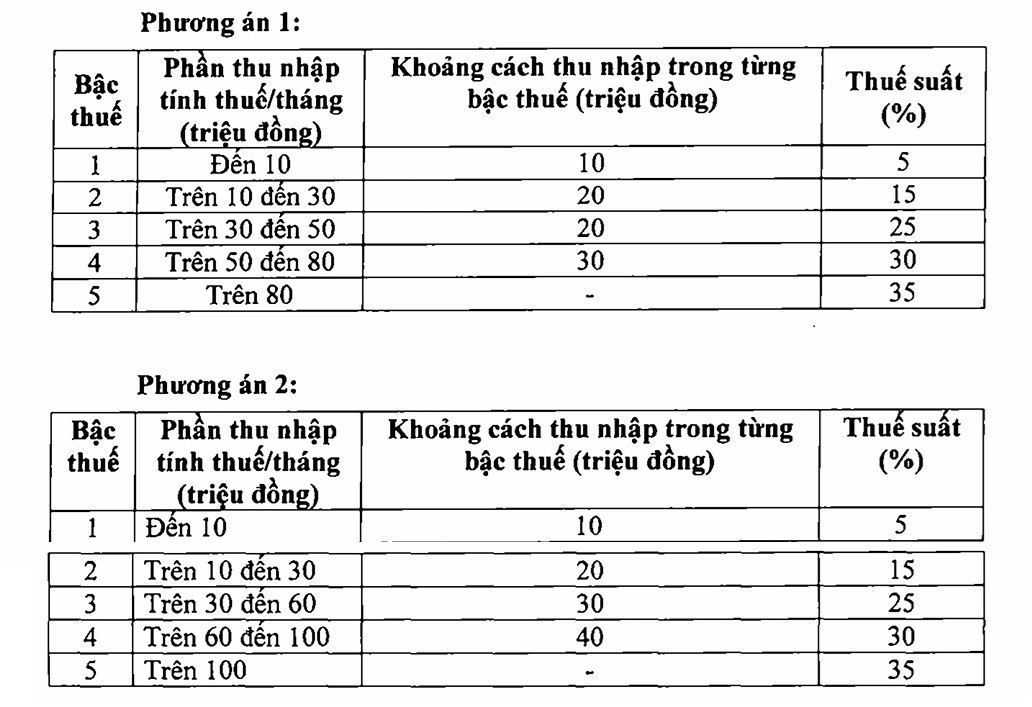

In the latest draft of the revised Personal Income Tax Law, the Ministry of Finance proposed a plan to amend the progressive personal income tax table from 7 levels to 5 levels, with the highest tax rate being 35%.

According to the current Personal Income Tax Law, the progressive tax schedule applied to income from salaries and wages includes 7 tax rates: 5%, 10%, 15%, 20%, 25%, 30% and 35%.

The Ministry of Finance said that through reviewing the current tax structure, studying the trend of improving people's living standards in the coming time as well as international experience, it is possible to study to reduce the number of tax rates from the current 7 rates to an appropriate level; consider widening the income gap in the tax rates. Simplifying and reducing tax rates is to facilitate taxpayers' tax declaration and payment.

The Ministry of Finance proposed two options to amend the tax schedule, specifically as follows:

Analyzing the above two options, the Ministry of Finance said that with option 1, individuals with taxable income at level 1 will not be affected (however, with the adjustment of family deduction level, individuals with income at level 1 will have their tax reduced); individuals paying tax from level 2 or higher will also have their tax reduced compared to present.

For example, an individual with a taxable income of 10 million VND/month will receive a reduction of 250,000 VND/month; an individual with a taxable income of 30 million VND/month will receive a reduction of 850,000 VND/month; an individual with a taxable income of 40 million VND/month will receive a reduction of 750,000 VND/month; an individual with a taxable income of 80 million VND/month will receive a reduction of 650,000 VND/month...

For option 2, basically every individual with taxable income from 50 million VND/month or less will receive a tax reduction equivalent to option 1. For individuals with taxable income over 50 million VND/month, the reduction will be greater than option 1.

According to the drafting agency, through the consultation process, the majority proposed implementing option 2. There were also opinions suggesting further extension of income levels in each tax bracket, lowering the tax rate for each bracket, or even reducing the ceiling from 35% to 30% or 25%...

Currently in the region, the highest tax rate is usually 35% like Thailand, Indonesia, Philippines; while China, Korea, Japan, India apply a ceiling rate of 45%.

Adjusting tax rates according to the two options mentioned above, along with increasing family deductions and adding other deductions such as health, education , etc., the tax burden will be significantly reduced, especially for the middle-low income group, who will be exempt from personal income tax. For individuals with higher incomes, the level of tax regulation will also be reduced compared to the current level.

For example, an individual with one dependent earning 20 million VND/month from salary and wages, currently paying personal income tax of 125,000 VND/month, when making family deductions and tax schedule according to option 2, will not have to pay tax.

If the income is 25 million VND/month, the tax payable will decrease from the current 448,000 VND/month to 34,000 VND/month (about 92% reduction); if the income is 30 million VND/month, the tax payable will decrease from 968,000 VND to 258,000 VND/month (about 73%)...

According to the Ministry of Finance's calculations, adjusting the tax schedule according to option 1 would reduce the budget revenue by 7,120 billion VND and according to option 2, the revenue would reduce by 8,740 billion VND. Therefore, the Ministry of Finance submitted to the Government to implement option 2.

Source: https://vietnamnet.vn/bieu-thue-thu-nhap-ca-nhan-chi-con-5-bac-thue-suat-cao-nhat-35-2439467.html

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)