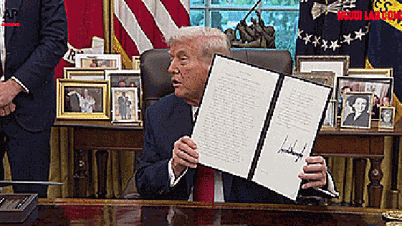

US President Donald Trump issued an executive order postponing the law's implementation until April 5 shortly after taking office and said the deadline could be extended to allow time to reach an agreement.

Oracle is also in talks to buy TikTok's US assets, but it is likely to take on a role overseeing data at the popular video app, which has 170 million US users.

According to legal documents from TikTok last year, global investors own about 58% of ByteDance, while Singapore-based Chinese founder Zhang Yiming owns another 21%, and employees of various nationalities — including about 7,000 Americans — own the remaining 21%.

The White House has been involved to an unprecedented degree in these closely watched trade negotiations, essentially acting as an investment banker.

Mr Trump initially supported a ban in his first term, but in recent months has pledged to “save TikTok” and keep the app in the US, arguing that it helped him win the 2024 presidential election.

The app briefly went down, then came back online shortly after Mr Trump's inauguration, when he signed an executive order delaying the ban for another 75 days.

Mr. Trump said earlier this month that his administration was in contact with four different groups about a potential deal for TikTok, without identifying them. Others vying to buy the app include an investor group led by billionaire Frank McCourt and another group linked to Jimmy Donaldson, better known as YouTube star Mr. Beast.

Other sources reported in January that the Trump administration was developing a plan for TikTok that would include tapping Oracle and some of ByteDance's existing investors to take control of the app.

Under the potential deal, ByteDance would retain a stake in the company, but data collection and software updates would be overseen by Oracle, which already provides TikTok’s infrastructure under a deal negotiated during Mr. Trump’s first term.

Source: https://www.baogiaothong.vn/tuong-lai-tiktok-tai-my-ro-net-hon-192250322013808146.htm

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

Comment (0)