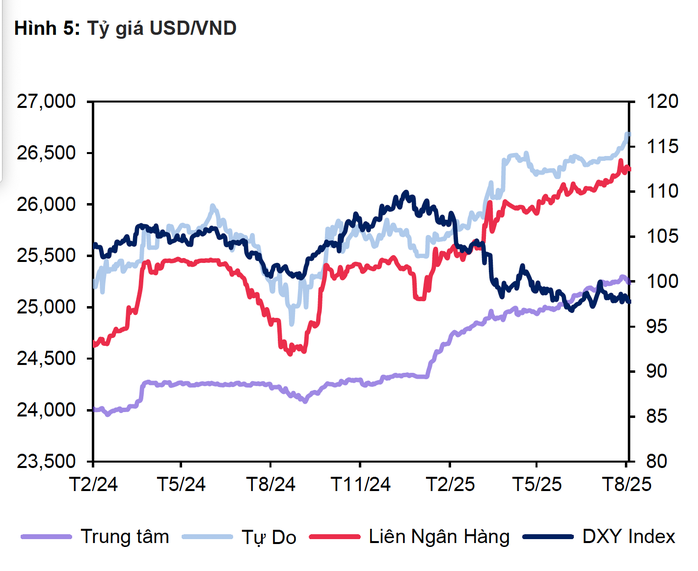

On October 2, the State Bank listed the central exchange rate at 25,177 VND/USD, down 10 VND compared to yesterday and marking a week-long decline.

At commercial banks, the USD price also cooled down. Vietcombank, BIDV andACB traded around 26,215 VND/USD for buying and 26,435 VND/USD for selling, 11 VND lower than yesterday.

Compared to the peak of more than 26,536 VND/USD in mid-August, the USD price has now decreased by about 100 VND.

USD price cooled down sharply compared to the peak of about 1 month ago

The move comes amid a weakening greenback. The USD Index (DXY) has remained at 97.7 points for a month, after the US Federal Reserve (FED) cut interest rates for the first time this year and is expected to continue cutting them further. This has helped cool the USD and reduce pressure on the USD/VND exchange rate.

According to a new forecast from UOB Bank (Singapore), DXY will continue to decline, possibly to 96.3 points in the fourth quarter of 2025 and 93.9 points in 2026. That creates conditions for other major currencies to increase in price.

Mr. Dinh Duc Quang, Director of Currency Trading Division of UOB Bank Vietnam, said that due to its large economic openness, Vietnam is strongly affected by global fluctuations. Therefore, he suggested that the exchange rate operating band should be widened to 5-6% per year, instead of 2% - 3% as before.

In addition, to maintain a long-term stable exchange rate, it is necessary to synchronously implement solutions for institutional reform, upgrading the stock market, developing corporate bonds, attracting FDI capital and building an international financial center. These measures will help increase foreign currency supply, strengthen confidence and contribute to maintaining a stable exchange rate.

USD/VND exchange rate developments in recent times. Source: MBS

Source: https://nld.com.vn/gia-usd-tai-cac-ngan-hang-giam-rat-manh-196251002141938292.htm

Comment (0)