SGGPO

The US Federal Reserve (Fed) kept interest rates at 5.25%-5.5% after its November meeting ended last night. Along with the upward trend of world stocks, the Vietnamese stock market also increased strongly, despite foreign investors still net selling nearly 330 billion VND on the HOSE floor.

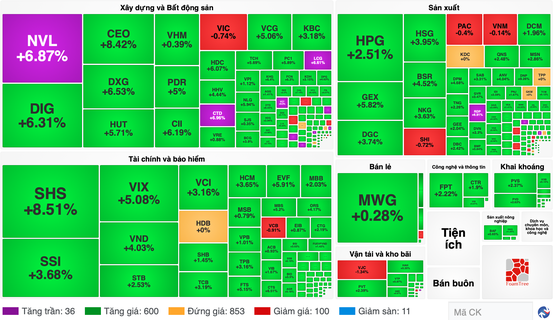

At the opening of the trading session on November 2, VN-Index opened a price gap (gap increase) of nearly 10 points. Then the market fell to fill the gap at the beginning of the session and then quickly increased strongly. Green covered the whole market. Even stocks that had fallen deeply in the previous sessions such as the three Vingroup stocks, only VIC decreased by nearly 1%, VRE and VHM regained green, both increasing by nearly 1%. Even MWG shares, after hitting the floor for the previous two consecutive sessions, also regained green.

The market's "pilot" stocks opened the morning session with stronger signals than the general market with MBS increasing by 5.2%, FTS increasing by 5.55%, VIX increasing by 5.08%, VND increasing by 4.03%, HCM increasing by 3.65%, VCI increasing by 3.16%...

Real estate and construction stocks soared with CTD, LCG, NVL hitting the ceiling, PDR up 5%, DXG up 6.53%, DIG up 6.31%, CII up 6.19, HDC up 6.07%, TCH up 5.69%, VCG up 5.06%, NLG up 5.94%...

Banking stocks also leaned towards green with large-cap stocks increasing strongly: TCB increased by 3.16%, TPB increased by 3.16%, BID increased by 3.5%, CTG increased by 2.19%, MBB increased by 2.03%... contributing to the strong increase of VN-Index.

In addition, the manufacturing and retail group also recovered well with GEX increasing by 5.82%, DGC increasing by 3.74%, HPG increasing by 2.21%, HSG increasing by 3.95%, BSR increasing by 4.52%, NKG increasing by 3.63%...

|

Vietnam's stock market recovers in line with world stock market trend |

Temporarily closing the morning session, VN-Index increased by 15.74 points (1.51%) with 442 codes increasing, 68 codes decreasing and 46 codes remaining unchanged.

At the end of the morning session, the HNX-Index also increased by 5.89 points (2.81%) with 145 stocks increasing, 31 stocks decreasing and 30 stocks remaining unchanged. Liquidity improved with the total trading value in the morning session of the entire market reaching nearly VND8,200 billion.

* The Ho Chi Minh City Stock Exchange (HOSE) has just announced that NVL (Novaland) shares will be removed from the warning list from November 3 because the company has resolved the cause that led to the stock being warned.

Previously, Novaland also submitted a proposal to remove NVL shares from the warning list after overcoming the reasons why the securities were put on the warning list; at the same time, explaining the reasons for the delay in disclosing information on the 2022 audited financial statements and announcing that the company had completed the disclosure of information on the 2022 audited financial statements. In addition, Novaland has also complied with regulations on information disclosure on the stock market over the past 6 months.

After being removed from the warning list, NVL shares closed the morning session with a sharp increase in amplitude to 14,000 VND/share with a buy surplus of nearly 4.7 million shares.

Source

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

Comment (0)