The tug-of-war continued, causing the VN-Index to lose nearly 3 points in today's session. The focus was on the sudden strong selling pressure from foreign investors.

After a continuous tug-of-war from the previous session, VN-Index slowed down its increase and lost nearly 3 points (2.73 points) in today's session, down 0.22% to 1,227.31 points.

The market was immersed in "red" when selling pressure suddenly increased from foreign investors, making investors' sentiment about the short-term market outlook more pessimistic.

Liquidity also dropped sharply by 17.6%, the total of 3 floors reached 20,266 billion VND, of which, HOSE reached 17,908 billion VND, HNX reached 1,588 billion VND and UPCoM reached 770.6 billion VND.

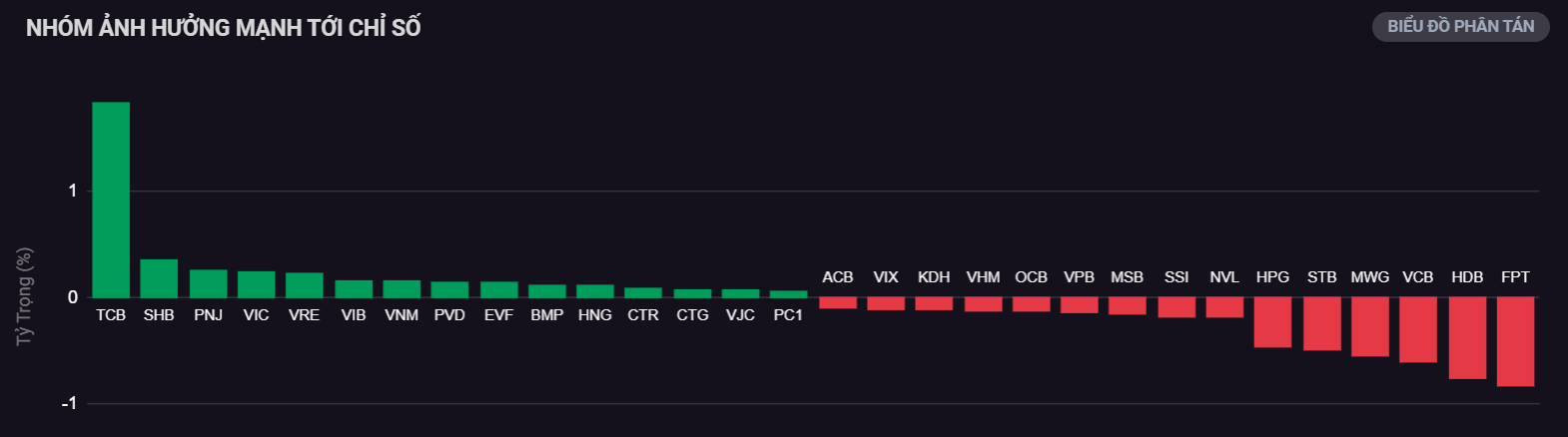

After spreading the "wave" to the market, the group of banking stocks regained their form, continuing to contribute positively in today's session. In particular, TCB (Techcombank, HOSE) led the market with an increase of 3.33%, contributing an equivalent of 1.83 points of increase. Next wasSHB (SHB Bank, HOSE) also increased strongly by 1.7%.

Groups that strongly influence the index

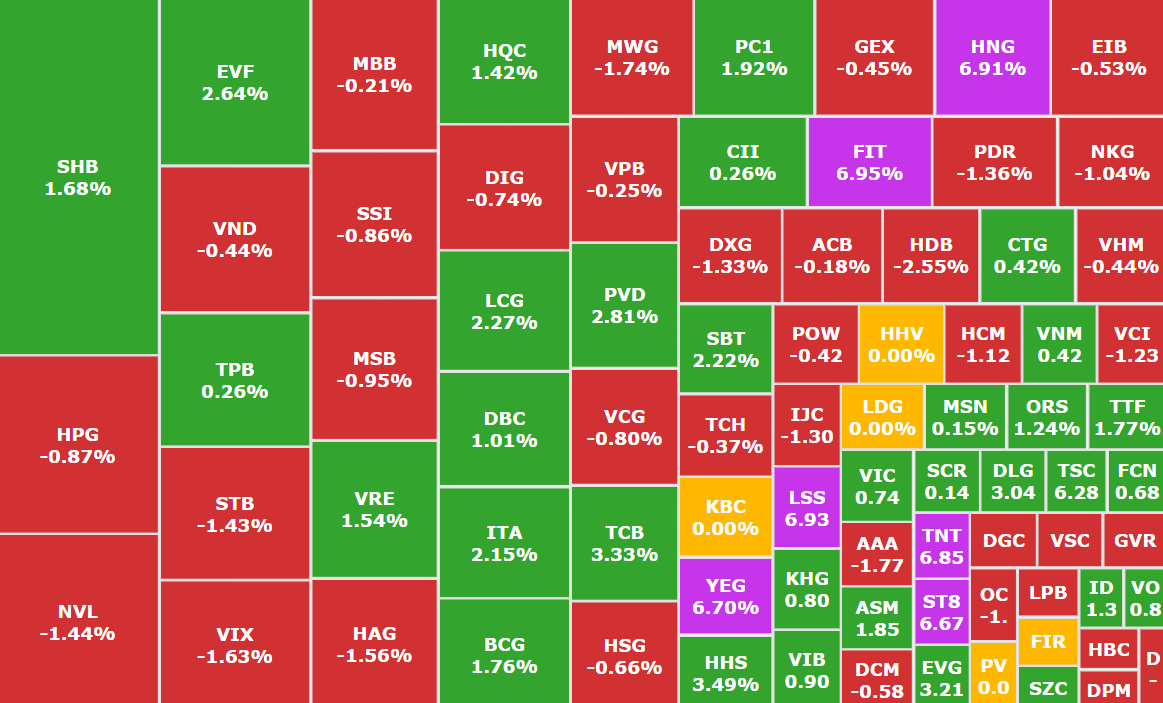

Banking groups are clearly differentiated, blue-chip stocks negatively affect the market (Source: SSI iBoard)

In addition, the positive status also appeared in the "Vin family" group: VIC (Vinhomes, HOSE), VRE (Vincom Retail, HOSE), VHM (Vinhomes, HOSE). At the same time, many other codes created highlights such as: VTP (Viettel Post, HOSE) increased by 5.4%, DMP (Binh Minh Plastic, HOSE) increased by 4.7%, DHC (Dhuoc Hau Giang , HOSE) increased by 2.9%,...

However, the advantage still leans towards the selling side, creating resistance to the market's upward momentum. Many industry groups have lost points, typically the securities group when "red" covered: SSI (SSI Securities, HOSE) decreased by 0.86%, VND (VNDirect Securities, HOSE) decreased by 0.44%, VCI (Vietcap Securities, HOSE) decreased by 1.23%, VIX (VIX Securities, HOSE) decreased by 1.63%,...

In addition, the industry groups Retail, Information Technology, Steel - Galvanized Steel, Chemicals and Fertilizer also lost points with the codes: MWG (Mobile World, HOSE) down 1.7%,FPT (FPT, HOSE) down 1.2%, HPG (Hoa Phat Steel, HOSE) down 0.9%,...

"Red" spreads across the market today

The focus today comes from strong selling from foreign investors. In total, on all 3 floors, about 920 billion VND was net sold, this is also the strongest net selling session of foreign investors since the beginning of the year.

Among them, a series of blue-chip stocks were sold heavily: HPG (Hoa Phat Steel, HOSE) suffered the greatest selling pressure with a value of 150 billion VND, followed by VPB (VPBank, HOSE) and MSN (Masan Group, HOSE), which were sold for 117 billion VND and 110 billion VND respectively.

The market is expected to temporarily stop below the 1,233 - 1,234 point range, VN-Index will slightly adjust and accumulate in the range of 1,222 - 1,230 points.

According to Mr. Bui Thang Long, investment consultant at VPS Securities, the technical signals show that the selling amplitude is relatively low, so there is not much potential risk. Therefore, there is still a lot of room for the market to move up to the 1,250 point area, with the driving force coming from the VN30 group.

Banking stocks continue to maintain their role in driving the market but there is differentiation. In addition, the industrial real estate group is also showing a positive upward trend. Investors are advised to continue holding leading stocks because there are still many growth opportunities.

Source

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

Comment (0)