Minh Phu Seafood Corporation (MPC) has just announced documents for the 2023 Annual General Meeting of Shareholders. Minh Phu is a leading enterprise in the field of shrimp farming and exporting, known as the "king of shrimp".

With such a position, this year, most of Minh Phu's production and business targets have decreased compared to 2022. The production output and export turnover targets for 2023 are expected to be 45,000 tons and 540.5 million USD, respectively, down 30% and 13% compared to 2022.

In 2023, Minh Phu Seafood plans to have revenue of nearly VND12,790 billion, down about 22% compared to the previous year. Profit after tax decreased by 23% to VND639 billion.

In the context of negative seafood exports, MPC's business results "went backwards" in the first quarter of 2023. Revenue was only half of the same period, reaching VND 2,123 billion and equivalent to 17% of the yearly plan. Minh Phu reported a loss after tax of VND 98 billion.

MPC said that in addition to the impact of reduced sales revenue, the business results of commercial shrimp farming companies Minh Phu Loc An, Minh Phu Kien Giang and shrimp seed production company Minh Phu Ninh Thuan were ineffective. Of which, inventories accounted for nearly 50%, equivalent to 4,741 billion VND.

Similarly, Vinh Hoan Corporation (VHC) - the "boss" of pangasius exports of female general Truong Thi Le Khanh reported that the first quarter profit was less than half of the same period. According to the first quarter financial report of 2023, the company recorded revenue of VND 2,221.58 billion, down 32% over the same period and after-tax profit of VND 218.98 billion, down 60% over the same period last year. In particular, the gross profit margin decreased sharply from 23.8% to 17.3%.

The main reason is the decline in exports to key markets, especially the US market. In March alone, exports to the US market were VND393 billion, down 40% compared to the same period; and in February it was VND197 billion, down 69%.

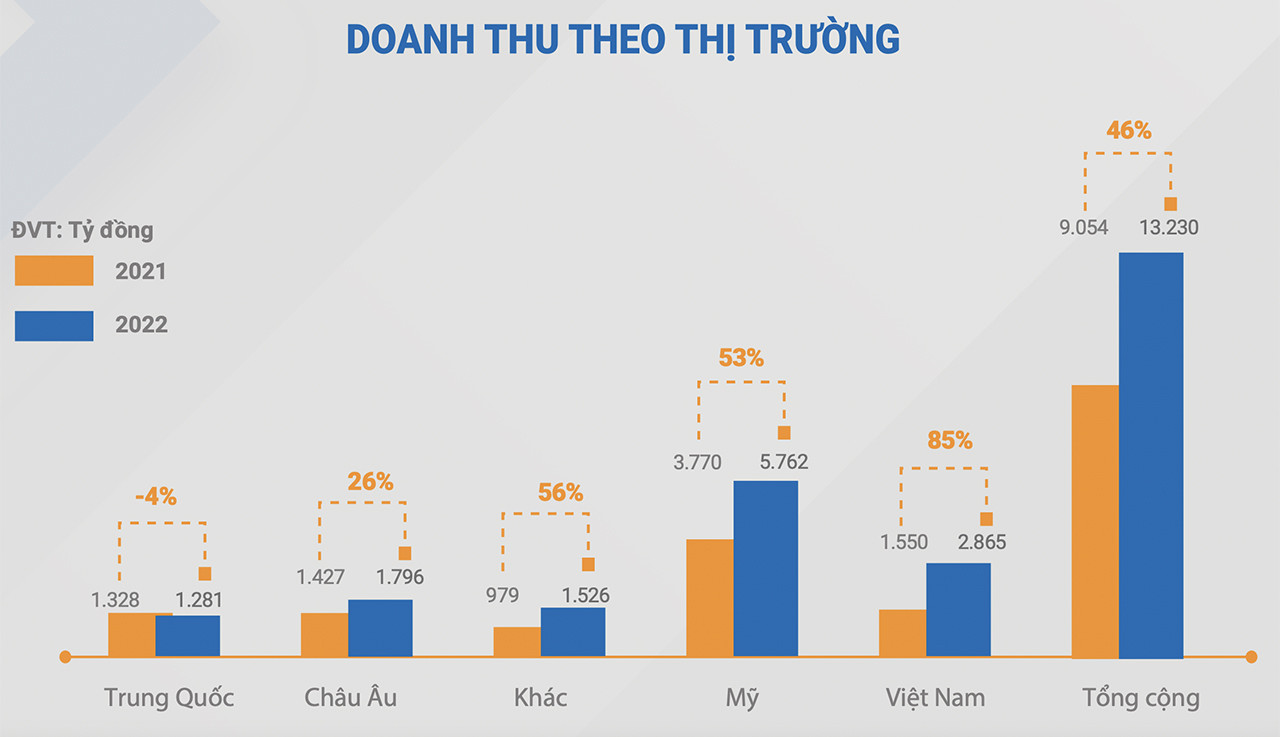

Previously, in 2022, Vinh Hoan had a revenue of 13,230 billion VND. Profit after tax reached 1,975 billion VND, exceeding the plan by 230 billion VND in revenue and 375 billion VND in profit. Despite the decline in the last quarter of the year, the US is still the market with the highest proportion of Vinh Hoan, with tra fish revenue of more than 248 million USD.

In 2023, Vinh Hoan plans to do business with revenue of VND 11,500 billion, down 13.1% over the same period and expected after-tax profit of VND 1,000 billion, down 49.4% compared to the actual performance in 2022.

Another seafood company, Nam Viet Joint Stock Company (ANV), has had its first quarter 2023 business results clearly reflecting signs of declining growth due to the impact of inflation. ANV's net revenue and after-tax profit reached VND1,155 billion and VND92 billion, respectively, down 56% over the same period. As of March 31, ANV's inventory reached VND2,666 billion, accounting for 47% of the company's total assets.

In 2021, China accounted for 22% of ANV's total revenue. However, by 2022, due to the impact of the Zero Covid policy in this country, revenue from China decreased by 27% compared to 2021 and accounted for only 11% of total revenue.

In 2022, ANV recorded revenue and profit of VND 4,897 billion and VND 674 billion, respectively.

Having trouble

According to a report by VNdirect Securities, the seafood industry is facing many challenges. Weakened demand for seafood due to high inflation and high inventories are also among the reasons affecting US seafood imports in the short term. Inventories in this market remain high, so importers have to reduce or stop placing new orders in the last months of 2022 and into early 2023.

Seafood exports to the Chinese market have not been as expected. Seafood export turnover in the first four months of 2023 to China only reached 364 million USD, down 30% over the same period due to the sharp decline in key export items such as shrimp and pangasius.

Vietnam’s shrimp products face strong competition from Ecuador and India, whose strengths are small-sized, low-priced frozen shrimp. As for pangasius exports, the export value to the Chinese market fell sharply by 68% year-on-year in the first four months of the year.

VNdirect believes that due to weak demand from major export markets and high production costs, listed seafood exporters in the industry, especially pangasius enterprises, have set more cautious business plans compared to 2022.

Meanwhile, shrimp exporting enterprises are somewhat more optimistic about business results in 2023 when expecting revenue and profit to increase compared to the same period. However, given the challenges of the shrimp industry, VNdirect believes that the plans of enterprises are quite ambitious.

Faced with such difficulties, seafood enterprises are looking for new directions. Mr. Le Van Quang, General Director of Minh Phu, said that this year, the company is focusing on three major projects: the new breading factory of Minh Phu Hau Giang Company, the new processing factory of Minh Phat Company and the seawater pipeline project in Kien Giang of the high-tech company, with the goal of expanding production and improving the quality of each Minh Phu product on the market.

In addition, Minh Phu also builds and completes models of wild tiger shrimp farming, extensive tiger shrimp farming, semi-intensive tiger shrimp farming, tiger shrimp - rice farming, intensive white-leg shrimp farming and high-tech super-intensive white-leg shrimp farming suitable for each region with low costs equal to India from 2030 and to Ecuador from 2035.

Ms. Truong Le Khanh, Chairman of Vinh Hoan, said that in 2023, the company will have two new business segments, aquatic feed products and fruit and vegetable products, coming into operation. By participating in feed processing, Vinh Hoan closes the sustainable pangasius supply chain.

Adding fruits and vegetables to its product portfolio, Vinh Hoan hopes to develop more diverse processed food products combining seafood and agriculture to provide nutritious and convenient meals for consumers around the world.

Source

Comment (0)