Widespread digital transformation

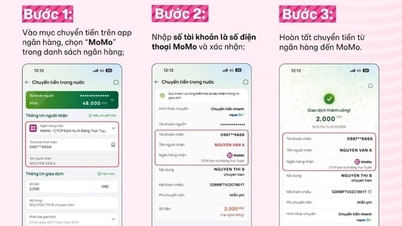

Cashless payments have made breakthroughs, increasing sharply in socio -economic fields, changing people's transaction habits.

Ms. Tran Thi Quy, a small trader in My Thach Bac block (Ban Thach ward) said that she was hesitant to use banking services before, but when the bank staff enthusiastically instructed her on how to use QR codes, Ms. Quy found them simple, so she boldly registered to use them. "I'm also happy that I'm not outside the increasingly popular trend of electronic payments. Using QR codes makes it more convenient to pay when doing business, and I don't have to worry about getting change," Ms. Quy said.

Non-cash payments and digital transformation of the banking industry have helped people and businesses in the area to transact, pay safely, conveniently, save time and costs through digital platform applications that are becoming increasingly familiar. The formation of the bank's digital payment ecosystem has helped customers' transactions to be stored and secured.

According to the State Bank of Vietnam Region 9, Da Nang city currently has more than 82,000 electronic payment acceptance points, 3,547 POS devices and 821 ATMs. Transactions via electronic channels account for 87.5% of total payment transactions.

This is a high rate compared to the national average, reflecting a clear step forward in the trend of reducing cash usage in Da Nang. The above achievements are thanks to the infrastructure serving the digital transformation of the banking industry that has always been focused on investment, upgrading and development by credit institutions in the area. That is the basis for the banking and inter-bank electronic payment system to operate stably and safely.

Create a new push

It can be seen that the bottleneck in digital banking payments in the area is that cashless payment transactions are still limited in rural, mountainous and island areas. The elderly are not bold enough to make cashless payments.

In the context of increasingly rapid development of artificial intelligence, it is required that the bank's technology infrastructure be invested in a more modern and synchronized way to not only meet internal requirements but also adapt to many different protocols and integration methods, providing smarter and more personalized services to customers.

Mr. Pham Trong, Deputy Director of the State Bank of Vietnam Region 9, said that the banking industry is accelerating the implementation of Resolution No. 57-NQ/TW of the Politburo on breakthroughs in science and technology development, innovation, and national digital transformation to create a boost for the operation of the smart digital ecosystem, to increase services and meet greater needs for payment and security of customers.

Accordingly, continue to upgrade and improve infrastructure for science and technology, digital transformation of the banking industry to ensure security, safety and focus on building a shared database system for the banking industry. Encourage credit institutions to deploy new technologies such as AI, Big Data, Blockchain... to serve the construction of flexible and sustainable data infrastructure.

Commercial banks need to invest in security technology infrastructure and update modern security applications to help improve the efficiency of digital payments and protect customers.

The banking industry integrates, connects, and shares information with other industries and fields to expand the digital ecosystem, develop digital banking services, contribute to the formation of an interconnected digital ecosystem, and create favorable conditions for people and businesses to access services quickly and effectively.

Mr. Vo Van Duc, Director of Vietcombank Quang Nam branch, said that the bank focuses on biometric authentication when processing daily transactions.

Vietcombank has piloted the implementation of remote digital signature on VNeID, allowing customers to register for digital signatures and digital authentication with just one simple operation. Services such as online disbursement have been deployed, expanding to online guarantees, online foreign currency trading and online investment. All are automated, ensuring legal compliance and high security.

Digital identification has opened up a safe and transparent financial ecosystem, helping banks optimize operations and control risks. That banking activity has promoted and contributed to promoting a green lifestyle through paperless transactions.

Solutions to speed up cashless payments in remote areas

To promote the development of cashless payments and accelerate the implementation of the digital banking ecosystem, State Bank Region 9 recommends that the State Bank of Vietnam develop and promulgate mechanisms and policies to encourage electronic payments and offer preferential transaction fees for people in mountainous, remote and isolated areas.

There is a mechanism to encourage banks to open transaction points in remote areas; strengthen technical infrastructure to ensure ATM installation in remote communes; and waive account maintenance and transaction fees for people receiving social security payments.

The People's Committee of Da Nang City continues to direct the People's Committees of remote communes, border areas, and islands to actively coordinate with credit institutions to widely propagate non-cash payments. Promote investment in telecommunications infrastructure, improve the quality of high-speed internet coverage in remote residential areas.

Source: https://baodanang.vn/day-nhanh-trien-khai-he-sinh-thai-so-ngan-hang-3307977.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on nuclear power plant construction](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/22/1761137852450_dsc-9299-jpg.webp)

Comment (0)