After recovering more than 14 points, returning to the 1,280 point mark yesterday (May 23), today VN-Index suddenly plummeted with a sell-off trend and soaring liquidity.

At the end of the weekend session (May 24) , VN-Index continued to shake strongly, reversing and plummeting 19.1 points to 1,261.93 points - this is the lowest point this week.

Notably, this development was recorded right after yesterday's 14-point recovery, returning to 1,280 points.

Thus, the first two sessions of the week saw the market trading almost sideways. By mid-week, the VN-Index had been in a state of continuous shaking for three consecutive sessions, falling sharply by more than 10 points on May 22, then increasing by 14 points on May 23 and continuing to plummet by 19 points on May 24.

At the beginning of the weekend morning session (May 24), VN-Index was in a state of not too strong fluctuations. In the afternoon session, the signal of decline appeared from the beginning of the session, and by 2:00 p.m., the index began to plummet. At one point, it even fell by 30 points, reaching the 1,250 point mark at 2:20 p.m.

At the same time, the HNX and UPCoM floors fell to 241.72 points (-2.1%) and 94.4 points (-0.81%) respectively.

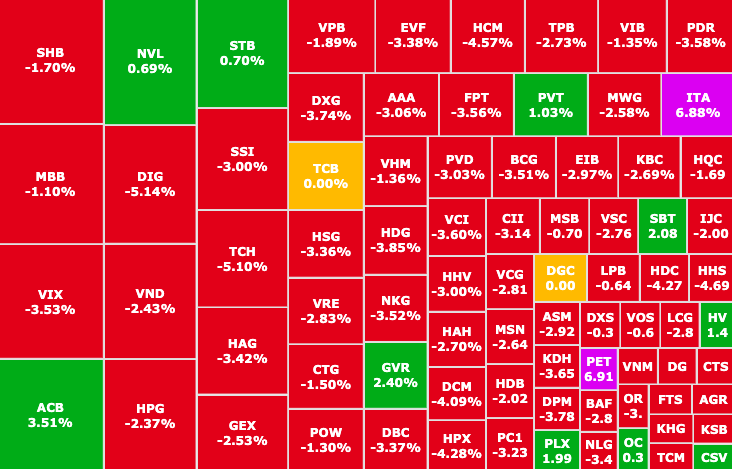

The market is red today after yesterday's "recovery" session.

The whole market was dyed red, with 364 codes decreasing, 93 codes increasing and 43 codes remaining unchanged on the HOSE floor.

Notably, liquidity skyrocketed to VND35,500 billion, a sharp increase of 52.4% compared to yesterday's session (VND23,300 billion), reaching a record level in the past 2 months. This shows that the trend is leaning towards the selling side, with strong selling pressure and profit-taking psychology right after yesterday's rebound session.

Banking, real estate and securities attracted the most cash flow with VND6,292 billion, VND5,623 billion and VND3,651.6 billion, respectively.

The negative momentum of the market also comes from the actions of foreign investors when they recorded a strong net selling session today, reaching a value of more than 1,600 billion VND.

The focus of net selling was on technology stockFPT (FPT, HOSE) with 347 billion VND. This caused FPT to fall sharply by 4.07%, becoming the stock with the most negative impact on the VN-Index, contributing 3.36 points to the decrease.

Pillar stocks reversed and fell sharply, creating resistance to the market's growth momentum (Photo: SSI iBoard)

Next, many pillar stocks reversed and decreased sharply , focusing on retail, banking, and real estate stocks such as: VPB (VPBank, HOSE), HPG (Hoa Phat Steel, HOSE), MWG (Mobile World, HOSE), MSN ( Masan , HOSE), MBB (MBBank, HOSE),...

The VN30 group had 25 stocks decreasing and 1 reference stock. Of which, only 4 stocks increased, including:ACB (ACB, HOSE) increased by 2.81%, GVR (Vietnam Rubber, HOSE) increased by 2.54%, PLX (Petrolimex, HOSE) maintained a strong consecutive increase of 1.74% today, STB (Sacombank, HOSE) increased by 0.53%.

Another "bright spot" came from some small stocks that increased "to the ceiling": ITA (Tan Tao Investment and Industry, HOSE) increased by 6.88%, PET (Petroleum General Services, HOSE) increased by 6.91%,...

Source: https://phunuvietnam.vn/vn-index-phien-cuoi-tuan-chiu-luc-xa-manh-roi-tu-do-20-diem-20240524161017778.htm

Comment (0)