Investors wait for positive signals

The correction mainly came from strong net selling pressure from foreign investors, with a value of up to more than 2,000 billion VND. Although liquidity increased slightly by about 1,200 billion VND compared to the previous session, cash flow remained at a fairly cautious level and had not returned to the bustling level as at the peak period in July and August. Banking and large-cap stocks led the market correction trend during the session.

Investors monitor stock market developments during the weekend trading session.

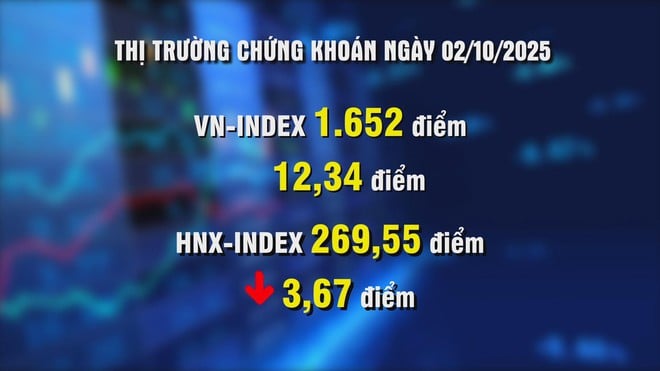

However, the current decline has not caused investors too much concern. The VN-Index is still maintaining around the 1,600-point support zone, in the context of a stable macro economy and expectations of market upgrade next week, creating confidence. In addition, the third quarter business results reporting season and dividend information from many businesses are also expected as bright spots that can support the market.

Although liquidity has not really improved, the trend of shifting from speculation to selection is becoming clearer. The market is entering a phase of capital repositioning, in which cash flow from domestic organizations is expected to play the main supporting role. With this picture, the stock market still has a chance to recover when positive information is announced in the coming time.

>>> Please watch HTV News at 8:00 p.m. and 24G World Program at 8:30 p.m. every day on HTV9 channel.

Source: https://htv.com.vn/chung-khoan-giam-diem-phien-cuoi-tuan-nha-dau-tu-cho-tin-hieu-tich-cuc-222251003171726502.htm

![[Photo] Bustling Mid-Autumn Festival at the Museum of Ethnology](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/da8d5927734d4ca58e3eced14bc435a3)

![[Photo] Solemn opening of the 8th Congress of the Central Public Security Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/f3b00fb779f44979809441a4dac5c7df)

![[Photo] General Secretary To Lam attends the 8th Congress of the Central Public Security Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/79fadf490f674dc483794f2d955f6045)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)