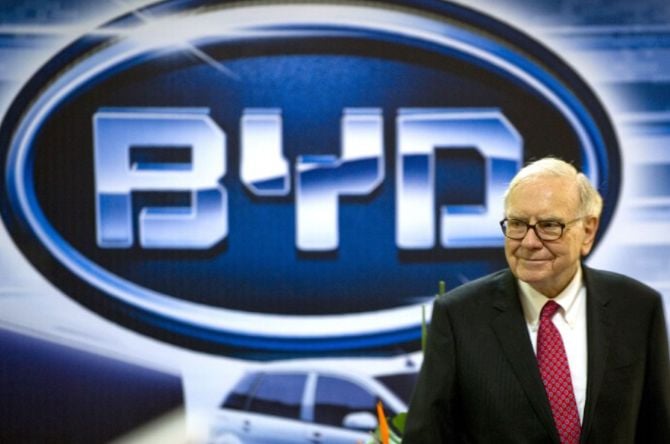

Berkshire Hathaway, the investment fund once led by Warren Buffett, suddenly divested all its capital in BYD.

"Extraordinary" investment chapter

Berkshire Hathaway's decision to invest in BYD 17 years ago came after strong urging from partner Charlie Munger. In 2008, Berkshire spent $230 million to buy 225 million BYD shares.

At that time, this decision was considered reckless because the electric vehicle industry was still young and had countless potential risks. However, reality has proven the incredible foresight of the company's leadership when this investment has brought Berkshire a return of up to 3,890%. Before the sale began, the company's stock value increased 41% in the second quarter of 2022, reaching $9 billion.

Step-by-step withdrawal process

Berkshire began reducing its holdings from 225 million shares in August 2022. As of June 2024, Berkshire had sold nearly 76% of its shares and now holds less than 5% of BYD's total outstanding shares.

When the stake is below 5%, the company is not required to disclose information on subsequent sales under Hong Kong stock exchange regulations.

However, the financial filing for the first quarter of 2025 of Berkshire Hathaway Energy (BHE), the subsidiary that holds this stock, listed the value of its investment in BYD as zero as of March 31. A Berkshire spokesperson later confirmed that the entire stake in BYD had been sold.

Reason for divestment: Not just profit-taking

The biggest question is why Buffett gave up such a profitable investment? Here are a few reasons for the billionaire's decision.

Profit Realization and Capital Reallocation : On the one hand, this is a completely reasonable profit-taking move after nearly two decades. This divestment gives Berkshire a huge amount of capital to reallocate to other investment opportunities.

Seeking greater safety: Warren Buffett himself did not elaborate on the reasons for the sale, but in 2023 he said BYD was an “incredible company” run by an “incredible man.” However, he added: “I think we’ll find things to do with the money that I’m more comfortable with.” This underscores Buffett’s philosophy of investing in safety and sustainability, not just returns.

Rising geopolitical risks: Analysts believe geopolitical risks are key. The BYD divestment comes just as Berkshire sold almost all of its shares in Taiwan Semiconductors (TSMC) after only a few months of buying it. When selling TSMC, Buffett said he was “reassessing” geopolitical risks due to China’s claim that Taiwan is part of China, stating: “This is a dangerous world .” Policy uncertainty, trade wars and geopolitical volatility are factors that even a cautious investor like Buffett must consider.

For Buffett, the withdrawal from BYD is understood as part of a defensive strategy, helping Berkshire stay away from risks beyond its control.

Signals for international markets

Berkshire's divestment from BYD has created some uncertainty among investors, and BYD's stock price has been under pressure. However, many Chinese experts emphasize that this does not mean that BYD is weakening. BYD still maintains a solid foundation, with continued growth in revenue and profit in the first half of 2025 and superior technological capabilities, surpassing Tesla in sales in some periods.

Chinese experts believe that BYD has matured and developed strongly enough to no longer need "guarantees" from any investors.

For international markets, however, Buffett’s departure is an important reminder that Western corporations are increasingly wary of large-scale investments in China, especially amid trade and geopolitical tensions.

Source: https://doanhnghiepvn.vn/doanh-nhan/ty-phu-my-warren-buffett-thoai-von-hoan-toan-khoi-byd-du-loi-nhuan-3-890/20250922031904828

![[Photo] Prime Minister Pham Minh Chinh attends the groundbreaking ceremony of two key projects in Hai Phong city](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/27/6adba56d5d94403093a074ac6496ec9d)

Comment (0)