Fund certificate price is not a measure of attractiveness

One of the most common mistakes made by investors, especially those new to the market, is to use the price of fund certificates to measure the price and thus evaluate long-term investment performance. However, the price of fund certificates hardly reflects the attractiveness or investment potential of the fund, said Mr. Vo Nguyen Khoa Tuan - Senior Director of Securities at Dragon Capital.

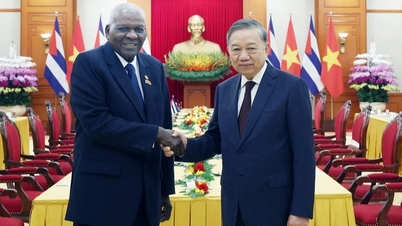

Dragon Capital experts at an investor event (Photo: DC).

Instead of worrying about price, this expert advises investors to pay attention to fundamental factors such as investment performance in the medium and long term with 2-year, 5-year, 10-year cycles; long-term investment strategy of the fund; capacity and reputation of the fund management company; transparency, risk management ability and investment discipline of the portfolio management team.

An example is the story of the DC Dynamic Securities Investment Fund (DCDS) managed by Dragon Capital. More than 2 years ago, the price of 1 DCDS fund certificate only fluctuated around 61,000 VND. By early July 2025, this number had exceeded 92,000 VND, equivalent to a growth rate of more than 50% in less than 3 years, showing that the investment results come from the strategy of holding the right fund, at the right time and with enough patience.

Superior performance often comes from long-term investment experience.

According to Mr. Nguyen Sang Loc, Director of Portfolio Management at Dragon Capital, the difference in DCDS's investment performance, especially during volatile market periods, lies in its proactive risk management philosophy and flexible investment strategy.

Mr. Nguyen Sang Loc - Director of Portfolio Management of Dragon Capital (Photo: DC).

“This philosophy was applied during the strong market correction last April. When the market was in turmoil and many portfolios were in the red, strict risk management and early defensive measures helped DCDS not only avoid most of the shock but also many stocks in the portfolio went against the market, bringing value to investors. It was these decisive actions during that difficult period that contributed to the impressive investment performance of 51.87% in the last 2 years and 57.27% in the last 3 years for DCDS,” said Mr. Loc.

Net worth increased sharply, reflecting internal improvement

The net asset value (NAV) of DCDS fund has continuously set new peaks in recent weeks, according to Mr. Le Anh Tuan - Director of Dragon Capital Investment Division. This growth is reasonable according to the market, reflecting the recovery from the foundation of listed enterprises.

DCDS’s portfolio currently consists of 100% listed stocks, with market prices transparently determined on the stock market through the supply-demand mechanism. Accordingly, the increase in market prices reflects expectations for real improvements in the business foundation.

By the end of June 2025, the VN-Index had recorded an increase of about 14-15% compared to the beginning of the year. At the same time, the profits of listed enterprises grew by approximately 12-13 %. “Last year’s market was heavily discounted due to many unfavorable factors. Therefore, the current increase is completely consistent with the recovery of enterprises,” Mr. Tuan analyzed.

Mr. Le Anh Tuan - Director of Dragon Capital Investment Block (Photo: DC).

Rather than worrying about how much the market has risen, investors should focus on assessing the quality of the assets in their portfolios. Businesses with solid fundamentals will continue to create long-term value, even when the market experiences short-term fluctuations.

Determine the optimal time to take profit

In the investment world, the question “when is the optimal time to take profit?” always makes many people wonder. According to Mr. Vo Nguyen Khoa Tuan, most profit-taking decisions are made too early and are not optimal.

History has recorded that in the period of 2016-2017, when VN-Index broke out after a long period of accumulation around the 600-700 point range, many investors "took early profits" and missed the next growth opportunity of 50% to 70%. Currently, the market is witnessing a similar period when VN-Index has accumulated for nearly 3 years around the 1,200-1,300 point mark, while the Vietnamese economy is likened to a "compressed spring" that has just begun its first phase.

Dragon Capital expert shares his views on the optimal time to take profit (Photo: DC).

Mr. Tuan also gave advice that goes against the crowd mentality: "When the market accelerates, for many people, it is a signal of risk, but for us, it is a signal to increase investment."

Sharing the same view, according to Mr. Le Anh Tuan, investment is a real psychological battle, therefore, he advises investors to simplify their investment by focusing on fundamental factors and maintaining the discipline of regular investment and holding for the long term.

Source: https://dantri.com.vn/kinh-doanh/chuyen-gia-dragon-capital-gia-chung-chi-quy-khong-la-thuoc-do-do-hap-dan-quy-dau-tu-20250718165858921.htm

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

Comment (0)