Japan once dominated the list of the world's 500 largest companies by revenue, but after nearly 30 years, the situation has changed completely.

In 1995, when Fortune magazine published its first modern-day Global 500 list, the largest company at the top of the list was Mitsubishi, Japan. With $176 billion in revenue, "Mitsubishi's revenue was larger than AT&T, DuPont, Citicorp, and P&G combined," Fortune said. The Global 500 is Fortune 's annual list of the world's 500 largest companies by revenue.

Five other Japanese companies are also in the top 10, including Mitsui, Itochu, Sumitomo, Marubeni and Nissho Iwai (later Sojitz). Japan is the second most represented country on the list, with 149 companies. The US is the top country with 151. However, Japanese companies in the top 500 have the largest total revenue in the world, surpassing both the US and Europe.

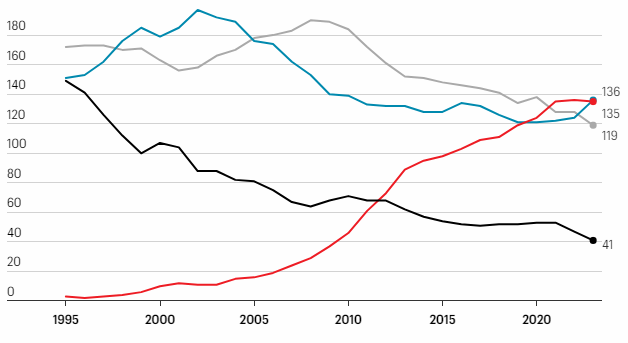

But 28 years later, the situation is completely different. According to the list released earlier this month, Japan has 41 representatives in the Global 500 this year, much lower than the US and mainland China, with 136 and 135 companies, respectively.

Number of Japanese (black), Chinese (red), American (blue), European (grey) companies in the Global 500 over the years. Chart: Fortune

Japanese companies on the list also had a combined revenue of only $2.8 trillion last year, equivalent to 6.8% of the global total. The US's ratio was 31.8% and China's was 27.5%.

Toyota Motor is the largest Japanese company on the list, ranking 19th with $274 billion in revenue. Mitsubishi has fallen to 45th with $159 billion.

Fortune believes that there are many reasons why Japan, which dominated the Global 500 30 years ago, has fallen so sharply. These include a weak yen, few innovative companies, and the rise of China. These are also the challenges that the Japanese economy in general is facing.

The Rise of China

In 1995, China had just three representatives in the top 500. Now it has 135, replacing many Japanese representatives. In fact, Chinese companies are now encroaching on many of Japan’s strong areas. Earlier this year, China overtook Japan to become the world’s largest auto exporter. Part of the reason is the boom in electric vehicles, with companies like carmaker BYD and battery maker CATL.

Weak yen

Currency fluctuations may also explain the decline of Japanese companies in the Global 500. Over the past year, the yen has fallen 20% against the dollar, making revenue converted to dollars lower.

For example, Toyota Motor's 2022 revenue would be equivalent to $331 billion in 2021 exchange rates. That would put it in the top 10.

Toyota electric cars on display in Tokyo (Japan). Photo: Reuters

A weak yen makes Japanese exports cheaper, but also makes imports more expensive. Japanese businesses now face higher costs for energy and other imported goods.

“Japan is involved in importing raw materials from all over the world, then processing them, making them more valuable and selling them. Therefore, a weak currency is not beneficial in this situation,” said Fast Retailing CEO Tadashi Yanai in April 2022.

A surprise surge in exports helped Japan’s GDP rise 6% last quarter, a sign that the supply chain disruptions caused by the pandemic have eased. But domestic spending remains weak, leaving the world’s third-largest economy under pressure post-pandemic.

Japan missed out on the tech boom

The bigger problem is that Japan’s economy has been stagnant for a long time, leaving fewer growth opportunities for established companies and startups. Over the past decade, Japan’s GDP has grown by just 5.3%. In comparison, the US grew by 23% and mainland China by 83%.

Norihiro Yamaguchi, an economist at Oxford Economics, argues that Japanese companies have missed the internet boom compared to other major economies like the US and China. He attributes this to a culture of cautious investment. “Japanese companies tend to focus on cutting costs/headcount, rather than increasing revenue or opening new businesses,” he says.

Japan also has no Big Tech companies like Alphabet, Microsoft, Alibaba or Tencent. "Unlike China, Japan has not seen the rise of a new class of entrepreneurs like Alibaba's Jack Ma or Tencent's Pony Ma," said Vasuki Shastry, a researcher at Chatham House. This is because "sluggish economic and structural reforms have not created the engine for breakthroughs."

Some Japanese companies have been on the Fortune list for decades, but new representation is almost nonexistent. “The lack of new successful companies has caused Japan’s presence on the list to shrink,” Yamaguchi said.

In contrast, the US and China have many emerging names. Tesla is one example. The electric car company was included in the Global 500 list three years ago, and is now ranked 152nd, ranking above three-quarters of the Japanese companies on the list.

Ha Thu (according to Fortune)

Source link

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)